Eightcap is a platform that bridges the gap between web3 and TradFi. This guide assesses the quality and diversity of the platform’s tools and features, pits it against competitors, and tests its customer support to form an overview of this industry-heavyweight. Find out how it shapes up in this 2024 Eightcap review.

KEY TAKEAWAYS

• Eightcap is a broker that offers access to over 800 instruments, including forex, commodities, CFDs, and crypto.

• The platform provides a variety of trading tolls and platforms like TradingView, MT4, MT5, and code-free automations.

• Eightcap is regulated by multiple authorities, which include ASIC, FCA, and CySEC.

• Despite its strengths, Eightcap’s limited global availability is an area where it can improve.

Eightcap at a glance: Overall assessment

We found that Eightcap excels across multiple key parameters, scoring high marks in almost every category:

| Criteria | Fees | Assets | User experience | Compared to competitors | Safety | BeInCrypto Score |

| Score | 5/5 | 5/5 | 4/5 | 4/5 | 4/5 | 4.4 |

What is Eightcap?

Eightcap is an online trading platform or broker, not an exchange. It provides access to over 800 instruments in various financial markets, including forex (foreign exchange), indices, commodities, and cryptocurrencies.

Moreover, the platform allows traders to speculate on the price movements of these assets using contracts for difference (CFDs). It offers trading tools and resources to assist traders in their decision-making.

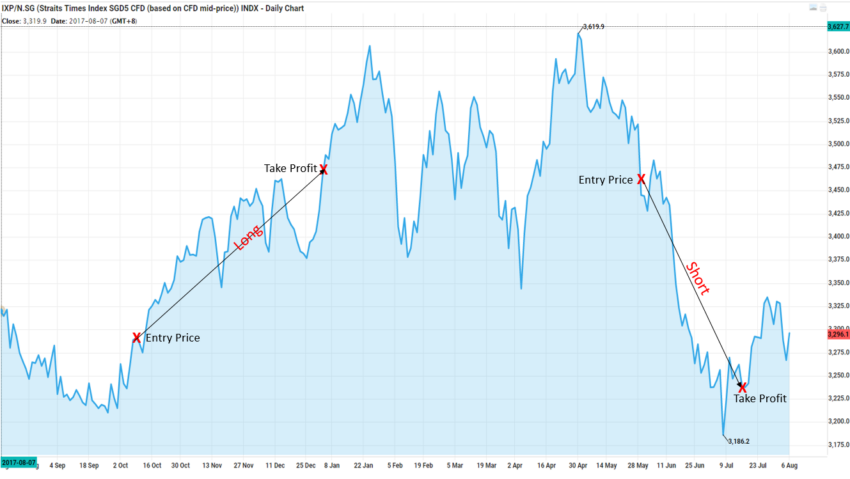

Here is a brief overview of CFDs and how they work:

A contract for difference (CFD) is a financial derivative that allows traders to speculate on the price movements of various underlying assets without owning them.

Instead, CFDs involve a contract between the trader and a broker, where the trader can profit or incur losses based on the difference between the asset’s opening and closing prices.

CFDs are popular for their flexibility and ability to trade on rising and falling markets, but they come with inherent risks, including leverage. One of the standout features of Eightcap is that it offers not only CFDs but also crypto CFDs.

Eightcap history

Joel Murphy, the Founder and Director of Eightcap, established the company in 2009 in Melbourne, Australia. In a noteworthy achievement, Eightcap was globally honored as the Broker of the Year for 2023 at the Global Forex Awards.

Its services have also garnered numerous other awards, including the Most Innovative Affiliate Program recognition from Global Business Review, the title of Best Crypto Broker as awarded by AtoZ Markets, and the Annual Review Award presented by International Business Magazine.

What can you trade on Eightcap?

Eightcap is primarily known as a forex and CFD broker. Depending on the account type and region, it’s possible to trade in these categories:

- Forex: A wide range of currency pairs, including major and minor pairs

- Indices: Contracts for differences in major global stock indices

- Commodities: This could include metals like gold and silver, energy commodities like oil, and possibly agricultural products

- Cryptocurrencies: CFDs on popular cryptocurrencies such as Bitcoin, Ethereum, and more

- Shares: CFDs on individual stocks from major global stock exchanges

- Other assets: Depending on the region and the time, they might offer other trading instruments

Where is Eightcap available?

