Decentralized Exchanges (DEX) rise in prominence, but centralized exchanges still outrank them when it comes to users. DeversiFi aims to change that.

Considering that cryptocurrencies rely on decentralized blockchain to power them, it doesn’t make sense that much of the crypt space relies on a few specific points of failure — centralized crypto exchanges (CEX).

While Binance, Coinbase, and others provide expediency and convenience, traders must rely on them for security and liquidity. Even more so, users have to give up their private keys for the price of convenience.

This is why DeversiFi aims to bring a central, easily understandable level of control to the DeFi space.

A brief history

DeversiFi hails its origin from EthFinex Trustless. It was the first hybrid DEX launched in September 2018 as a Bitfinex spinoff.

This was the world’s first trustless exchange running on Ethereum that could also link up with a CEX. More specifically, to Bitfinex order books, a crypto exchange based in Hong Kong.

Since then, trustless.ethfinex.com became app.deversifi.com.

It is now detached from Bitfinex and becoming its own company and DEX, the independent DeversiFi, developed by Liquidity Labs Holdings Limited (LLH). However, DeversiFi still partners with Bitfinex, as well as with StarkWare, Infura, WBTC, Consensys, and Ledger.

DeversiFi’s CEO is Will Harborne, who first outlined the project back in 2017. He previously worked at Cambridge Consultants before moving to IBM. After which, he joined Bitfinex to work on blockchain tech, ultimately resulting in DeversiFi.

Ross Middleton is the co-founder of DeversiFi and CFO, previously working on both EthFinex and Bitfinex. Outside of blockchain space, he worked at Centrica, Russian Gazprom, and RWE on global energy trading desks.

The third co-founder and COO is Daniel Yanev. He is in charge of the project’s growth. Like Harborne, he also holds a Masters of Engineering degree from the University of Cambridge. In charge of DeversiFi’s technology is Konrad Strachan, as the CTO and marketing falls under Lexi Short as CMO.

DeversiFi explained

DeversiFi started out as a Decentralized Exchange (DEX) but has since expanded to be a control center from which users can access DeFi.

