As Ethereum struggles to surpass crucial price levels despite the Merge, Securities and Exchange Commission Chairman (SEC) Gary Gensler’s latest comment have triggered a new debate.

According to Gensler, a crucial criterion used by courts to decide whether an asset is a security might be met by cryptocurrencies and intermediaries that permit investors to “stake” their coins, reported the Wall Street Journal.

SEC chair continues to push the security narrative

“From the coin’s perspective… that’s another indicia that under the Howey test, the investing public is anticipating profits based on the efforts of others,” he told reporters after a congressional hearing.

In Ethereum, staking includes depositing 32 ETH to activate validator software. After the proof-of-stake (PoS) transition, the Shanghai upgrade – slated for six to 12 months after the Merge – is an essential phase since it releases the staked ETH.

Staked ETH and freshly-produced ETH immediately following the Merge will all stay locked on the Beacon Chain and not be withdrawable until the Shanghai upgrade is activated.

Gensler believes that “[Staking] looks very similar – with some changes of labeling – to lending.”

Crypto businesses, including Coinbase, Circle, Gemini, Nexo, and Celsius, were previously flagged by the federal regulators for their yield-bearing products, sparking the discussion over “unregistered securities.”

However, proponents of the crypto industry have criticized the SEC, pointing out its “regulate-by-enforcement” strategy and the absence of regulatory advice.

Merge excitement fails to give sheen to Ethereum

The regulatory debate over “staking” is not the only discussion over the Ethereum Merge event. The much-anticipated overhaul has also failed to spark its price action. At the time of writing, Ethereum has lost close to 9% of its value in the past day.

While maintaining a 24-hour range between $1,454 and $1,641 on CoinGecko, the second-largest crypto remains 70% down against its peak high of around $4,870.

At current price levels, only 52% of ETH holders remain in profit per current market data analyzed by IntotheBlock. With that, only 1% of holders are breaking even while 47% are Out of Money. Despite the weak price action, exchange and on-chain signals lean towards a bullish market at press time.

Meanwhile, the global cryptocurrency market cap has also spiraled down close to $1 trillion as Bitcoin trades under the crucial level of $20,000.

Miners turn to Ethereum Classic and other alts

The PoS transition has also forced the miners to turn to other options like Ravencoin and Ethereum Classic. According to CryptoCompare, since the start of the Merge day, the hash rate for Ethereum Classic has increased by 240%, while Ravencoin has gone up by 51%.

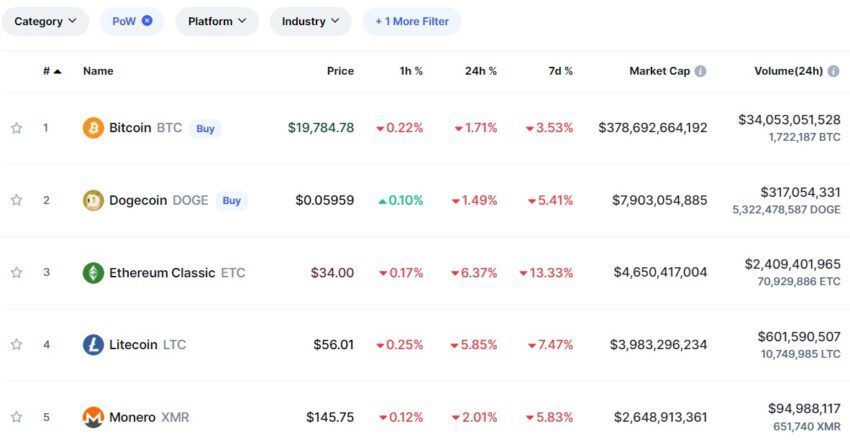

CoinMarketCap’s PoW ranking has now ranked Dogecoin under Bitcoin as the largest crypto in the category.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.