Eightcap offers its trading services in multiple jurisdictions, including Australia, the United Kingdom, the Bahamas, and Cyprus.

This global presence allows clients in these regions to access and utilize Eightcap’s trading platforms and services while operating within the regulatory frameworks of their respective countries.

How to sign up for Eightcap in 2024?

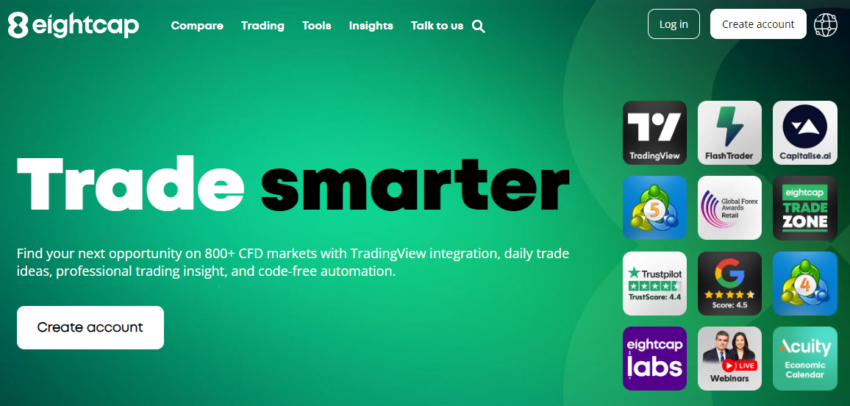

1. Firstly, go to the Eightcap official website and select “Create Account.”

2. Secondly, fill out the form with your personal information.

3. Lastly, you will be redirected to the following screen to complete KYC verification. Simply follow the steps to begin.

Features and tools from Eightcap

Eightcap is a platform laden with features. First, it provides a wide array of order types, including market orders, limit orders, and stop-loss orders, allowing traders to execute their strategies with precision.

When it comes to account management, Eightcap allows a maximum of five trading accounts per entity type. Entity types are categorized as individual traders, joint account traders, company traders, or trust traders, ensuring flexibility for various trading setups.

For traders seeking to streamline their strategies without the need for coding, Eightcap integrates Capitalise.ai, a code-free automation tool. This feature empowers traders to create, test, and automate trading strategies using everyday English.

Eightcap offers a choice of trading platforms to suit individual preferences. Traders can enjoy the power of Tradingview, WebTrader, MT4, and MT5 platforms.

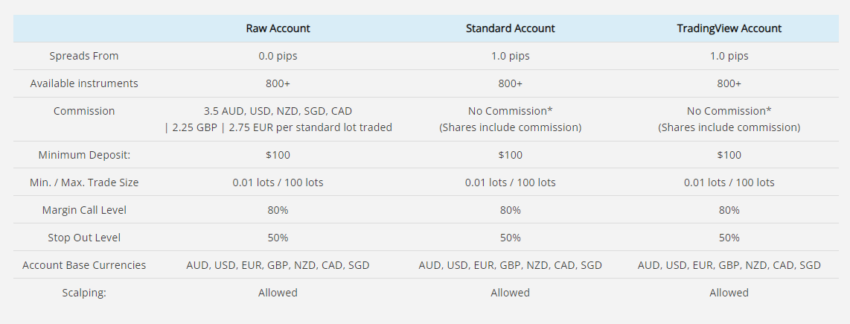

Eightcap offers account types to suit different trading styles and levels of experience. The Raw Account is tailored for experienced forex CFD traders and offers specialized benefits.

The Standard Account provides competitive spreads, making it suitable for a wide range of traders. Additionally, the Tradingview Account offers advanced charting tools and indicators for traders seeking comprehensive technical analysis capabilities.

For those looking to practice and refine their trading strategies, Eightcap offers a demo account, with demos expiring either 30 days from creation or once they have executed 5,000 orders.

Eightcap features in summary

- Trading platforms: Enjoy the power of TradingView, WebTrader, MT4 & MT5 trading platforms.

- Advanced charting: Access advanced charting tools, expert advisors, and custom signals.