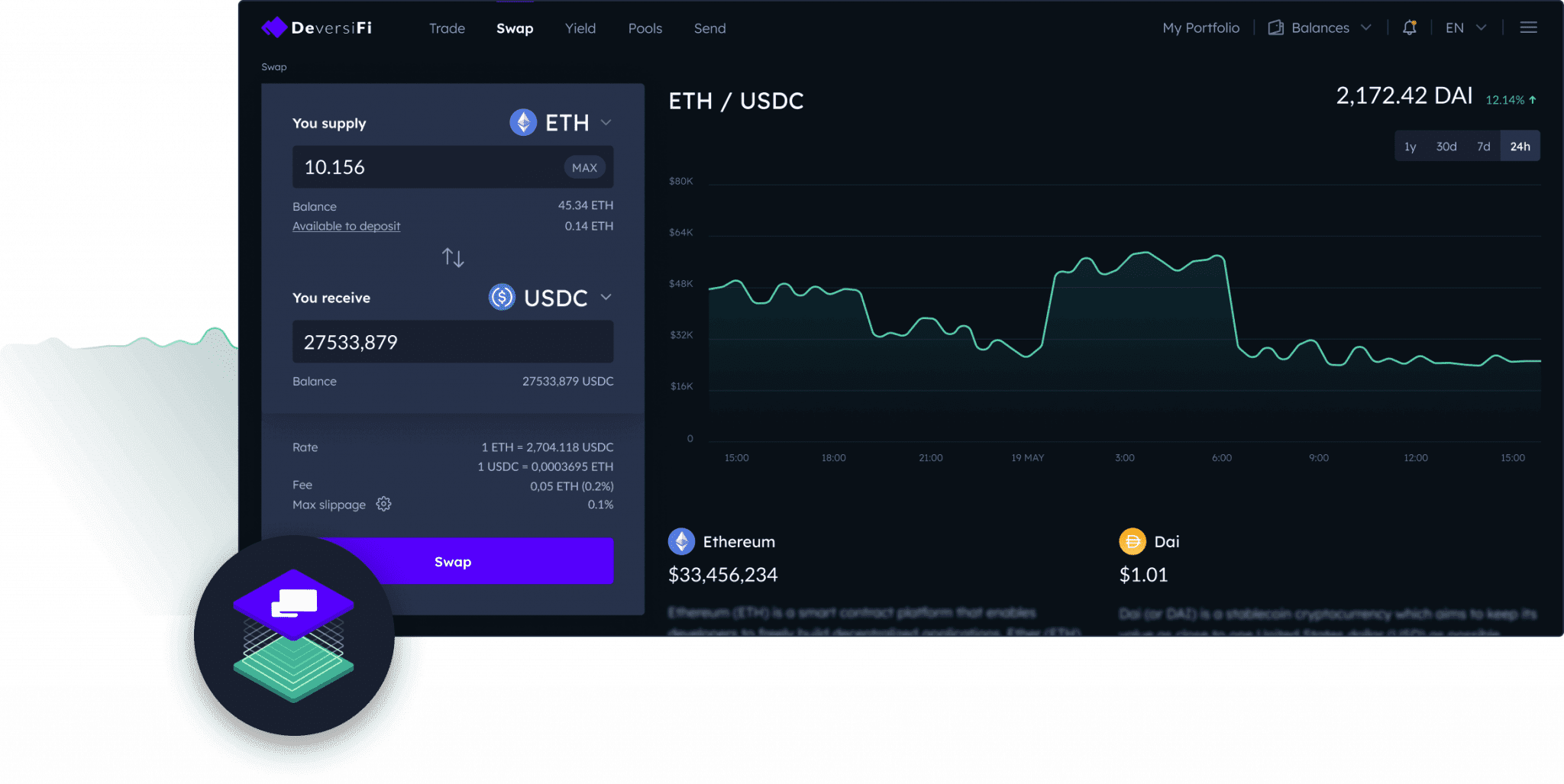

You can swap tokens by connecting it to your wallet. Therefore, it is unnecessary to transfer your funds somewhere else just to swap it for another token. This means that you retain the ownership of your private keys during the entire process.

