New research by Colombia’s central bank finds that the adoption of a central bank digital currency (CBDC) will have a minimal impact on a struggling economy.

However, the authors of the working paper did stress that the central bank had not yet ruled out a CBDC. Although, for it to succeed, the project has enough desirable features to generate a “core group of users.”

Research Recommends Spending Limits and No Interest Payments

In their deliberations, the authors also recommend a particular kind of CBDC that would include spending limits. The report states:

“After revising several aspects of the retail CBDC, it is established that the more convenient design for the Colombian economy should be based on a tiered architecture (either the hybrid or intermediated by commercial banks), contain holding and spending limits, be resilient to a wide range of incidents, and be non-interest bearing….

Considering the scenario described by the abovementioned design aspects, the expected macroeconomic effects of introducing this form of digital money into the economy would be nil, especially its potential detrimental disruptive effects on both financial intermediation and financial stability.”

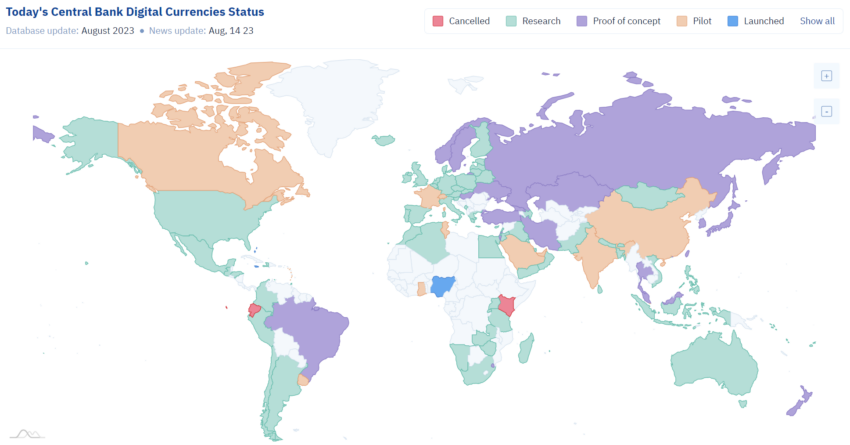

The paper acknowledges that not all governments have the same reason for adopting a CBDC. It notes that in some countries like the Bahamas, the motivation is clear.

In that case, it facilitates the transfer of money across the disparate islands. However, in other countries, the reasoning is not so obvious.

Learn more about fiat-pegged digital currencies: What Is a Stablecoin? A Beginner’s Guide

Colombia is also unlikely to need an immediate alternative to cash, as close to 75% of retail transactions are settled with physical money. That contrasts with countries such as India, China, and the United Kingdom, where digital payments are incredibly common.

Colombia Should Push Forward on Regulating Stablecoins

Bank deposits remain the predominant form of digital money, typically in the national currency, with minimal interest. Issued by commercial banks, they are redeemable on demand at their full value and backed by government and regulatory guarantees.

The report also notes that, regardless of a CBDC, policymakers should continue to develop rules on backed digital assets like stablecoins.

When launched, stablecoins have not always proved popular. Nigeria’s e-Naira had a very low adoption rate until this year when a scarcity of banknotes supercharged adoption.

The African nation first launched the digital currency on October 25, 2021. Although commercial banks have proven nonplussed by the innovation, according to the head of its central bank.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.