The Avalanche (AVAX) price broke out from long- and short-term descending resistance trendlines.

While the price still trades below the $10.80 long-term resistance, it has already cleared the $9.80 one.

Avalanche Moves Above Long-Term Resistance

The technical analysis from the daily timeframe shows that the AVAX price has fallen under a descending resistance trendline since April. The decrease culminated with a low of $8.61 in September.

The altcoin began an upward movement shortly afterward and broke out from the trendline in October. At the time of the breakout, the trendline had been in place for 165 days. AVAX has increased by 25% since.

Today, AVAX reached a high of $10.78. It was the first time it had reached the $10.80 horizontal resistance area since August.

It is worth mentioning that the Avalanche price increase accelerated shortly after the launch of Stars Arena, a SocialFi platform on the Avalanche blockchain. Stars Arena is a fork of Friend.tech, a similar platform that has recently struggled with phishing issues.

The daily RSI supports the continuing of the increase. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite. The indicator is above 50 (green circle) and moving upwards, both considered signs of a bullish trend.

AVAX Price Prediction: Will Breakout Above $11 Occur?

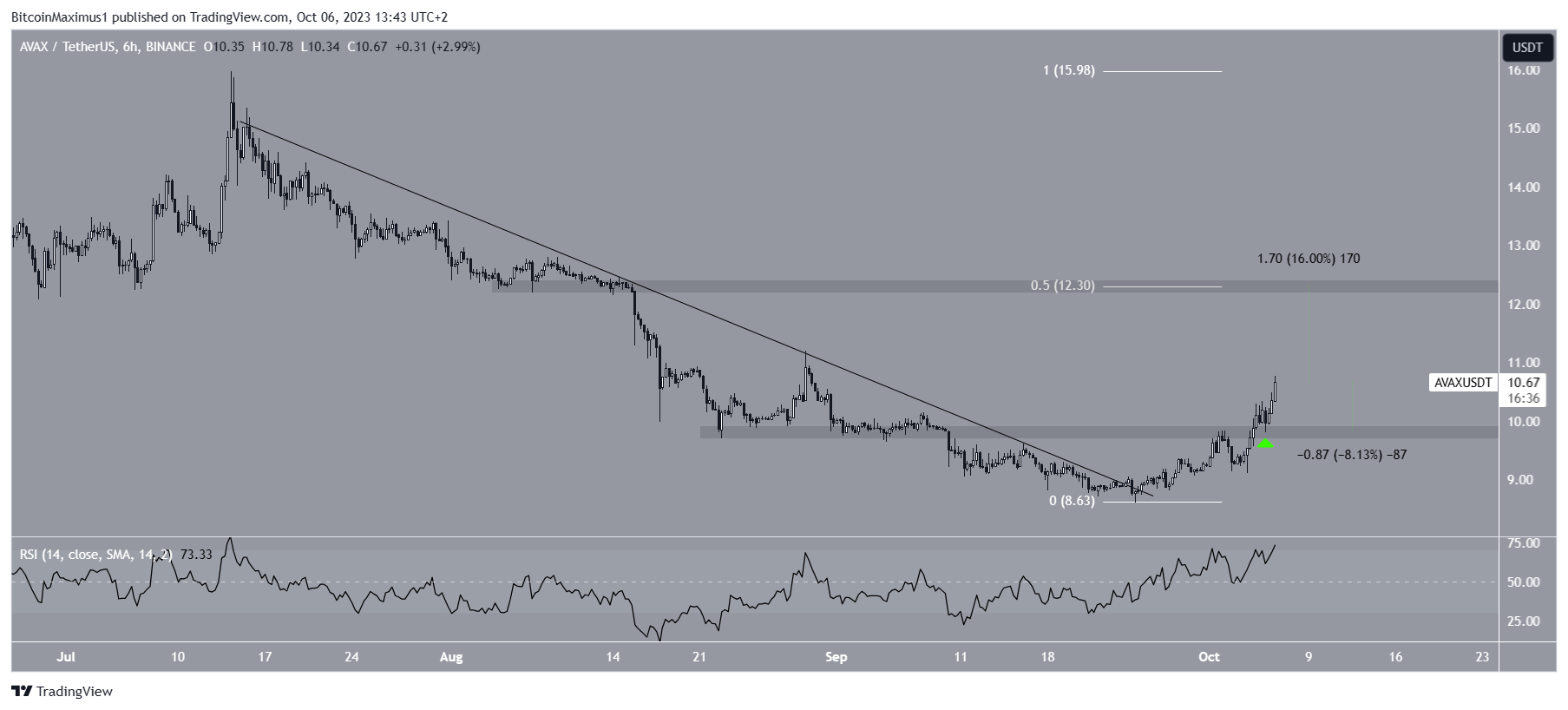

The analysis from the six-hour timeframe legitimizes the ongoing breakout in the daily one. The chart shows that AVAX broke out from a descending resistance trendline on September 25, initiating the current upward movement.

AVAX also moved above the $9.80 horizontal resistance area during the increase. After such breakouts, it is customary for the price to validate the area as support, as the price did on October 7 (green icon).

Read More: 9 Best Crypto Demo Accounts For Trading

Similarly to the daily timeframe, the six-hour RSI is bullish. The indicator is above 50 and increasing, both considered signs of a bullish trend.

If the upward movement continues, the AVAX price can increase by another 16% and reach the $12.30 horizontal and Fib resistance area.

According to the Fibonacci retracement levels theory, following a significant price change in one direction, the price is expected to partially return to a previous price level before continuing in the same direction.

The 0.5 Fib level often acts as the top of the increase if the movement is corrective.

Despite this bullish AVAX price prediction, a sudden loss of momentum could cause an 8% retracement to the $9.80 horizontal support area.

The six-hour RSI is approaching overbought territory and could catalyze such a drop.

For BeInCrypto’s latest crypto market analysis, click here.