Axie Infinity’s (AXS) 21% price gains over the past have sparked hopes that investor interest could return to the metaverse sector. On-chain analysis examines key factors that could impact AXS price action in the days ahead.

Axie Infinity’s price dropped to a yearly low of $4 on October 19. But since then, many users have sprung into action to avert terminal losses.

Increased User Activity Has Helped Defend the $4 Support

AXS price managed to defend the vital $4 support level last week, and on-chain data shows that increased user activity was a major driving factor.

As AXS price sank toward $4 on October 19, the Axie Infinity network witnessed a significant increase in user activity, according to data from CryptoQuant.

Indicatively, the chart below shows that Axie Infinity had attracted a monthly low of 173 active addresses on October 15. But after a week of consistent increase in user activity, it reached a 3-month peak of 445 active addresses on October 24.

Daily Active Addresses is a standard metric for measuring the user activity level on the blockchain network. An increase in Daily Active Addresses is a bullish signal. This implies that more users are interacting with services built on the network.

And with the AXS native token being utilized more in daily transactions, it quite explains why the recent price performance has been positive.

However, it still remains to be seen if the investors will hold out for the long-term recovery of the metaverse sector or exit at a favorable price point.

Mounting Exchange Reserves Raise Warning Signals of Early Exits

Axie Infinity’s 20% price gains over the past week are significantly higher than top mega-cap coins like Litecoin (LTC) and Bitcoin Cash (BCH) could manage. However, recent on-chain movements suggest that AXS holders may not stick around for the long haul.

As the crypto markets’ made a majorly bearish start to the year, the metaverse sector emerged as one of the most troubled sub-sectors. Over 90% of investors across the four largest metaverse projects. Including The Sandbox (SAND), Enjin (ENJ), and Decentraland (MANA), dipped into loss positions.

Based on the increase in AXS Exchange Reserves this week, confidence in the long-term recovery of the sector still appears considerably low. As AXS prices rose this week, investors started moving tokens to exchanges.

The CryptoQuant chart below shows that investors have deposited 354,000 AXS tokens into exchange wallets between October 19 and October 26.

Exchange Reserves track the real-time changes in the number of a particular cryptocurrency deposited across spot trading platforms. An increase in Exchange Reserves often indicates that holders seek short-term exit opportunities.

As observed recently, AXS price dropped rapidly when Exchange Reserves increased significantly around July 26 and August 12.

If this pattern reoccurs, the 354,000 AXS deposited into exchange-hosted wallets this week could potentially put downward pressure on price.

Read More: 9 Best Crypto Demo Accounts For Trading

AXS Price Prediction: The $7 Resistance is Critical

Despite the positive media sentiment in the crypto markets, Axie Infinity’s price could face significant resistance if holders book profits early.

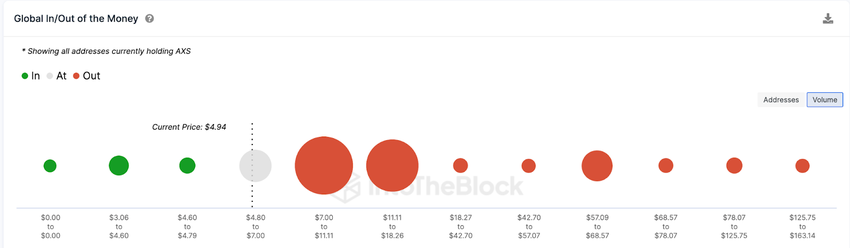

The Global In/Out of the Money data, which is an on-chain representation of Axie Infinity holders’s historical buying trends, also confirms this. It shows that the $7 territory could pose a significant obstacle to the ongoing price recovery.

As depicted below, 10,490 addresses had bought 128.27 million AXS at an average price of $7. If they opt to book early profits, this could set off an instant bearish reversal.

But if the user activity continues to rise, the Axie Infinity price rebound could reach the $10 range.

Alternatively, the bears seize control if AXS price slips below the $4 mark. But as observed last week, the bulls will likely mount a strong support buy-wall around $4.40.

The chart above shows that 3,660 addresses currently hold 2.08 million AXS bought at the average price of $4.40. If they HODL, they could prevent the AXS price reversal.

But if that support level caves in, it could trigger a large AXS price decline below $3.