Chainlink (LINK) price has hit $11.50 for the first time since June 2022, after spending the past month as one top performers in the top 20 crypto rankings. On-chain analysis examines the key drivers and how further the bulls can push the LINK price rally.

Chainlink price is currently trading at a 16-month peak as the bulls seized control of the crypto markets this week. Beyond the renewed institutional interest in Bitcoin, what are the fundamental drivers of the ongoing LINK price rally?

Chainlink Transactions Have Been Rising Persistently Over the Week

Thanks to the growing demand for Asset tokenization and Real World Assets (RWA), Chainlink has been one of the most sought-after assets in the crypto world over the past month.

While Bitcoin’s (BTC) rally to a new 2023 peak of $35,000 brought renewed attention to the crypto markets this week.

However, recent on-chain data readings suggest that the LINK price rally is more than just a case of piggybacking.

As depicted below, the number of transactions on the Chainlink network has been on a steady rise since October 18. And by October 23, it reached a 9-month peak of 16,068 LINK transactions.

The Transactions Count metric refers to the total number of transactions conducted on the blockchain network within a daily timeframe.

Intuitively, an increase in transaction count suggests growing network usage and increased demand for the underlying native token.

Unsurprisingly, the LINK price uptrend has mirrored the rise in transactions count between October 18 and October 23.

This implies that the ongoing LINK price rally is driven by organic improvement in the Chainlink network fundamentals rather than investors speculating on the renewed bullish sentiment in the broader crypto markets.

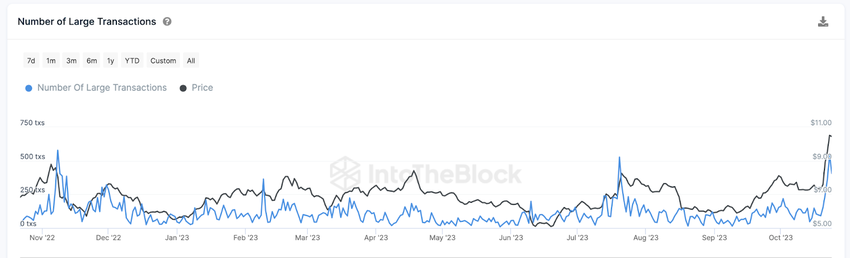

Crypto Whales Have Increased Trading Activity Significantly

A closer look at the on-chain data shows that the trading activity from whale investors is another contributing factor behind the Chainlink price rally.

According to IntoTheBlock, As depicted in the IntoTheBlock chart below, the Chainlink network recorded 544 and 406 Whale Transactions on October 23 and October 24, respectively. This means Chainlink has attracted 950 whale transactions in the last two days.

The Whale Transaction Count metric sums up the total number of individual transactions that exceed $100,000 in value.

Notably, the 950 transactions recorded between October 23 and October 24 is the highest level of whale demand for the LINK token since November 2022, when the FTX crash sent investors into a selling frenzy. And curiously, LINK price spiked 23% at the time.

However, considering the positive sentiment surrounding the crypto markets this time around, Chainlink bulls will likely push for significant gains this time around, especially if the whales keep buying.

Read More: 9 Best Crypto Demo Accounts For Trading

LINK Price Prediction: A Decisive Breakout above $12 Could Catalyze More Gains

From an on-chain perspective, the growth in Chainlink’s fundamental network demand puts it in good stead for more price gains.

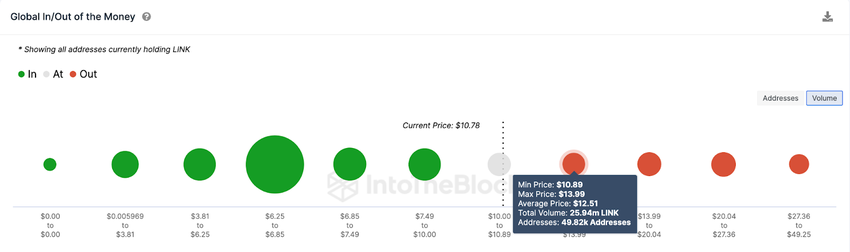

The Global In/Out of the Money data, which groups all current LINK holders by their entry prices, also confirms this optimistic prediction. However, it currently shows that the initial sell-wall at $14 could throttle the ongoing Chainlink price rally.

As depicted below, 49,820 addresses had bought 25.94 million LINK tokens at the minimum price of $14. With Chainlink’s price now at a 16-month peak, a number of those holders may consider selling soon.

But if the Chainlink bulls can stage a decisive breakout from the $14 range, the Chainlink price prediction could head toward $20.

On the downside, the bears could attempt to reverse a trend to the $6 level. However, the bulls will likely prevent that by mounting a buy-wall at $8 in this case. At that zone, 58,720 addresses had bought 52,880 LINK at the average price of $8.20

But if the bears can upstage that support level, Chainlink could suffer a bearish price downswing toward $6.