The cryptocurrency market has essentially erased all the gains made throughout 2021. This massive fall was mostly triggered by a handful of crypto fraudsters in 2022. Namely, ex-FTX CEO Sam Bankman-Fried, Alameda Research’s Caroline Elison, Terra’s Do Kwon, and the founders of 3AC.

The cryptocurrency industry is constantly making headlines across the globe. It was an infant industry that managed to reach a nearly $3 trillion market cap in under 10 years. Lately, though, exchange collapses and crypto fraud across the sector have massively set back progress.

As 2022 nears a close, BeInCrypto presents a compilation of the biggest crypto fraudsters.

The Year of Crypto Fraud

The latest and the most trending example was the FTX crypto exchange’s dramatic collapse due to mismanagement of customer funds to the tune of billions of dollars. Despite former CEO Sam Bankman-Fried going on an apology tour, there remain many unanswered questions over the illegal usage of customer funds and the exchange’s close relationship with the Alameda Research trading firm. The exchange’s native token, FTT, was also used in dubious ways to mislead investors, customers, and regulators.

A Reddit thread described this so-called ‘Infinite Money Scheme’ wherein Sam Bankman-Fried and Alameda used FTT to conduct fraud.

As BeIncrypto reported on Dec. 13, the disgraced founder of the bankrupt exchange was arrested in the Bahamas. The apprehension step was a collaborative effort by the Bahamian and American authorities.

What Went Wrong?

Over $150 billion within three days, starting from Nov. 9. This is how much the world’s 15 largest cryptocurrencies lost in market value. This is due to the crypto exchange platform FTX behind this FTT token. On Nov. 6, the token started depreciating, losing over 80% of its value in 72 hours.

Once considered a bear market thriver, the demise of FTX sent shockwaves through the crypto industry.

FTX was the brainchild of Sam Bankman-Fried (commonly known as SBF on social media). He was previously hailed as the savior of the cryptocurrency industry. Sam Bankman-Fried also founded the quantitative trading firm Alameda Research in 2017.

A Dubious Relationship

FTX was launched in 2019 as an exchange platform for buying and selling cryptocurrencies. Sam Bankman-Fried was the majority owner of both companies. This raised suspicions among industry players, traders, investors, and stakeholders that there may be some conflict of interest regarding whether research is prioritized on FTX or vice versa.

On Nov. 2, CoinDesk released a report based on leaked Alameda Research asset data. According to the data, Alameda claimed to have over $14 billion in assets by the end of June 2022, most of which consisted of the exchange’s own FTT tokens. Herein, Alameda CEO Caroline Ellison tried to quell the uncertainty and said that the firm’s finances were under control and the company was on track.

However, it seems the market didn’t buy it, and traders began to withdraw their funds from FTX. Things escalated on Nov. 6 when Binance CEO Changpeng Zhao announced that it was completely offloading FTT worth hundreds of millions of dollars that it had in equity.

FTX processed $4 billion worth of transactions, far more than its average volume. Amid the sell-off, orders lagged and demand piled on.

By Nov. 7, that number had increased to $6 billion. A day later, FTX’s financials were in a slump. Binance then stepped in and offered to buy the company. It appeared that FTX would have a way out of its liquidity problems. However, the following day, Binance withdrew from the acquisition after performing some due diligence and looking into the company’s finances.

Sam Bankman-Fried Falls

Amid the chaos, the troubled exchange was being investigated by the Securities and Exchange Commission (SEC) and the Department of Justice. Soon, Bankman-Fried told investors that FTX could not cover withdrawals because the collateral had depreciated and could not be liquidated. He resigned from the CEO position at FTX on Nov. 11, and Alameda and FTX subsequently filed for bankruptcy.

But that wasn’t all. Shortly after declaring bankruptcy, the crypto analytics firm Elliptic was alerted that more than $400 million worth of cryptocurrencies appeared to be missing. The fallout prompted other exchanges to show proof of their reserves and called for more transparency in the industry.

For the time being, FTX is the largest crypto-related bankruptcy to date.

There’s another facet to this story that includes Sam Bankman-Fried’s alleged love, Caroline Ellison, the former head of Alameda Research. Although there’s not as much press on Ellison as Sam Bankman-Fried, the sister company’s CEO was equally at fault for mishandling client funds. Recent reports and sightings of Ellison in New York suggest she is walking around as a free woman at the time of publication.

Alameda used FTX customer funds to make its trades. Short or long, its collateral was not coming from its own pockets.

The fallen empire also had a multi-billion dollar gap between assets and liabilities. Despite SBF being arrested, there has been no official comment regarding Caroline Ellison. There are, however, speculations that she could testify against Sam Bankman-Fried in order to strike an immunity deal.