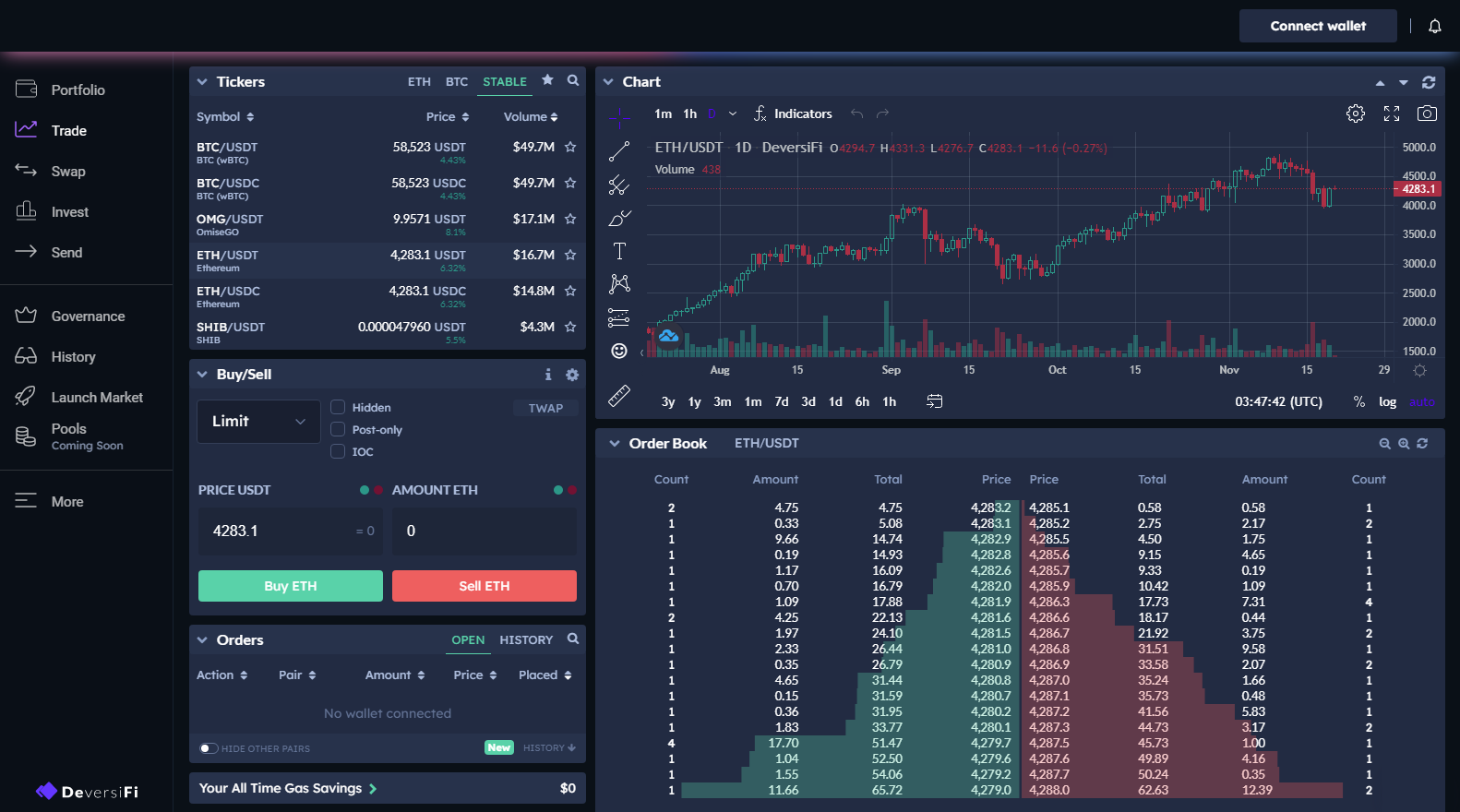

Furthermore, DeversiFi features an open order book, facilitating a transparent interaction between sell and buy walls. With it comes equally transparent market depth and price discovery. As is the case with other DEXs, it relies on liquidity providers to fill up liquidity pools for token pairs to be efficiently swappable.

All of that has been a standard across DEXs for quite a while. However, what sets DeversiFi apart is its capability to go head-to-head with CEXs. To accomplish that, DeversiFi has to be both fast and offer deep liquidity. As such, it is poised to be the most advanced DEX on the market.

“DeversiFi’s mission is to make DeFi easy for everyone, giving you access to the best of Ethereum swapping, sending, lending, trading and investing, but all in one place, without expensive gas fees and with complete privacy,” says the team.

DeversiFi’s key features

In a nutshell, DeversiFi protocol consists of:

- Over-the-Counter (OTC) trading as one of the first DEXes to do so.

- Decentralized Exchange (DEX) with high liquidity, access to over 30 markets.

- API trading allows developers to add DeversiFi protocol into Ethereum-based wallets.

- Margin trading.

Although it runs on Ethereum — notable for traffic congestion, high fees, and capability to only process ERC-20 tokens — DeversiFi can perform in excess of 9000 transactions per second (tps).

With this speed comes instant trade settlement, regardless of using an API (application programming interface) or through the platform itself.

High liquidity

Its most important feature is high liquidity. Through a hybrid model, it gains liquidity from both decentralized and centralized sources, including self-custody ones. In practice, this means that traders on DeversiFi can trade knowing they will receive very low slippage and have access to optimal token pricing.

Asset storage

When it comes to security, DeversiFi uses offline crypto asset storage. This way, user funds are guaranteed for prompt withdrawals at any point in time.

Furthermore, DeversiFi takes transaction data off-chain, thus preventing other traders from copying trading strategies. Perhaps most importantly, DeversiFi offers very low network fees thanks to its Layer 2 scalability solution, with fees ranging between 0 and 0.2%.

