The world of DeFi lending continues to evolve, with some remarkable platforms offering users more incentives and advantages. One of the most recent developments is the concept of self-repaying loans — loans that pay themselves off using collateralized assets to produce yield. Alchemix Finance does just that.

This concept for wealth building is fairly new in the crypto community. Yet, the project has managed to innovate ideas — or rather, alchemize ideas — into a practical, yield-bearing protocol with demonstrable access. Here’s how Alchemix works and the various use cases its native token, ALCX, offers.

What is Alchemix?

Alchemix is a DeFi protocol that allows users to earn interest and borrow against their crypto asset deposits. The platform functions as a lender as well as a savings account which isn’t an entirely new concept. What sets Alchemix apart from other lending protocols is that the protocol enables loans to pay for themselves automatically.

Essentially, a deposit’s earned yield is used to repay the loan. The deposit acts as collateral, allowing users to receive advances on the yield instantly. Moreover, a user’s risk of being liquidated is minimal. This is because the platform mints its own synthetic token versions of the collateral.

Alchemix, along with similar platforms, is demonstrably playing its part in accelerating the DeFi boom.

“DeFi boom is a very near equivalent of an apocalyptic event for the traditional financial institutions.”

― Mohith Agadi

Who founded the ALCX coin?

Launched in February 2021, pseudonymous developers led by Scoopy Trooples founded the Alchemix protocol and its subsequent ALCX crypto. Trooples funded a few up-and-coming DeFi projects through eGirl Capital, a VC fund also made up of a pseudonymous team.

The platform only accepted DAI at the time until the team created a new vault that would accept ETH deposits to mint alETH tokens. The project has since experienced significant success reaching a $125.59 million total protocol TVL.

DID YOU KNOW? There was a loss of 2,200+ ETH when users began withdrawing their ETH collateral without repaying their loans. The team then set up a campaign asking users to return the lost ETH in exchange for rewards. Eventually, they were able to recover more than half of the lost funds.

How does Alchemix work?

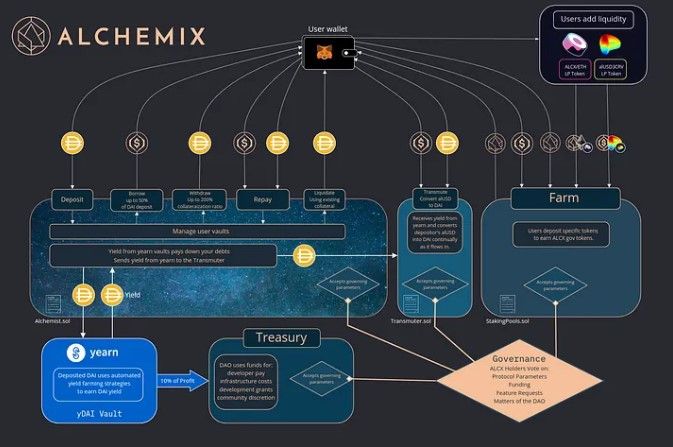

Alchemix uses Yearn to generate yield. It essentially pools together the platform’s collateralized assets and deposits those funds into other DeFi protocols. Each user makes a deposit which becomes collateral for a loan (up to $1 for every $2 deposited.) The profits that are yielded from those deposits are then used to pay off everyone’s loan debt over a period of time using Yearn’s vaults. Alchemix stacks various protocols on top of each other for maximum yield returns. Users can convert loans for fiat purchases or stake for additional yield.

To use the platform:

- Connect your wallet to the Alchemix platform (you must have some DAI in the wallet)

- Deposit your crypto into Alchemix via its vault page

- Alchemix stakes your DAI into a Yearn vault to obtain yvDAI

- You borrow alUSD worth up to 50% of the amount of deposited collateral

- The yield accrued to the yvDAI is periodically harvested to repay the debts of depositors

The interest you earn on Alchemix is greater than that on Yearn due to its sheer volume and the Transmuter’s bonus treasury. The Transmuter used to convert alUSD back to DAI but is no longer needed due to increased liquidity.

Right now, the Transmuter is used to ensure alUSD doesn’t lose its peg. Therefore, Alchemix finance limits how much alUSD is created to ensure this doesn’t happen. This means you may have to wait until the mintable amount increases before borrowing against your collateral if the demand is high.

