The US is struggling to admit that the economy is in recession. That’s despite a recent warning by the World Bank that the US, China, Eurozone, and other major economies are sharply slowing into recession with disastrous long-term effects on developing economies.

Given the controversy generated by its playbook to the 2007/08 recession, Washington may have chosen to make tough choices behind the cover of willed opacity. In the circumstances, Bitcoin’s safe haven promise has come into focus once again.

What role could the crypto asset play at a time of economic uncertainty?

US: ‘we are not in a recession’

A Reuters poll of economists and independent observations by top CEOs that the U.S could tip into recession next year concur with a World Bank report that the global economy is in its steepest slowdown since 1970.

Washington, however, has repeatedly dismissed concerns over the recession. “We are not in recession,” U.S President Joe Biden top aide told MSNBC on Nov. 3, on the back of positive employment data. “The economy is growing. It is strong. It is creating jobs.”

Earlier, press secretary Karine Jean-Pierre strongly dismissed concerns that the country is entering recession. “We are not…there are no meetings or anything like that happening in preparing for a recession…what we are seeing right now is a strong labor market.”

The White House’s determined refusal to acknowledge the elephant in the room may be a little too strong. It is hard to imagine that recession is completely off the agenda in the US. Based on the interconnectedness of a global economy that is taking an unprecedented beating this year.

America’s key trading partner, the U.K, has revealed that it is facing its longest recession since reliable records began in the 1920s. GDP growth is expected to decline by around 0.75% in the second half of 2022, and fall further over the next two years.

Unemployment will double to 6.5% during the two-year economic downturn, according to the Bank of England.

World Bank: ‘we are edging toward a global recession’

The World Bank report forecast an interconnected global downturn that will spill down to the global south. It says a global recession is already in the making as central banks have raised rates at a degree of synchronicity not witnessed in the past 50 years.

“Investors expect central banks to raise global monetary-policy rates to almost 4% through 2023 – an increase of more than 2 percentage points over their 2021 average,” said the report.

Bar the easing of supply disruptions and labor-market pressures, interest rate hikes could leave the global core inflation rate, excluding energy, at about 5% in 2023, it stated. That’s almost double the five-year average before the covid-19 pandemic.

“The world’s three largest economies – the United States, China, and the euro area – have been slowing sharply. Under the circumstances, even a moderate hit to the global economy over the next year could tip it into recession,” said David Malpass, the bank’s president.

Closed-door sausage-making

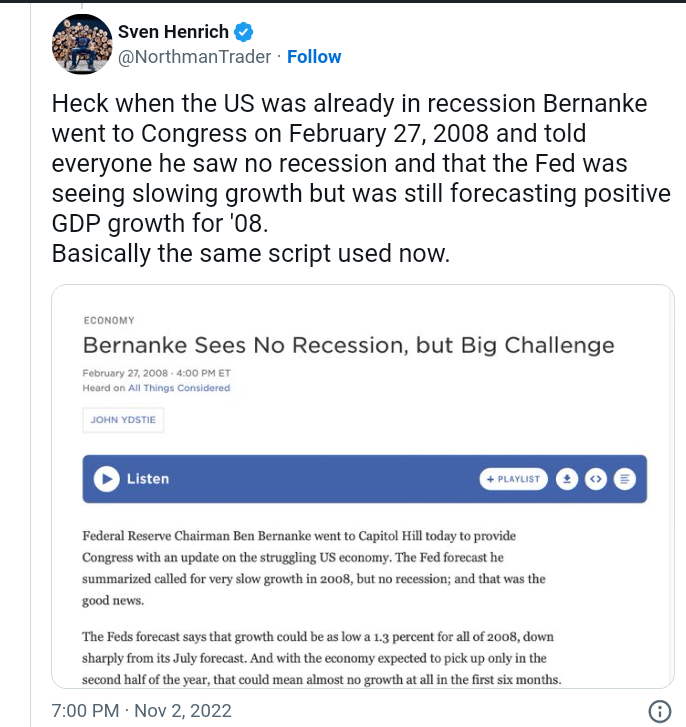

The Joe Biden administration’s overpromising tone in the face of contrary data by highly placed sources points to two potential reasons. One would be an isolationist certitude not moved by what is happening around the world.

Even if its economy was unassailable, it is surprising that inflationary responses by world central banks, a downturn of record proportions in the U.K, and a simultaneous slowdown in China and the Eurozone, would not rouse the US into alert mode.

