It seems that a new DeFi darling emerges every week now to enjoy surges in popularity, collateral lockup, and oftentimes boosts in token prices. At the moment, InstaDApp appears to be the DeFi flavor of the week.

Another day has yielded another all-time high for DeFi markets with the total value locked (TVL) hitting $2.47 billion yesterday. The momentum is still strong for all things DeFi, while the overall crypto market has been relatively lethargic.

Since the same time last month, the decentralized finance ecosystem has grown by 125% in terms of TVL. Cryptocurrency market capitalization, meanwhile, has remained flat, oscillating between $260 and $270 billion as the big players struggle to break through resistance zones.

DeFi is currently yielding greater investment rewards as trading can be arduous when markets are flat, and volume and volatility low, which has definitely been the case for Bitcoin since the halving. Speculators and investors are constantly on the lookout for the next big thing, and this week, InstaDApp appears to be winning the race.

InstaDApp DeFi Collateral Surges

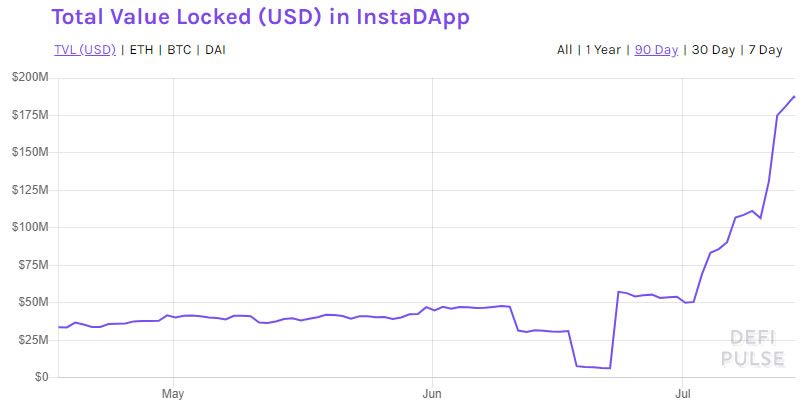

InstaDApp is currently ranked fifth in terms of TVL, recently surpassing Aave. This month alone, TVL on the platform has surged a whopping 275% from around $50 million to an all-time high of $187 million. In late June, the TVL figure was even lower (around $6.5 million) which would show another tenfold increase, clocking in a 2,700% bump in less than a month.

“The #1 tool that helps #DeFi yield farmers do their jobs better is hands-down @Instadapp. Total Value Locked: *6/21: $6.4 million *7/13: $183.8 million (+2754%) The *free* platform that @sowmay_jain @smykjain & team are building is fueling an agricultural revolution”InstaDApp is a smart wallet with a user-friendly interface that has been built on top of popular DeFi projects such as MakerDAO, Compound, dYdX, Kyber, Oasis, and Uniswap. It allows users with little technical knowledge to perform more advanced actions such as leveraging or saving by buying or selling crypto collateral in a single transaction. The platform offers features such as the option to lend assets or add liquidity to Uniswap pools and ‘Bridge’ which allows users to migrate debts between Maker Vaults and Compound Finance. The platform was launched on the Ethereum mainnet in December 2018, and updated to version 2 in April 2019. Unlike its DeFi brethren, InstaDApp has yet to launch its own native token. InstaDApp Founder and CEO, Sowmay Jain [@sowmay_jain], noted that the platform is increasingly being used to farm tokens for deposit into high-yield smart contracts on other DeFi platforms.

Farmers are innovating on Instadapp. Minted 7M DAI from Maker at 0% interest to deposit on Compound. Soon coming up with more cross protocol recipes.

The recent addition of new platforms, such as Uniswap V2, to InstaDApp, appears to be driving the momentum at the moment. On Sunday, the platform tweeted that wrapped Bitcoin (wBTC) positions can now be refinanced between Maker and Compound. The proposal to increase the wBTC collateral factor to 40% was recently passed by Compound governance, this allows it to be used to borrow other crypto assets.

Earlier this month, InstaDApp introduced a system called ‘Debt Swap’ to take advantage of the liquidity farming frenzy that has propelled DeFi to new heights. The protocol now enables the switching of Compound stablecoin debt from USDT to DAI in a single click, resulting in greater COMP earnings. The announcement elaborated;

The recent addition of new platforms, such as Uniswap V2, to InstaDApp, appears to be driving the momentum at the moment. On Sunday, the platform tweeted that wrapped Bitcoin (wBTC) positions can now be refinanced between Maker and Compound. The proposal to increase the wBTC collateral factor to 40% was recently passed by Compound governance, this allows it to be used to borrow other crypto assets.

Earlier this month, InstaDApp introduced a system called ‘Debt Swap’ to take advantage of the liquidity farming frenzy that has propelled DeFi to new heights. The protocol now enables the switching of Compound stablecoin debt from USDT to DAI in a single click, resulting in greater COMP earnings. The announcement elaborated;

The Debt Swap recipe allows you to move your Stablecoin debts within the Compound protocol giving you access to the best interest rate at any given time.InstaDApp has continued to innovate as DeFi has grown, enabling greater earning potential for crypto holders. The results can clearly be seen in the four-digit surge in collateral on the platform, and it doesn’t even have a native token yet.

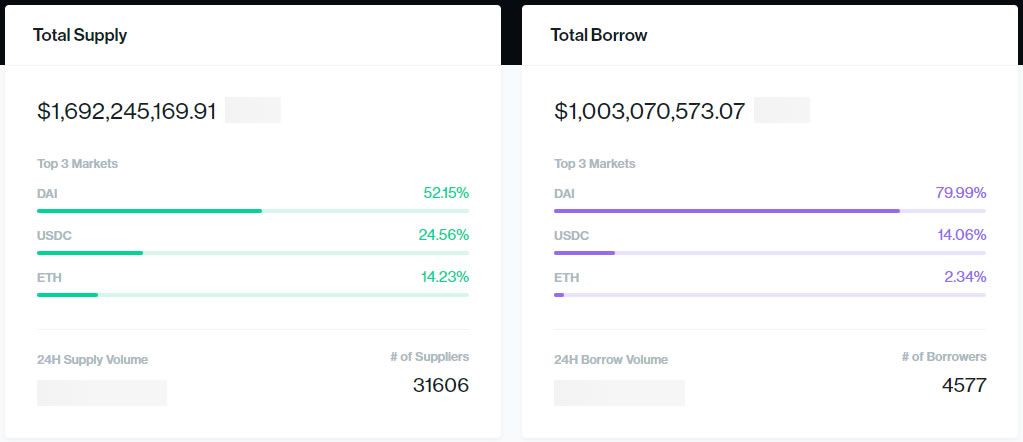

Compound Tops $1 Billion in Loans

In a related development, Compound Finance is continuing to go from strength to strength, building upon the success of its COMP token distribution incentive. According to the Compound market overview, crypto loans have topped a massive one billion dollars on the platform.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored