Serum DEX Token Surges

Decentralized derivatives exchange Serum has just launched its SRM token across a range of exchanges and DeFi protocols. Launched late on Aug 11, SRM was priced at just $0.11 at the time of the IEO. Within the first eight hours of trading, token prices had surged a monumental 1,700% to top out just under $2 at the time of press.

In order to operate a staking node, one million SRM, or 1 MSRM is needed. At today’s rates, that works out to equal a whopping $1.75 million.

FTX and Alameda Research CEO, Sam Bankman-Fried [@SBF_Alameda], stated that it was the highest load its servers had experienced, adding;

In order to operate a staking node, one million SRM, or 1 MSRM is needed. At today’s rates, that works out to equal a whopping $1.75 million.

FTX and Alameda Research CEO, Sam Bankman-Fried [@SBF_Alameda], stated that it was the highest load its servers had experienced, adding;

We took a lot of preemptive steps to mitigate this, and it mostly kept things online, though there were pain points… Time to double FTX’s servers again.The demand for DEX tokens is a testament to the popularity of this farming frenzy that has yet to cool off.

Yam Yield Farming Fruitful

Yam.Finance, also launched on Aug 11, promises to bring the fairness back into farming with a protocol and ‘zero-value token’ that aims to be totally democratic and decentralized. Yearn.Finance and Ampleforth have already made similar offerings and statements. Yam is a little different though, offering an elastic supply token that can expand and contract depending on market conditions. The final aim for this economic experiment is eventual price stability and a peg to the U.S. dollar:We have built Yam to be a minimally viable monetary experiment, and at launch there will be zero value in the YAM token.

