The biggest January crypto predictions deal with Chainlink (LINK), BNB, and Ethereum (ETH) layer-2 scaling solutions.

December was a decisively bullish month for the cryptocurrency market, concluding a bullish year. BeInCrypto looks at the top crypto predictions for January 2024.

LINK Will Be One of the Biggest Gainers

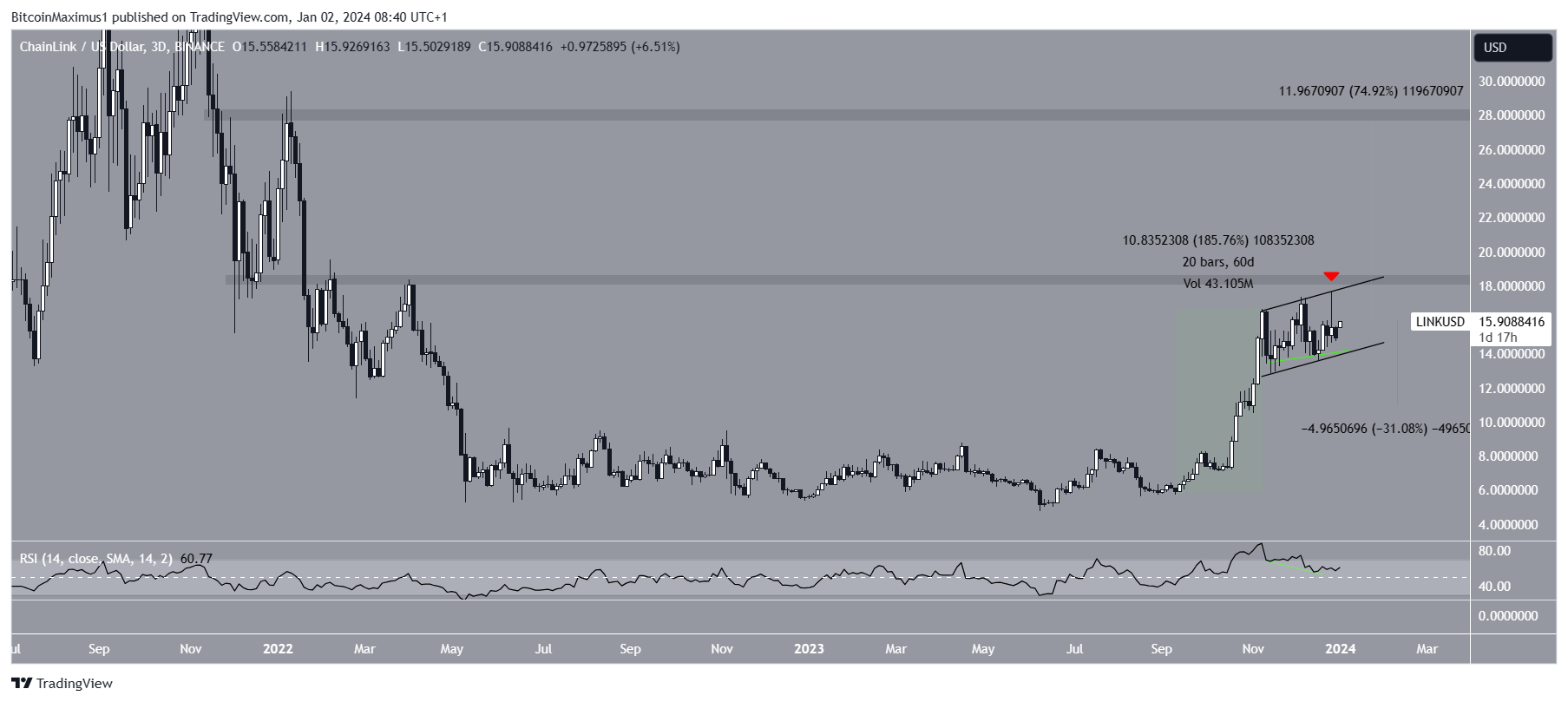

The LINK price was one of the biggest gainers in September and October 2023, increasing by nearly 200%. However, the rally has slowed considerably since then, and LINK has consolidated inside an ascending parallel channel. Despite reaching a 2023 high of $17.67 on December 28, the LINK price created a long upper wick (red icon) and fell.

Nevertheless, the RSI gives a bullish reading. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset. Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite.

The RSI is above 50, increasing, and has generated a hidden bullish divergence (green), a sign of trend continuation.

The channel’s resistance trend line is at $18.50, coinciding with a long-term resistance area. If the LINK price breaks out, it can increase by 75% to the next resistance at $28.

Despite this bullish LINK price prediction, a breakdown from the channel will invalidate the potential breakout. Then, LINK can fall by 30% to the closest support at $11.

