Bitcoin (BTC) price spent the better part of the weekend consolidating around the $35,000 mark. However, several on-chain data points are now flashing green signals for another BTC price upswing.

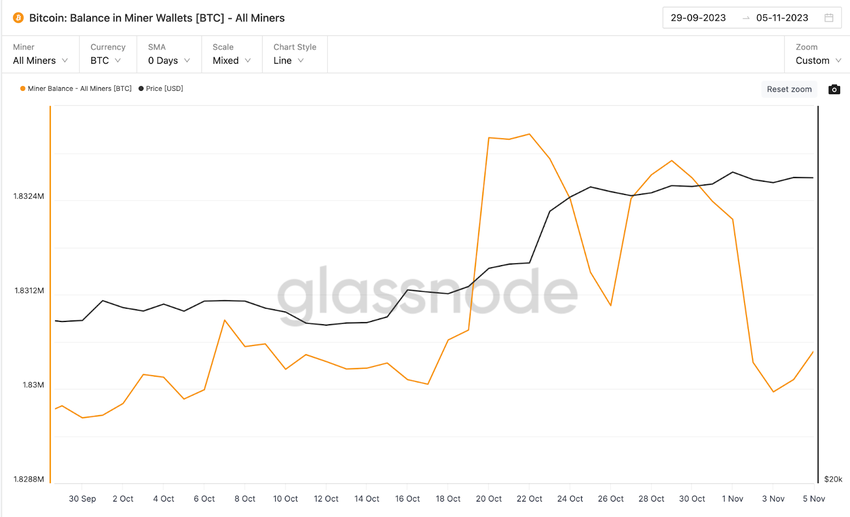

When Bitcoin price hit a new 2023 peak last week, BTC Miners took advantage of the rally to offload part of their reserves. On-chain data show that the miners have had a more positive disposition over the weekend.

Bitcoin Miners Have Snapped Out of Their Selling Activity

Bitcoin price rallied to a new yearly peak of $35,700 as markets reacted positively to the Non-Farm Payroll report for October 2023. Bitcoin miners capitalized on the rally to sell off over 2,000 BTC. This effectively triggered a sharp price retracement below $34,300.

However, a vital on-chain indicator now shows that the BTC miners have taken on a bullish disposition over the week. The Miners’ Reserves chart below illustrates how BTC node validators halted their week-long selling frenzy to acquire 583 BTC worth approximately $18.5 million.

As the name implies, the miner wallets metric tracks real-time changes in the balances held by recognized Bitcoin miners and crypto mining pools.

Currently, the miners hold approximately 10% of the total BTC in circulation. Hence, their trading activity often impacts BTC price action significantly.

If the Miners keep accumulating their block rewards this week, BTC price could continue upward toward $40,000.

Read More: Top 11 Crypto Communities To Join in 2023

The Bulls are Currently Dominating the Spot Markets

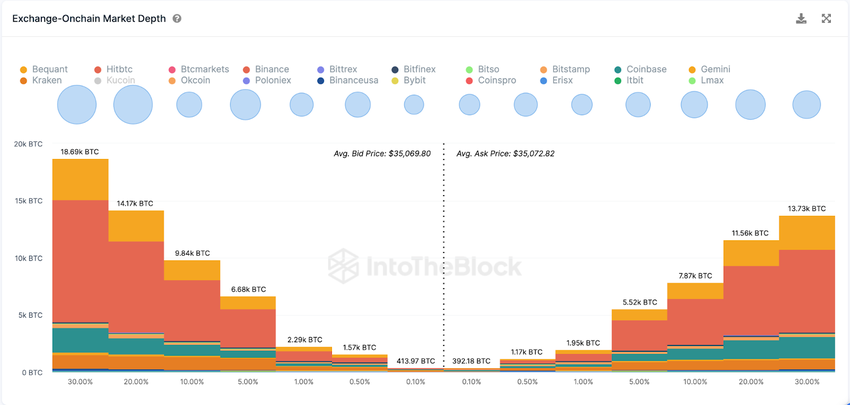

In further confirmation of the growing bullish momentum, Bitcoin market demand has exceeded market supply. According to Aggregate Order Books data from IntoTheBlock, the bulls have placed active orders to purchase 55,000 BTC around the current prices.

Meanwhile, the traders have only put 43,000 BTC up for sale.

The Aggregate Order Books chart compiles the total number of buy/sell orders that traders currently have listed across various crypto exchanges. When the buy orders exceed the market supply, it implies a dominant buying momentum within the market.

With fewer BTC coins currently available, buyers may have to up their bids to get their orders filled quickly. This could inadvertently push up the BTC price further toward $40,000 this week.

BTC Price Prediction: Is $40,000 a Viable Target?

From an on-chain perspective, the bulls appear to be firmly in control of the Bitcoin markets in November so far. If the miners keep accumulating, the BTC price is like to reclaim the $40,000 in the weeks ahead.

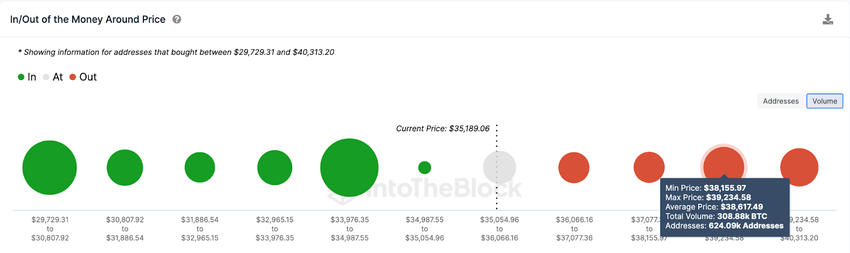

The Global In/Out of the Money (GIOM) data, which groups the current BTC holders according to their entry prices, also confirms this bullish forecast.

It shows that BTC must scale the $38,600 resistance for the bulls to be confident of flipping $40,000. As depicted below, 624,090 holders had bought 309,880 BTC at an average price of $38,612. If those holders sell early, they could slow down the rally significantly.

But if that resistance level caves, Bitcoin price will likely reclaim $40,000 as predicted.

On the downside, the bears could negate the optimistic prediction if the BTC price reverses below $33,000.

But, in that case, the 2 million BTC holders who bought 604,200 BTC at the minimum price of $33,900 will mount a support wall. If those investors can HODL, BTC price will likely defend the $34,000 territory and prevent a significant bearish reversal.