Cardano (ADA) price has conspicuously stagnated within the $0.24 – $0.28 territory since the crypto market crash on August 17. An in-depth analysis of recent on-chain data trends paints a curious picture of the next possible ADA price action.

The Cardano price rejected $0.28 after Grayscale’s landmark victory over the US Securities and Exchange Commission (SEC) on August 29 failed to trigger a sustained crypto market rally. Since then, an interesting faceoff has emerged between Cardano whales and retail investors.

Cardano Whales Withdraw $47M, But Retail Investors Are Buying

Following the failed market rally at the end of August, cracks appeared as Cardano whales sold off a significant chunk of their holdings.

On August 29, the Santiment chart below shows that Cardano whales (wallets with 1 million to 10 million ADA balances) held 18.15 billion coins cumulatively. That figure has since declined by 190 million coins to hit 17.96 billion ADA on September 13.

But interestingly, Cardano retail investors (wallets holding one to 1 million ADA) took a bullish stand simultaneously. During that period, they increased their balances by 30 million coins, from 13.08 billion to 13.11 billion ADA.

Valued at the current price of $0.25, the whales have withdrawn $47.5 million, while the retail investors have made cumulative capital inflows of about $7.5 million between the August 29 rally and September 13.

While the bearish whales currently have the upper hand, current data from the order books of exchanges suggest the standoff is far from over.

Strategic Traders Have Piled Up Orders to Buy More ADA

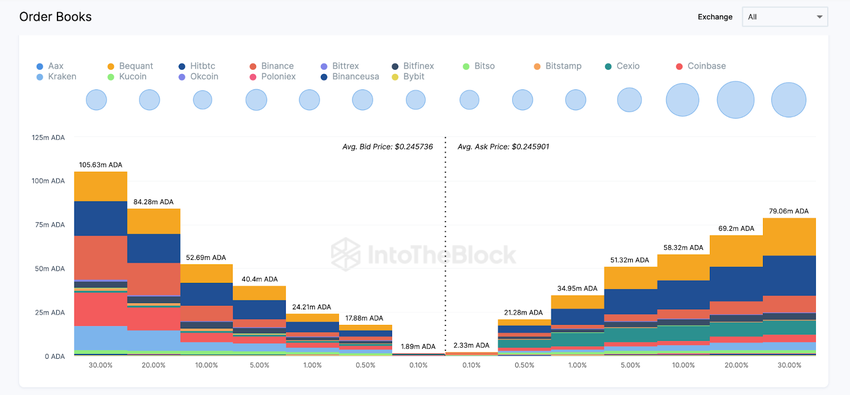

With superior financial power, the whales have forced a Cardano price downswing from $0.27 to $0.24 over the last two weeks. But based on the active ADA orders placed across 16 top crypto exchanges, including Binance and Coinbase, Cardano bulls have not thrown in the towel.

As depicted in the aggregate data from the Exchange Order Books chart below, Cardano bulls have placed orders to purchase 327 million ADA around the current prices. This is significantly higher than the 238 million ADA the bears currently have for sale.

The Exchange On-chain Market Depth chart depicts the volume of active orders Cardano traders placed across recognized crypto exchanges.

The chart above depicts that after weeks of rapidly selling, the bears are now running out of steam. In fact, the current market demand for ADA now exceeds supply by 89 million tokens.

This suggests ADA prices could witness an uptick in the coming days as competing sellers may now have to increase prices to fill their orders quickly.

ADA Price Prediction: The Bulls Could Hold the $0.25 Support

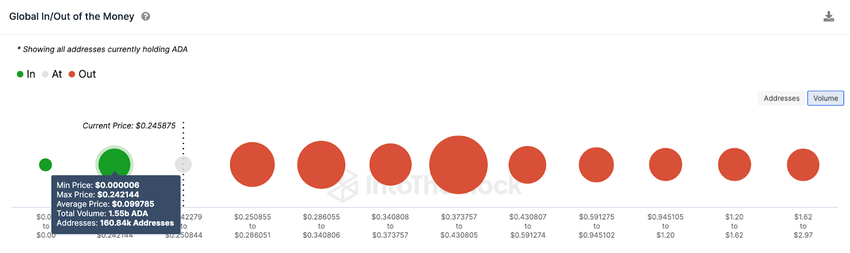

From an on-chain perspective, Cardano bulls have enough in the tank to hold the $0.25 support territory despite the crypto whales’ bearish pressure. The In/Out of Money Around Price (IOMAP) data, which depicts the purchase price distribution of current ADA holders, also confirms this stance.

It vividly illustrates that the $0.24 mark is the last significant line of defense before Cardano’s price slides towards $0.10.

As shown below, 160,840 addresses currently hold 1.55 billion ADA coins bought at the maximum price of $0.24. If the strategic traders activate their buy orders as predicted, Cardano’s price will hold firm at the $0.25 support.

But if the bearish whales conduct another large sell-off, they could overpower the retail investors and force a downswing toward $0.10.

Conversely, if the Cardano bulls receive a significant boost, ADA could increase toward the $0.35 range. But in that case, the 482,000 addresses holding 5.4 billion ADA bought at the minimum price of $0.28 could pose major resistance.

But if the bulls can push that sell wall aside, Cardano’s price could head toward reclaiming $0.35.

Read More: 9 Best Crypto Demo Accounts For Trading