Ripple’s (XRP) price is looking at a potential drawdown on the daily chart after failing to breach a key resistance level.

The lack of recovery is probably pushing investors to sell, which could further the decline, making recovery even more difficult.

Ripple Investors Take a Step Back

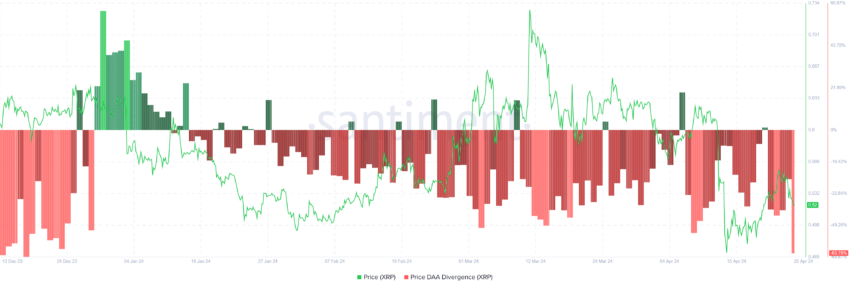

As the XRP price fell to $0.42, it triggered pessimism among many of the token holders, which is evident in their behavior. The price daily active addresses (DAA) divergence is presently flashing a sell signal.

This occurs when either the price is rising and participation is declining, or both factors are negative. The latter situation is what XRP is witnessing, which suggests that XRP holders will likely move to sell their assets before they accrue more losses.

The sentiment of saving oneself is further extending to potential investors as well. This is evident in the network growth metric, which is currently at a four-year low. Network growth is measured by the rate at which new addresses are formed on the network.

Read More: Everything You Need To Know About Ripple vs SEC

It is used to assess the traction of the project in the market and whether it is losing or gaining. Ripple is evidently losing traction since potential investors are noting that there is no benefit in making a transaction with XRP.

Thus, XRP price could bear the brunt of the bearishness.

XRP Price Prediction: Holding Above This Level Is Key

XRP price trading at $0.51 is just at the 23.6% Fibonacci Retracement of $0.73 and $0.42. This Fib level is also known as the bear market support floor. The reason behind this is that as long as this support is not broken, the crypto asset still has a chance at noting a recovery.

However, given the bearishness noted among the investors, it seems probable that the XRP price could fall through this support. This would result in the altcoin falling to test $0.47 as support, which will mark an 18% decline as the Ripple token hits the support of $0.42.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

Nevertheless, if the XRP price manages to bounce off the 23.6% Fib line and reclaim the 38.2% Fib marked at $0.57 as support, the bearish thesis could be invalidated. This would allow the altcoin to rise by $0.60 and recover its recent losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.