- Crypto Crusher dashboard: Exclusive access to the Crypto Crusher dashboard for trade ideas, clear entry/exit levels, and market sentiment.

- Capitalise.ai: Create, test, and automate trading strategies using everyday English with Capitalise.ai (code-free automation).

- FlashTrader: Easily target multiple profits, calculate position size, and place stops and limits with just one click using the trade ticket.

- TradeZone: Receive weekly trade ideas from experts, along with weekly market forecasts and mid-week commentary webinars.

- Margin trading: Benefit from margin trading to amplify your trading potential.

- Diverse asset selection: Trade over 800 assets, including cryptocurrencies, indices, forex, commodities, and stocks.

- ForexVPS: Access ForexVPS services to optimize your trading experience.

- Demo account: Practice and refine your trading strategies with a demo account.

- Multiple account types: Choose from various account types, including Raw Account for experienced forex CFD traders, Standard Account with low spreads, and Tradingview Account with advanced charting and indicators.

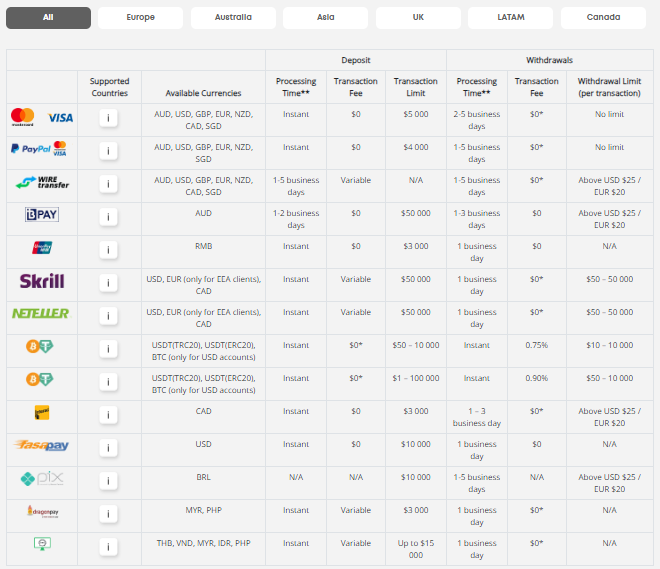

Deposit and withdrawals

Eightcap offers a variety of convenient deposit and withdrawal methods to accommodate the needs of its traders across the globe.

These methods include Visa and Mastercard, which are widely accepted credit and debit cards, as well as online payment systems such as PayPal, Skrill, and Neteller. This provides flexibility for those who prefer digital payment options.

Traders can also use traditional banking channels like wire transfers for their transactions, ensuring accessibility for a broader range of users. BPay, UnionPay, and Interac are additional payment options that cater to specific regions and preferences.

The platform accepts USDT and BTC for deposits and withdrawals, allowing for transactions with digital assets. Note that you will have to whitelist any wallet that you use.

For traders in Brazil, Pix from the Central Bank of Brazil is available as a deposit method. DragonPay is another payment option that adds flexibility for users in select regions.

Security and payment processing

It’s important to note that Eightcap does not charge any internal fees for deposits or withdrawals. However, traders should be aware that the provider they use may impose transaction fees or international processing fees.

It’s advisable to check with the chosen payment provider for any additional charges.

Eightcap’s finance team reviews each withdrawal request, which typically takes one to two business days.

Eightcap does not provide details on any internal processes, methods, or practices regarding security. This includes security for accounts, data collection/ privacy, or user funds insurance.

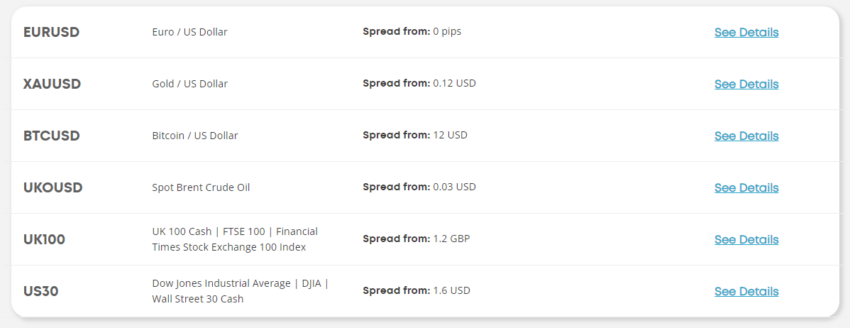

Eightcap offers a wide range of assets at various prices. In general, the platform offers low, competitive spreads.