Yet, Biden’s press secretary will have the world believe that Washington is not holding any meetings whatsoever. Another reason for the White House’s overpromising tone in the face of combined stresses could be willed opacity.

Officially acknowledging recession could send unexpected triggers through the markets. But the US cannot simply buy time or wish away the inevitable. It may simply have chosen to fight fire behind the scenes.

Hilary Clinton infamously told a closed-door Goldman Sachs meeting that politics is like making sausage, according to leaked emails published by Wikileaks. There might be no takers if the public saw the process.

Following the 2008 recession, Barack Obama’s stimulus package was a case of unpalatable sausage-making.

Britain’s uncertain slouch into recession has already seen it going between three prime ministers in the space of a few months. The US democracy is just as fraught and polarized right now. Closed-door sausage-making is an option for Biden as long as he can manage it.

The Bitcoin alternative

Interestingly, Bitcoin (BTC) traces its roots to the angst of the 2007/08 recession. Founder Satoshi Nakamoto wrote about the bailout of banks, as yet concealed in the U.K, in the genesis block of Bitcoin 13 years ago.

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” wrote Nakamoto, the enigmatic pseudonymous creator of Bitcoin.

One of Bitcoin’s compelling use cases was the possibility of sheltering your finances from unilateral federal decisions. Like the controversial bailing out of commercial lenders using public funds after the subprime-mortgage crisis in 2009.

Another use case was Bitcoin’s potential to survive stressful times. Transacted outside the ambit of central bank policies and inflationary responses, BTC has been regularly discussed in the same breath with gold, particularly since the pandemic triggered fears of inflation.

Bitcoin’s correlation to gold has risen sharply over the past two years. Bloomberg commodity strategist Mike McGlone previously said that the crypto asset will eventually transition from a risk-on speculative asset to the crypto market’s version of the metal.

As digital gold, Bitcoin appeals to the cashless internet economy largely on account of its characteristics that include round-the-clock price transparency, and the lack of limits, interruptions, or third-party oversight.

Sovereignty from realpolitik

It is not yet sufficiently clear though, that Bitcoin can maintain its sovereignty from realpolitik. Global crises, including the Russian invasion of Ukraine, coincided with a dramatic fall in the value of Bitcoin, which hit a multi-year low of about $17,500 in June.

Heavy-handed policing of cryptocurrency by the US, in particular, in response to its potential for sanction-busting and geopolitical games, has also demystified the asset’s aura as a self-referential haven.

But Bitcoin can have its second 2009 moment by serving as a hedge to inflation and a safe haven for investors. The responsibility has to begin with the crypto community. Bitcoin needs to innovate in keeping with the cypherpunk values of Satoshi Nakamoto.

It should undermine increased invasions into its universe by nation-state actors, and evolve beyond its present correlation to the stock market. In this capacity, BTC is not only sensitive to economic data which shapes and ‘unshapes’ recessions, but also speculative tendencies.

Wharton professor Jeremy Siegel told a Bloomberg podcast this week that US stocks will rise between 20% to 30% over the next two years, and house prices will decline as much as 15% from their peak.

“Stocks are quite undervalued. If you buy stocks, in a couple of years, you’re going to be very happy,” Siegel explained, adding:

“If you’ve got that long horizon and you’re young today, this is a golden time. You’re not buying at the top. You’re buying near the bottom. You are going to be guaranteed great returns when you retire.”

Many crypto analysts argue that Bitcoin reached a bottom with its June lows. By the same measure, the digital asset could stand out during the predicted global recession, tracking the stock market, in line with Siegel’s forecasts.

Bitcoin’s self-reflexivity

The World Bank’s bleak forecast offers few prescriptions. Developing economies are encouraged to maintain foreign currency reserves. Gains from this will be only relative as destination currencies will likely have taken a beating too.

For individuals staring into the abyss, BTC’s quality as a safe haven comes into focus. Still, Marxist champions of digital freedom like Slavoj Zizek and Yanis Varoufakis have refused to romanticize Bitcoin.

They take exception to its use case as a means of speculation. Zizek is more reproachful to the self-referential nature of speculation in cryptocurrency, its apparent creation of exchange value out of nothing.

Ironically, the self-reflexivity of Bitcoin would be ideal now more than ever but even Zizek may have overstated things. The distance between Bitcoin and the fallible world of governments, central banks and real-life investments has been reduced.

Got something to say about this article, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.