The CEO of stablecoin issuer Circle has urged Congress to move forward with stablecoin regulations to make digital US dollar payments faster and cheaper.

According to Jeremy Allaire, US Congress must focus on the reintroduced stablecoin bill to preserve the dollar’s dominance in global trade.

Stablecoins Offer Dollar Dominance to Help Customers: Allaire

Keeping the dollar as the primary international payment and reserve currency would empower US families in the digital payment space, Allaire said.

Growing threats to the dollar’s hegemony include China’s testing of the yuan for international trade. DBS Singapore offers a new service to settle client-merchant payments with China’s electronic yuan.

Allaire said in a new promo video,

“If America is to lead the world economy for the next 10 years and beyond that we need to build trust in digital dollars and regulate stablecoins today.”

Stablecoins store fiat currency value digitally for use on digitally-native payment rails. Issuers mint new stablecoins for each dollar a customer sends them, and they sometimes offer interest on deposits.

A bipartisan bill addressing stablecoin regulation was reintroduced on July 12 after being first tabled last year. House Financial Services Committee chair Maxine Waters put the skids on the regulation after Circle’s USD Coin lost its peg to the US dollar.

Also, in working in the regulations’ favor was a US ruling that Ripple‘s sales of XRP to customers through exchanges were not an investment contract. Seen as a big win for crypto, the bill could awaken lawmakers to the importance of bringing more shape to a digital economy that can no longer be ignored.

In the crypto economy, stablecoins play a huge role. They allow traders to park dollars in the digital economy to insulate against currency fluctuations.

Being a digitally-native asset, stablecoins allow quick crypto purchases. Crypto exchanges calculate exchange rates between different cryptocurrencies and stablecoins.

On the other hand, buying crypto with fiat often requires a person to wire money to an exchange. Depending on their bank, the process can take 1-3 days, making it difficult for buyers to exploit market conditions.

Read more here about crypto vs banking.

Some banks offer quicker settlements but with very high fees.

Stablecoin Regulations Must Address Capital Requirements

Stablecoin issuers need to keep liquid assets when customers exchange stablecoins for fiat. New US regulations will address issuers’ capital requirements if many customers want to draw money at the same time.

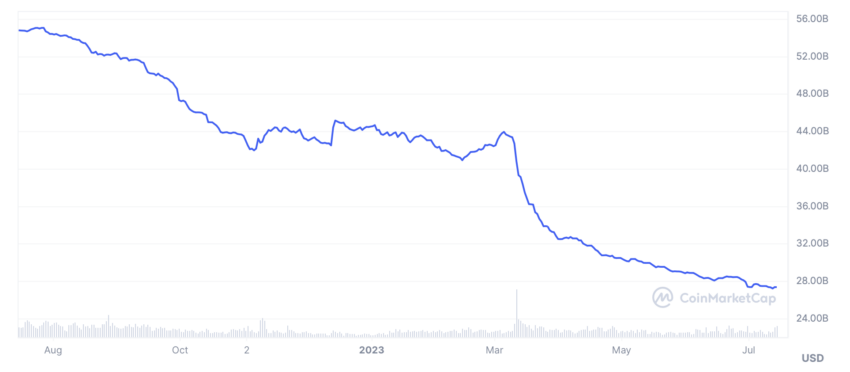

Circle held cash reserves for its USDC stablecoin in the defunct Silicon Valley Bank which froze deposits in March. The bank froze Circle’s holdings, preventing the USDC issuer from fulfilling its own withdrawal requests.

USDC lost its value of $1 after that as investors lost confidence. Circle restored services several days later.

Hong Kong, the original home of USDC rival USDT, the world’s largest stablecoin, said it would look at stablecoin regulation next.

The region recently introduced new crypto regulations, including custody rules and the number of stablecoins that exchanges can list.

Got something to say about stablecoin regulation or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.