Note that whether a spread is considered high, low, or medium can also depend on market conditions, volatility, and individual trader preferences.

Moreover, Eightcap also separates fees by account. Traders should consider these factors when evaluating the suitability of spreads for their trading strategies.

Pros and cons

Most things in life have tradeoffs. This is also true for brokers like Eightcap. Here is a snapshot of the platform’s strengths and weaknesses.

| Pros | Cons |

|---|---|

| User-friendly | Limited availability and services depending on location |

| Convenient deposit and withdrawal | Limited disclosure on security practices |

| Good customer service | |

| Multiple trading platforms and diverse account types | |

| Code-free automation |

How does Eightcap compare to others?

Here’s a quick look at how Eightcap shapes up against some of its key competitors.

| Platforms | Assets | Trading Platforms | Account Types | Assets | Licenses |

|---|---|---|---|---|---|

| Eightcap | Forex, crypto CFDs, commodities, indices, stocks | TradingView, WebTrader, MT4, MT5 | Raw, Standard, Tradingview, Demo | 800+ | ASIC, FCA, CySEC, SCB |

| Global Prime | Forex, crypto CFDs, commodities, indices, bond CFDs | MT4 | Raw, Standard, Demo | 150+ | ASIC, VFSC |

| OANDA | Stocks, stocks CFDs, indices CFDs, commodities CFDs, crypto, ETF funds CFDs | OANDA Web, MT4, MT5 | Standard, Premium (Elite Trader loyalty program), Demo | 68 | CFTC, NFA, FSA, ASIC |

| FP Markets | Forex, stocks, precious metals, commodities, indices, bonds, ETFs | MT4, MT5, IRESS | Standard, Raw, Demo | 10,000+ | ASIC, CySEC |

Customer support

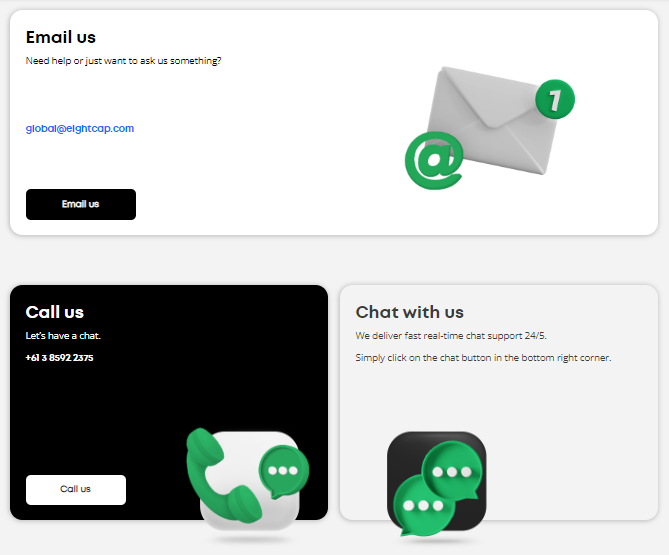

If you are looking for information on Eightcap’s user experience and customer support, here’s what you need to know. The company has three primary ways of communication, including phone, email, and a convenient chatbot.

When BeInCrypto contacted Eightcap, we found the service to be highly responsive, and the support staff was both helpful and knowledgeable. The option for phone support is a notable bonus.

As far as customer reviews go, the broker receives excellent marks on user satisfaction, according to Trustpilot. The overall user experience at Eightcap seems highly positive, with a user-friendly website and platform that is particularly welcoming to newcomers.

Users appreciate the ease of navigation and the simplicity of the platform, which makes it suitable for beginners and more advanced traders. Customer service is a strong point for Eightcap, with fast and helpful responses noted.

There are also multiple specific mentions of account managers providing exceptional service, which suggests a commitment to personalized support. In summary, Eightcap offers a user-friendly platform and efficient customer service, creating a positive trading experience for its customers.

Regulatory compliance and safety

Eightcap operates under various regulatory authorities in different regions. In Australia, the Australian Securities and Investments Commission (ASIC) regulates the company under the name Eightcap Pty Ltd.

