The Securities and Exchange Commission (SEC) has taken action against Titan Global Capital Management USA LLC, a fintech investment adviser based in New York. The firm will pay over $1 million to settle the charges without admitting the SEC’s findings.

The financial regulator has accused the company of using deceptive hypothetical performance metrics in its ads. Additionally, Titan faced allegations of compliance breaches that spread misinformation about the custody of clients’ crypto assets, the use of improper “hedge clauses” in client agreements, unauthorized use of client signatures, and a failure to establish protocols for employee crypto asset trading.

Titan Allegedly Misled Customers About How It Held Crypto Assets

The August 21 charges are the first alleging a violation of the SEC’s amended marketing rule, introduced in December 2020. A single rule has replaced previous advertising and cash solicitation rules.

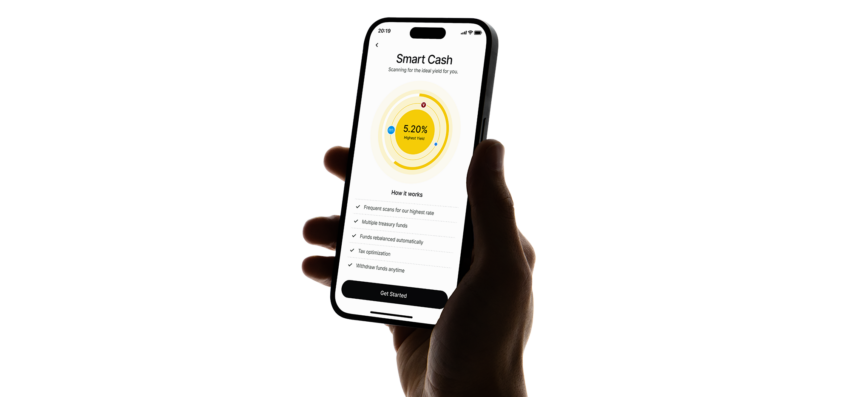

From August 2021 to October 2022, Titan, which has a mobile trading app, reputedly shared misleading information on its website concerning hypothetical performance metrics. Among them was the advertisement of “annualized” performance outcomes reaching as high as 2,700 percent for the Titan Crypto strategy.

Why assets should you invest in this year? Look no further: Crypto vs. Stocks: Where To Invest Your Money in 2023

The SEC contends that these ads were deceptive and missed critical information. For instance, the hypothetical performance projections presupposed that the strategy’s initial three-week performance would hold for an entire year.

Furthermore, the SEC order claims that Titan violated its marketing rules by promoting hypothetical performance metrics.

The SEC’s investigation found that Titan also gave contradictory statements to clients about how it held custody of crypto assets. The company also embedded language in its client advisory agreements, which falsely implied that clients had relinquished non-waivable legal claims against Titan.

The Investment Advisor Will Pay Over $1 Million

Contrary to its declarations, Titan did not implement guidelines and procedures for employee personal trading in crypto assets. The trading firm allegedly also failed to obtain client signatures for certain types of transactions in client accounts.

“When offering and marketing complex strategies, investment advisers must ensure the accuracy of disclosures made to existing and prospective investors. The Commission amended the marketing rule to allow for the use of hypothetical performance metrics but only if advisers comply with requirements reasonably designed to prevent fraud,” said Osman Nawaz, Chief of Enforcement’s Complex Financial Instruments Unit, in a statement.

“Titan’s advertisements and disclosures painted a misleading picture of certain of its strategies for investors. This action serves as a warning for all advisers to ensure compliance.”

Titan accepted a cease-and-desist order, a censure, and agreed to pay $192,454 to return ill-gotten gains. The firm will also pay interest and a $850,000 fine.

The money will go to the clients who were harmed. Though it has settled, Titan does not admit or deny the SEC’s findings.

The US regulator will often settle with a firm accused of wrongdoing to avoid lengthy legal proceedings. In cases such as these, the company takes no legal responsibility for the accusations.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.