One of the largest regions on the planet for crypto adoption growth is Latin America. This is largely due to economic instability, failed monetary policies, and rampant inflation devaluing local currencies.

In its Crypto Landscape in Latin America report for the second half of 2023, Mexican crypto exchange Bitso revealed that Bitcoin and stablecoins dominated local markets’ buying behavior.

Crypto Adoption Surge in Latin America

It revealed that Bitcoin made up around 53% of the average portfolio composition. However, digital dollars were the fastest-growing cryptocurrencies in the region.

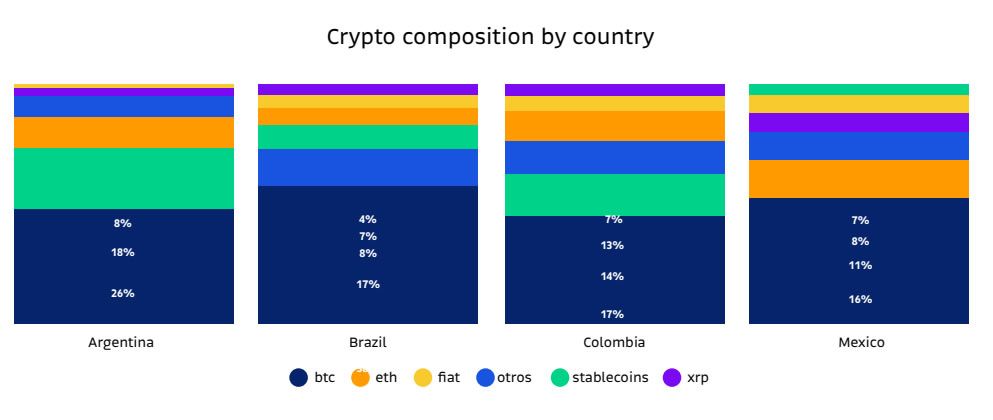

The two leading stablecoins, USDT and USDC, comprised 26% and 17% of the average portfolio of Argentina and Colombia users, respectively. Unsurprisingly, this is driven by the economic environment and inflationary pressures in each country.

Buying behavior reflects the same trend regarding the preferred cryptos. Bitcoin and stablecoins made up 68% of the total cryptos acquired in the second half of 2023.

However, Argentina was the exception, with digital dollars comprising 60% of purchases, compared to just 13% for Bitcoin. Inflation in Argentina has surged to 211% and is set to top 250% this year, according to the Organisation for Economic Cooperation and Development. Furthermore, Bitcoin prices hit record highs recently against the Argentine peso.

In Mexico and Brazil, the preference for Bitcoin was greater, with 40% BTC vs 28% for stablecoins and 35% vs 19%, respectively. In Mexico, XRP was a relevant part of the average portfolio, comprising around 8% of the total average holdings.

Brazil is the only country in which memecoins and altcoins were a relevant part of the portfolio, it reported. Brazilians have, on average, 17% of total holdings in altcoins vs 11% regionally.

Moreover, they tend to favor Shiba Inu (SHIB) but are not keen on Ethereum (ETH) compared to other Latin American countries.

Read more: 7 Ways To Handle Retirement With Increasing Inflation

The report also noted that crypto holders in Latin America remained steadfast during the bear market.

“The data suggests that big, long-term cryptocurrency holders have continued to hold despite crypto industry concerns and issues raised in 2022 and the beginning of 2023.”

Brazil and Argentina Lead the Way

Women’s crypto adoption is also increasing across Latin America, though still lower than men’s. Adoption rates tend to rise with age for women, it noted.

Colombia and Brazil have the most balanced gender distribution at 33% and 31% women, respectively.

Overall, countries like Brazil, Argentina, and Mexico are among the top 20 in the world for crypto adoption, it noted. However, it reported that Colombia had the highest growth in registered users for the exchange in 2023.

Bitso also described the region as one with “high indexes of unbanking and unequal access to financial services,” and concluded:

“Latin America exhibits remarkable enthusiasm for cryptocurrencies, making it a vibrant and dynamic region in the crypto space.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.