In the United Kingdom, it is authorized and regulated by the Financial Conduct Authority (FCA). Eightcap is also authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

Additionally, Eightcap Global Limited is regulated by The Securities Commission of The Bahamas (SCB).

Invest responsibly

Trading in financial markets carries inherent risks, and it’s essential to approach trading and investment decisions with caution. Past performance is not indicative of future results, and you should never invest more than you can afford to lose.

Additionally, it’s advisable to thoroughly research and understand the products and services offered by brokers and consider seeking advice from financial professionals if necessary. Remember that trading involves both the potential for profit and the risk of loss, and you should only trade with funds that you can comfortably risk.

The ins and outs of Eightcap

Eightcap is a well-regarded broker offering competitive spreads, regulatory compliance, and multiple trading platforms. Its diverse asset selection and code-free automation options make it appealing to a wide range of traders.

If you are looking for alternatives with better tradeoffs, you will find it hard to find a better option. Of course, the platform isn’t perfect. Eightcap could benefit from further global expansion as well as offering greater transparency around security and user data.

Frequently asked questions

Eightcap does not provide any direct bonuses. However, the platform does have partner and affiliate programs that individuals or businesses can leverage.

Eightcap is regulated in multiple regions. Some of these include the Bahamas, Australia, the U.K. and more. Users should should trade based on their own risk appetite.

Some of the biggest disadvantages of Eightcap are its regional restrictions. The platform is not available in many regions and services are restricted in some regions as well. Users should be aware of regional limitations when trading on Eightcap.

Eightcap supports a multitude of deposit and withdrawal methods. Some of these include crypto, wire transfer, and debit/ credit card to name a few. Eightcap does not currently support third-party payments.

Yes, Eightcap does charge fees. The platform’s fees differ based on the instrument traded and the type of account held. It’s essential for users to review the fee structure in detail before trading to understand the costs associated with their specific activities.

Eightcap is regulated in many regions, providing users with added confidence in the platform’s safety. This often includes regular audits, transparency requirements, and measures to protect users’ funds, further enhancing the platform’s trustworthiness and reliability.

While Eightcap doesn’t have its own standalone app, it integrates with reputable platforms like Metatrader. The company is regulated in multiple countries, ensuring a commitment to user safety and transparent practices.

Eightcap operates with business entities in various countries, such as Australia, U.K., Bahamas, and Cyprus. Users should check their local regulations or the Eightcap website to confirm the platform’s availability in their specific location.

Eightcap is an Australian-based broker providing access to a wide array of assets such as stocks, crypto, forex, commodities, and indices. With its platform, traders and investors can engage in various financial markets, capitalize on price movements, and craft diversified investment portfolios.

Yes Eightcap is regulated. Eightcap is regulated in multiple jurisdictions, including ASIC in Australia, FCA in the United Kingdom, CySEC in Cyprus, and SCB in The Bahamas.

The minimum deposit to initiate trading on Eightcap is $100. Users can fund their accounts using various methods such as card payments, crypto transfers, wire transfers, and several other options.

No, Eightcap does not have a dedicated mobile app. You however use the Metatrader platform with Eightcap on mobile. Metatrader is a globally recognized trading platform, known for its robust features and mobile-friendly interface, allowing Eightcap users to seamlessly trade on-the-go and manage their portfolios from anywhere.

Yes. Eightcap has a demo account. Eightcap’s demo accounts typically expire either after 30 days from creation or once they have reached 5000 orders.

Yes, you can transfer money to and from your bank account. Some of the methods for transfer includes bank transfer, credit/ debit card, and crypto to name a few.

Yes, Eightcap requires KYC. The platform enforces KYC to ensure compliance with regulatory bodies. This involves verifying the identity and financial source of its users, thereby reducing the risk of fraudulent activities and maintaining the platform’s integrity and trustworthiness in the financial ecosystem.

Yes, Eightcap is a legitimate business and operates under regulatory oversight in various countries. Being regulated ensures that the platform adheres to stringent financial standards and practices set by governing bodies.

Eightcap is often lauded for its customer support in reviews. The platform offers a range of support methods, including a chatbot, email, and direct phone assistance.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.