All eyes have been on Bitcoin this week as the asset surged to a two-year high of $50,000. Ethereum has been lagging behind so far, but there are several narratives based on fundamentals that suggest it could outperform during this bull market cycle.

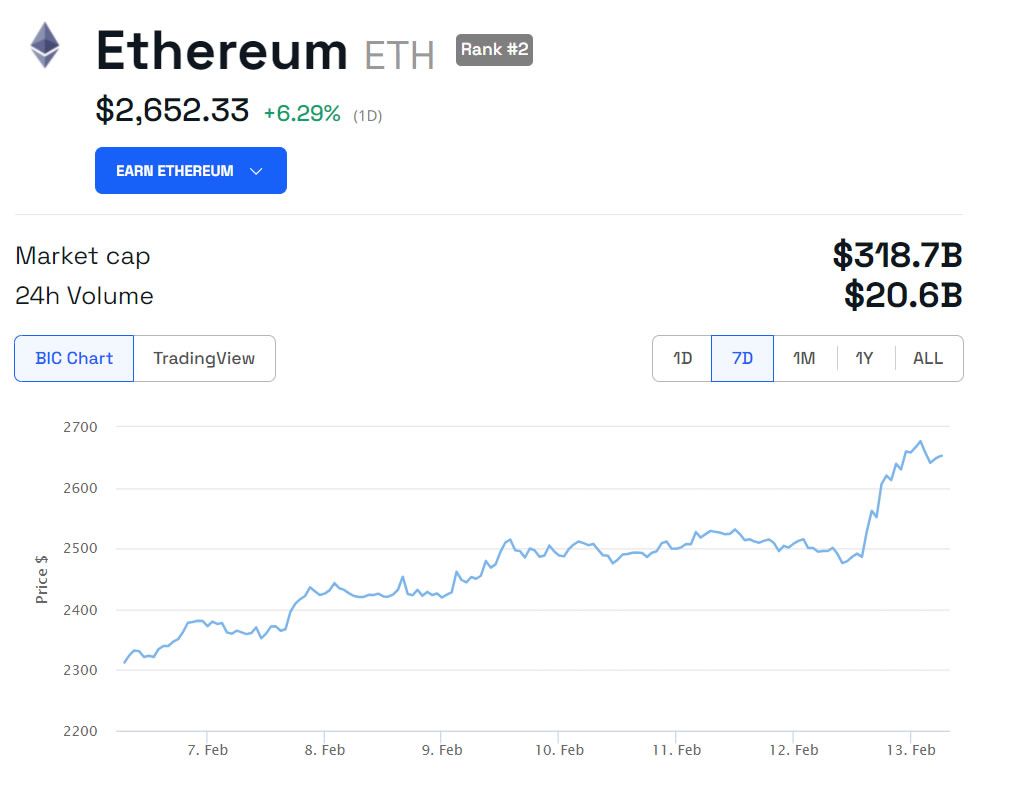

Ethereum has been the sleeping tiger in this year’s crypto rally. It hit a 21-month high of $2,700 on January 12 but has failed to break resistance there this week.

Ethereum Fundamentals Never Better

Ethereum’s ‘big brother’ Bitcoin has powered to a two-year high in the meantime. Nevertheless, these narratives indicate that it is only a matter of time before Ethereum wakes up.

More than a quarter of the Ethereum supply has now been locked up in staking platforms, as reported by BeInCrypto. This reduces the amount of ETH available in markets for spot trading or investing.

Moreover, 0.21% of the ETH supply is being burned annually, further reducing the amount of the asset available. According to Ultrasound.Money, the Ethereum supply has decreased by 357,148 since the Merge in September 2022. At current prices, this works out at a supply cut valued at $947 million in less than 18 months.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

The launch of highly anticipated spot Ethereum ETFs will also reduce the available supply. Especially if they follow a similar trend as the Bitcoin products which are now hoovering up more coins than the network produces daily.

Additionally, EIP-4844 set to be deployed in March, will significantly reduce layer-2 gas fees. This is likely to result in an increase in adoption, usage, and transactions.

All indicators show a rising demand for ETH, which has a shrinking supply, observed Impact3’s Kyle Reidhead.

“This is the most basic law of economics. If demand is increasing, and supply is decreasing, then the price has no choice but to pump.”

Further fundamentals were highlighted by other industry observers, such as restaking narratives through platforms like EigenLayer.

Read more: What Is EigenLayer?

TradFi and Fed Influences

It will also not be long before traditional finance discovers Ethereum’s golden properties of high yields and a deflating supply. There is also the onboarding of Ethereum and users for dApps like Farcaster.

Furthermore, Federal Reserve rate cuts will make holding cash less attractive, which is bullish for crypto assets offering greater yields.

This is also a potential victory for Coinbase against the SEC, eliminating fears over what the agency has self-proclaimed to be securities.

ETH prices have gained 6% on the day to reach $2,650, but the asset has yet to make a new 2024 high.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.