Read More: How to Buy Chainlink

BNB Will Finally Move Above $400

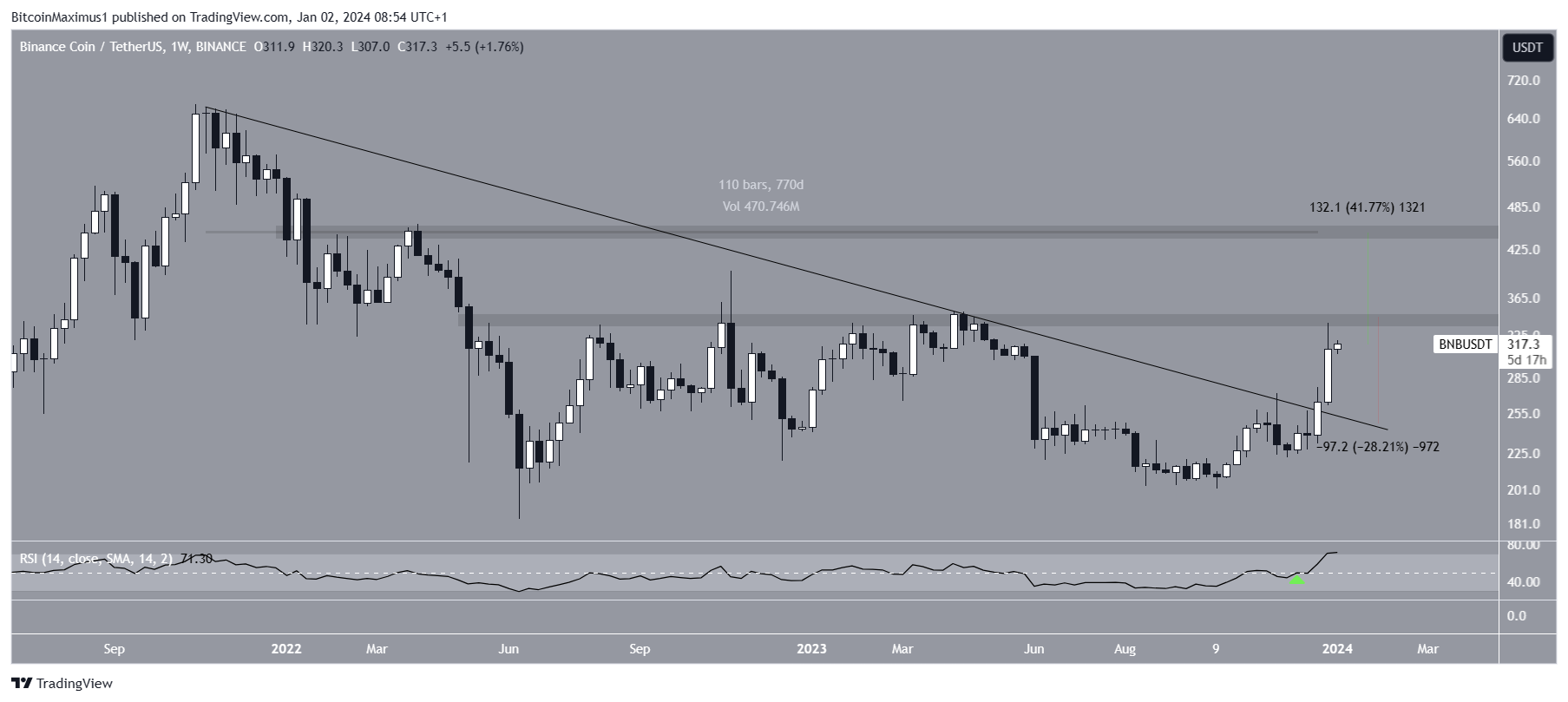

The BNB price has increased since October 2023, when it was trading at a low of $202. The upward movement caused a breakout from a long-term descending resistance trend line that had been in place for more than 770 days. The increase led to a high of $320 last week.

The weekly RSI legitimized the breakout since it moved above 50 (green icon) while the price broke out.

Now, the BNB price faces resistance at $345. If it breaks out, there is no resistance until $450, which could lead to a rapid increase of more than 40%.

Despite this bullish BNB price prediction, a strong rejection at the $345 level can trigger a 30% decline to the closest support at $245.

Read More: How to Buy BNB

Arbitrum (ARB) and Polygon (MATIC) Conclude January Crypto Predictions

One of the biggest developments in the second half of 2023 was the significant price increase of Solana (SOL) and its ecosystem. This might have resulted in a lack of liquidity in the Ethereum ecosystem. However, this could change in January, especially in the layer-2 scaling solutions ARB and MATIC.

The ARB price has nearly reached an all-time high and is closing above the final resistance area of $1.70. If this happens, the price can increase by 45% to the next resistance at $2.50.

The MATIC price also shows bullish signs since it broke out from a long-term descending resistance trend line in place for 740 days. So, the price can increase by 50% to the next resistance at $1.55.

These bullish predictions will be invalidated with a close below the $1.70 resistance area and the descending resistance trend lines, respectively. This could cause drops of 30% for ARB and MATIC.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.