Order management

To get it as close as possible to CEX performance, DeversiFi uses real-time order management. This makes the activity faster than other DEXs, by utilizing the message-signing process. At the same time, one doesn’t need to register for an account or go through burdensome KYC (know-your-customer) procedures.

Layer 2 bridge

Lastly, to make ERC-20 tokens move as efficiently as possible, DeversiFi deployed a Bitfinex bridge as its first Layer 2 solution.

This bridge to Polygon allows access to three major stablecoins — USDT, DAI, and USDC. Polygon, previously known as Matic, is itself a Layer 2 solution aiming to help Ethereum with its gas fees.

“Layer-2 is the future of blockchain. Whether it’s the Lightning Network for Bitcoin or roll-ups such as DeversiFi for Ethereum, cryptocurrencies, and DeFi are finally on the verge of becoming accessible to everyone” says William Harborne.

How does DeversiFi work?

The DeversiFi blockchain project combines the best from both worlds — decentralized security and custody with CEX’s fast speed and deep liquidity.

To make that feasible, it employs a Layer 2 scaling solution in the form of zkSTARKS, a zero-knowledge cryptography technology developed by StarkWare.

zkSTARK stands for zero-knowledge Scalable Transparent ARguments of Knowledge. These cryptographic computations allow users to share data with a third party without it being revealed to the party.

In practice, ZK combines numerous Ethereum transactions into a single batch to be processed as a single transaction, significantly reducing the network’s bandwidth footprint.

As everyone is aware, Ethereum is notorious for having both volatile and high transaction gas fees. zkSTARKS eliminates this while still borrowing from Ethereum’s blockchain security.

The ZK layer also serves as a privacy layer by employing ZKP (zero-knowledge proof). When it comes to safeguarding user crypto funds, StarkWare also provided DeversiFi with DAC — Data Availability Committee. Consisting of vetted parties, DAC stores the funds off-chain, making the platform quite robust.

Developers can use either C++, JavaScript, or Python-made API libraries to access the protocol. Outside of API, DeversiFi is supported by the most popular wallets — Ledger, Metamask, and Keystore on desktop and trust wallet, token pocket, and Metamask on mobile.

DeversiFi’s tokenomics

The ticker for DeversiFi governance token is DVF. It launched in June 2021. Staked DVF tokens can be used for either voting or signaling and are held on both Layer 1 and 2. The xDVF is just a staked version of DVF. One first needs to convert the latter into xDVF to be eligible for voting.

Fortunately, there are no time locks, so xDVF can be unstaked at will. The token’s maximum supply is 100 million DVF, while about 24.1 million are presently in circulation. Outside of DeversiFi DEX, you can also obtain the tokens on Uniswap and XT.COM.

However, the team has also indicated they will be airdropped.

“The DVF tokens are now in the hands of over 1000 community members and will also be airdropped to several thousand active users of the DeversiFi platform, giving the community real control over DeversiFi and a way of sharing the protocol’s success.”

DVF token achieved its ATH price at $18.60. This means that its market cap is still hovering under $300 million, making it a small-cap coin.

What is coming ahead for DeversiFi?

In May 2021, DeversiFi raised $5 million in a funding round led by ParaFi. The team put the money to good use to further scale up the protocol using zkSTARKS.

When it comes to enhancing its DeFi offering, the team is working on deploying DeversiFi’s rewards program and automated market maker (AMM), and expanding DeFi yield opportunities. This AMM goes live on December 1.

Users will be able to earn rewards via trading on the platform or by providing liquidity to the new AMM markets based on the percentage of trading fees paid weekly.

Centering on its core value as a user-friendly DeFi hub, the team will provide more options to onboard GBP and EUR fiat currencies.

The DeversiFi team is aiming to become as popular as MetaMask, onboarding at least 10 million users in the upcoming years. Although the enormous $23.7 million ETH transaction fee has captured headlines, the team’s quick response and recovery of the funds doesn’t detract from DeversiFi’s baseline prospect.

This is one in which it could become a CEX-like crypto exchange that is not censorable, thus enabling users to participate in Finance 2.0 without needing permission.

Trusted

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.