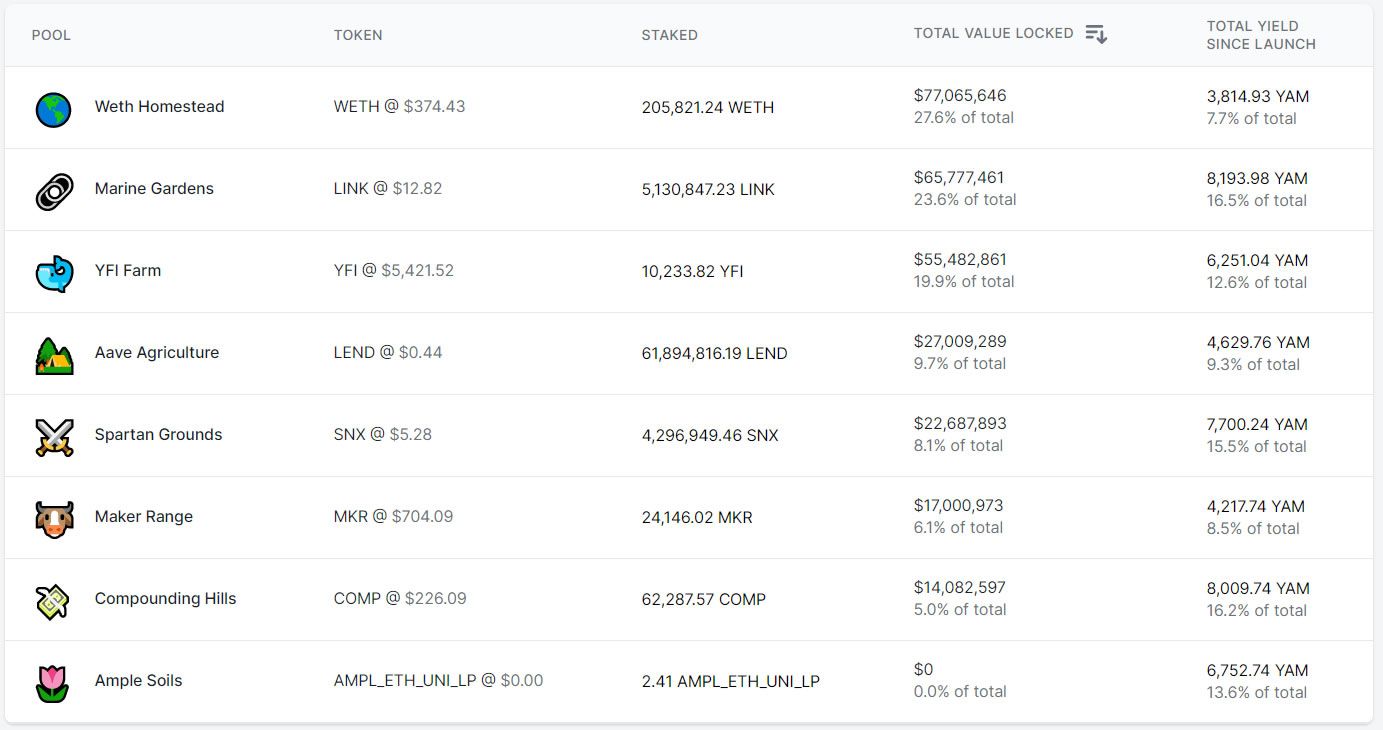

The project has stated that it will be reallocating 10% of each supply expansion to a treasury which will buy a high-yield USD-denominated stablecoin called yCRV. These ‘rebases’ will occur after the initial token distribution has taken place, which happened a few hours ago. There are 5 million YAM tokens in total with the first 2 million already distributed across eight staking pools. Holders of these eight tokens, which include COMP, MKR, LEND, YFI, LINK, SNX, wBTC, and an ETH/AMPL Uniswap pool, can deposit them as collateral on the Yam platform to earn tokens used to govern the platform. A further 3 million tokens will enter the YAM/yCRV Uniswap v2 liquidity pool with 1.5 million distributed in the first week, decreasing by 50% each week thereafter. Users can only stake for the first week, after which they will need to deposit their earned YAM into the liquidity pool in order to earn more. At the time of press, the token that was worth zero yesterday was trading at $100 after hitting a peak of $125. An analytics provider for the platform has reported that total value locked into these staking pools is already at $280 million collectively just nine hours after launch.YAM: An Experiment in Fair Farming, Governance, and Elasticity https://t.co/cyzvHZ2Blx

— Yam DAO (@YamFinance) August 11, 2020

Too Good to be True?

Naturally, this type of scheme has attracted the attention of the crypto stalwarts on twitter that have largely expressed caution. Compound Finance CEO, Robert Leshner [@rleshner], pointed out the security risks that could arise:While Shapeshift CEO Erik Voorhees [@ErikVoorhees] held nothing back, labeling it as a ‘scam’ and ‘pump and dump nonsense.’$YAM uses a non-standard ERC20 template (like $AMPL); using it as collateral or integrating it into a pooled protocol is a security risk that needs to be carefully analyzed 🍠

— Robert Leshner (@rleshner) August 11, 2020

Looking at things in a more positive light was Ethhub cofounder Anthony Sassano [@sassal0x], who stated that ‘bubbles are mathematically impossible’ in this new paradigm:$YAM looks like a scam… or to be more charitable, fairly transparent pump and dump nonsense.

— Erik Voorhees (@ErikVoorhees) August 12, 2020

Projects like this are not going to be good for defi…

What am I missing? Are the buyers willing participants in a silly game, or are people alleging actual value?

$YAM now at $100. Those of you in the old school who believe this is a bubble simply have not understood the new mathematics of potatoes, or you did not cared enough to try. Bubbles are mathematically impossible in this new paradigm. So are corrections and all else.

— sassal.eth/acc 🦇🔊 (@sassal0x) August 12, 2020

Surging DeFi Crop Prices

Good or bad, these new ‘Yam farms’ have had a direct impact on the prices of other DeFi tokens as farmers and yield hunters load up on tokens to stake in the eight new pools. It appears that collateral has been taken out of DeFi protocols to use these tokens since TVL across all markets has dropped 5% over the past 24 hours according to DeFi Pulse. COMP has cranked over 30% on the day to top $240, while Maker has also spiked 12% as it closes in on $700. SNX has made an 8% gain, LEND is up 12%, and AMPL has pumped 18% as they’re planted on new digital fields to grow Yams in what has become the latest darling of DeFi.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.