The arrest of the disgraced executive has stirred crypto Twitter as users give their opinions on who might be next in line to face the music.

The Downfall of Terra

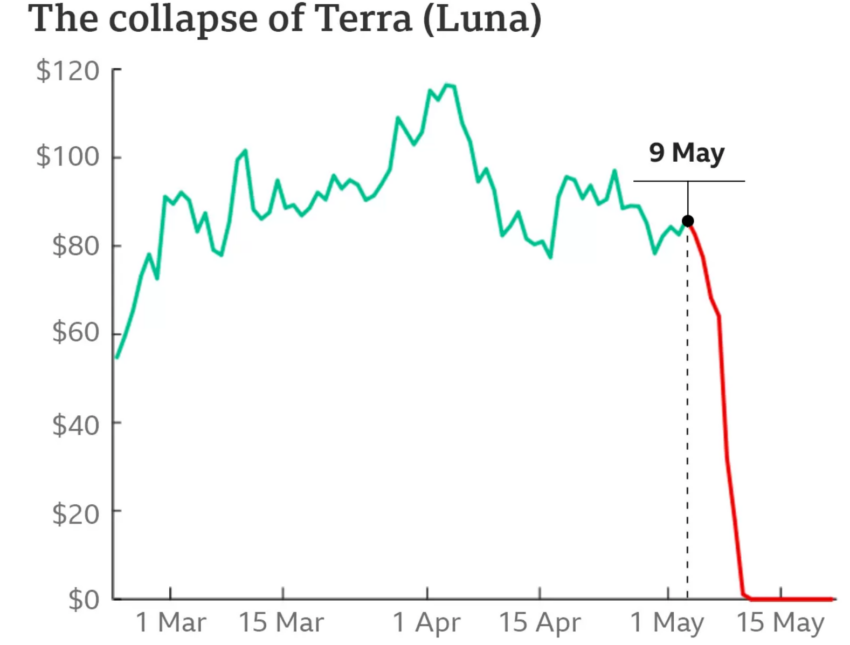

Do Kwon is the famed individual behind the TerraUSD (UST) stablecoin crisis that occurred in May 2022. The fall sent shock waves through the crypto sphere as UST lost its peg to the U.S. dollar and wiped out the support of its non-stablecoin sister asset LUNA, which dropped 99%, losing billions of dollars in market cap over the span of just a few days.

This caused around $200 billion dollars to be wiped off the crypto market cap.

Given that UST was an algorithmic stablecoin that used a series of smart contracts to keep the price at a dollar, it didn’t have billions of dollars of cash or other assets in reserve. Ideally, UST would always be worth one dollar if LUNA has value.

How did it fail?

There was a significant sell-off accompanied by customers trying to withdraw their funds, and the algorithm couldn’t keep up. In an emergency response, the LUNA Foundation Guard was forced to sell its Bitcoin reserves to try and inject more funds to save the stablecoin. This, in turn, pushed down the value of BTC and impacted the entire market.

After the fall, Do Kwon went missing from his home country of Singapore. Government authorities even issued an arrest warrant for Kwon, citing a violation of capital market regulations that led to a $40 billion loss for investors.

Now there are reports that Do Kwon is allegedly in Serbia. The Ministry of Justice in South Korea is asking for the cooperation of the Serbian government in the case. South Korea and Serbia do not have an extradition treaty, but both have acceded to the European Convention on Extradition.

Bad Bets for Three Arrows Capital

June 2022 saw the collapse of Three Arrows Capital (3AC). A fund that at one point had over ten billion dollars in AUM was reduced to a debtor with several counterparties knocking at the door. Needless to say, founders Su Zhu and Kyle Davies vanished following the fall.

It all started with one terrible bet, and that bet was Terra. One of the methods that Terra wanted to use to shore up the USD peg was the LUNA Foundation Guard or LFG. The LFG raised over $1 billion in Bitcoin, which was exchanged for $1 billion in LUNA. Those buying LUNA included the likes of Jump Crypto, Defiance Capital, and 3AC.

3AC bought 10.9 million LUNA that was locked due to vesting. That LUNA cost 3AC $559.6 million. 3AC was a big proponent of Terra and worked closely with the LFG to accumulate more of that Bitcoin. The death spiral of UST led to a collapse in the value of LUNA.

According to a Wall Street Journal post, Kyle Davies said that he and Zhu initially managed to handle the LUNA hit, but the market conditions post-Terra made things worse. This coincided with a toxic macro environment and poor crypto sentiment. 3AC was then ordered to liquidate its capital investments and filed for bankruptcy.

Overall, these events and the related executives have helped bring the dark, ominous clouds of crypto winter in 2022. Onto 2023 now.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.