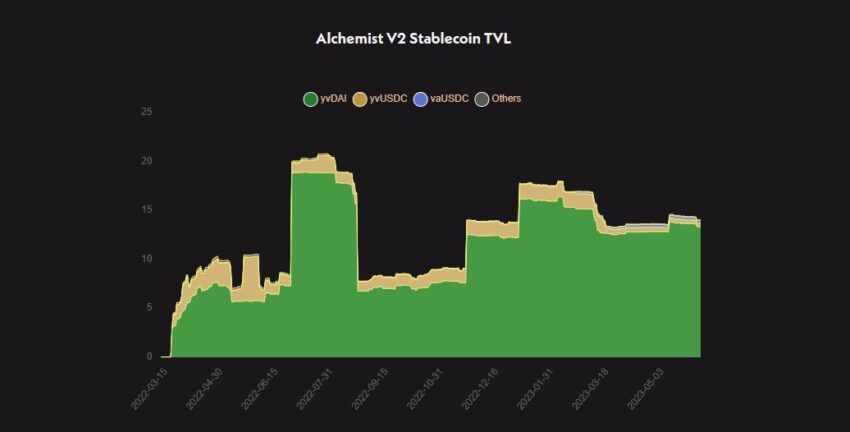

Alchemix V2

The Alchemix platform was upgraded in May 2022 and was dubbed Alchemix V2. This introduced more flexibility; borrowers could now start choosing their own yield strategies and collateralized token types. This essentially means borrowers can implement their own yield aggregators. This upgrade also introduced Vesper and AAVE vaults alongside the Yearn vaults. Below is the TVL for Alchemix V2 for both stablecoins and ETH.

What is a self-repaying loan?

A self-repaying loan refers to a loan that is automatically paid off via the yield earnings from an investment or business. Self-repaying loans are processed using smart contracts on a blockchain. The smart contracts automatically deduct the repayment amount from the person’s collateral until it is paid off, depending on the protocol’s rate. Then the collateral is returned to the borrower.

In the case of Alchemix, a user can deposit collateral that produces yield from other yield-bearing DeFi protocols. Then, the user can take out a loan of up to 50% of the value of the deposit. That yield would then be used to pay off the loan. Borrowers avoid the risk of liquidation by borrowing a synthetic version of the deposited asset. In addition to using yield to pay off loans, yield can also be used for spending and saving.

Pros and cons of Alchemix

Alchemix Finance has no doubt provided an innovative approach to lending. By stacking various protocols on top of each other, maximum yield is generated from the collateralized assets. This gives the protocol an almost Lego-like structure which accounts for much of the platform’s success. However, it’s worth noting both the benefits and potential risks of Alchemix before deciding to invest.

Pros

- Loan structure and yield strategy customization

- Options to borrow against stablecoins

- No liquidation risks

- Loans that amortize themselves automatically

- Synthetic tokens received can be staked

Cons

- Risk of failure if one DeFi protocol in the stack fails

- Not enough cryptocurrencies supported

- Can not buy ALCX with cash

Alchemix token (ALCX)

The Alchemix (ALCX) is the native token for the Alchemix protocol, used for governance. Those who hold ALCX are eligible to make important decisions regarding spending funds in the Alchemix DAO. Following Alchemix V2, the team announced that the token’s role would be used for funding development, incentivizing liquidity, and growing Alchemix’s vault integrations.

As of mid-June 2023, the live market price for ALCX is $14.14, with a market capitalization of $26 million. ALCX has a total supply of 2.14 million and a circulating supply of 1.8 million. It currently does not have a hard cap.

ALCX token distribution

The ALCX token has a carefully crafted emissions schedule. Furthermore, this token distribution assures that no development team member(s) will have enough tokens to control the protocol. The numbers below are based on the total expected supply after three years.

- Alchemix DAO: pre-mine of 15% of the projected supply after three years

- Alchemix DAO: an additional reserve of 5% of the projected three-year supply for bug bounties

- Staking pools contract: remaining 80% can be obtained by staking certain tokens and liquidity pool tokens

- Founders and community developers will have access to an exclusive staking pool which receives 20% of the ALCX block reward.

- Stakers and liquidity providers can obtain 80% of the ALCX block reward (with a portion sent to the treasury).

The Alchemix DAO receives 10% of the entire platform’s Yearn profits, and it uses the funds to pay developers, grants, infrastructure costs, and any other costs determined by the community.

alUSD

Aside from ALCX, the other token Alchemix uses is alUSD which is a synthetic stablecoin pegged to the U.S. Dollar. When funds are deposited, users can immediately borrow up to 50% of the value of those deposits as alUSD. The alUSD tokens can be converted back into DAI and exchanged for fiat, or they can generate even more yield in Alchemix pools.

Alchemix staking and liquidity pools

The platform relies on its participants to provide liquidity for its staking and liquidity pools which enables the lending process. In addition, users can further increase their yield on their synthetic yield.

For staking:

- Users can stake alUSD to earn ALCX

- Users can stake ALCX to earn ALCX

For liquidity pools:

- Users can stake SLP tokens to earn ALCX

- Users can stake SLP tokens to incentivize holding alUSD until the alUSD/DAI pair finds sufficient liquidity

Use Alchemix with caution

The Alchemix crypto protocol has introduced a new concept to DeFi with the introduction of self-repaying loans using synthetic tokens and the help of various yield-generating strategies. However, innovation always invites risks. Always do your own research before using any decentralized finance protocol in which you risk losing funds. Stay informed regarding the project’s security measures and its audits, and consider whether the platform aligns with your own risk tolerance and financial goals.

Frequently asked questions

What is Alchemix used for?

How does Alchemix make money?

Can you get liquidated on Alchemix?

How long does Alchemix loan take to repay?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.