The decentralized finance (DeFi) ecosystem is witnessing a robust resurgence, with the total value locked (TVL) catapulting to a staggering $60 billion for the first time in 18 months.

This milestone underscores the rising interest in the DeFi sector, with protocols like Lido Finance and restaking narrative leading this shift.

DeFi TVL Surges 68% in 4 Months

The DeFi ecosystem’s total value locked jumped 68%, from $36 billion in October 2023 to $60.55 billion. This rise is mainly due to the crypto market rally and sector innovations, especially in liquid staking and restaking.

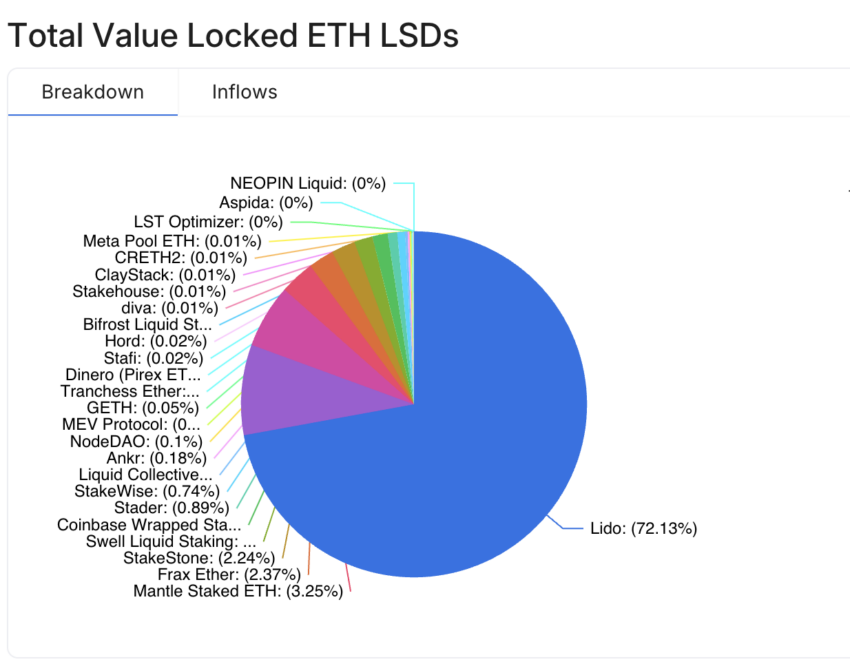

Lido Finance, leading in liquid staking, now has a 37% market share. Its TVL stands at $22.65 billion, with a 4.50% growth in the last seven days. The protocol is close to a major milestone of 10 million staked ETH, representing 72.13% of all liquid-staked Ethereum.

It is worth noting that the DeFi sector’s total liquid-staked Ethereum also rose, reaching 13.20 million ETH, worth $31.17 billion.

Read more: 11 Best DeFi Platforms To Earn With Lido’s Staked ETH (stETH)

Ethereum restaking, a novel DeFi narrative, is also becoming a key trend in 2024. It allows users to leverage the same ETH across multiple protocols, bolstering security across these platforms. This model has been instrumental in enhancing the robustness of smaller and emerging blockchains by leveraging Ethereum’s established security infrastructure.

At the heart of the restaking narrative is EigenLayer, a middleware platform that launched to mainnet in June 2023. Even without its native token, EigenLayer has carved a niche in the DeFi sector with a TVL of $4.07 billion, witnessing a notable 161% growth in just one month.

“Restaking is the fastest-growing crypto sector right now. A big wave of protocol launches using EigenLayer is coming our way,” Ignas, a pseudonymous DeFi researcher, said.

However, the restaking narrative also has its critics. Analysts like Miles Deutscher have raised concerns, drawing parallels between the restaking model and the DeFi Ponzi schemes that marred the sector in 2021 and 2022. Deutscher’s skepticism stems from the inherent risks and the pursuit of yield that characterized the previous DeFi manias, urging stakeholders to tread cautiously.

“I see restaking as the next version of the DeFi Ponzis…The re-staking narrative in my opinion is very reminiscent of the 2021 DeFi Ponzi protocols. When people take on more risk, they searching for yield, they’re hungry for opportunity on chain, and that is what really saw the DeFi Ponzi Mania of 2021[and] 2022,” Deutscher said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.