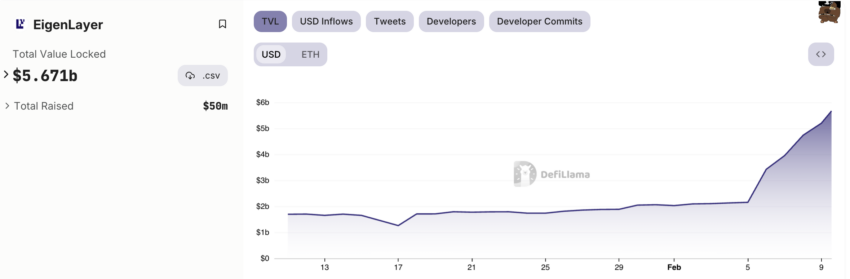

EigenLayer, a restaking protocol in the decentralized finance (DeFi) sector, has seen its Total Value Locked (TVL) soar by an impressive 171% in the past week.

The protocol launched in 2023 has swiftly gained the attention of the DeFi community due to several factors.

EigenLayer Becomes 5th Largest DeFi Protocol

According to DeFiLlama, EigenLayer’s TVL now stands at $5.67 billion, overtaking industry stalwart Uniswap and securing the fifth position among the largest protocols regarding TVL globally.

This surge in TVL is closely tied to EigenLayer’s recent strategic decision to temporarily resume token restaking and eliminate TVL caps for every token. This bold move, effective until February 9, 20:00 UTC, has ignited a flurry of activity within the protocol.

“While the unpause is temporary this time, in the coming months the pause and caps will be lifted permanently,” EigenLayer said.

Read more: What Is EigenLayer?

The entire DeFi ecosystem is currently experiencing a robust resurgence, with the total value locked across platforms rocketing to an astonishing $65 billion. This marks the highest point in 18 months, showcasing a revitalized interest and confidence in DeFi ventures.

A notable driver behind this resurgence is Ethereum’s transition to a Proof-of-Stake mechanism in 2022. This pivotal shift replaced Ethereum mining with staking, unlocking new avenues for staking rewards and enhanced mainnet security. However, the evolution did not stop with Ethereum staking. The network has continued to expand, with EigenLayer emerging as a key player in the DeFi space.

EigenLayer is at the forefront of Ethereum restaking, a novel concept wherein already staked Ethereum can be leveraged to lend security to other mainnet elements. This includes bridges, protocols, oracle networks, and scaling solutions. This groundbreaking approach allows stakers to accrue additional rewards from these entities, effectively compounding their gains.

Read more: Ethereum Restaking: What Is It And How Does It Work?

Airdrop hunters have also contributed to the success of EigenLayer. There is heavy anticipation of an airdrop from EigenLayer. Hence, the DeFi community is depositing their staked Ethereum to EigenLayer to increase their eligibility chances.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.