Where should we keep our cash? Should it be in the adrenaline-pumping crypto market or at legacy banks? In 2024, there is no longer a clear answer. Crypto didn’t have the best 2022, and in 2023, banks collapsed like nine pins, once again laying bare the fragility of the global financial system.

Amid this crypto vs. banking discourse, we will explore the actual state of affairs, helping you make informed decisions regarding any future financial moves. How did we get here, and is crypto or TradFi a safer bet? Let’s investigate.

KEY TAKEAWAYS

► Crypto offers decentralization, transparency, and borderless access but lacks insurance, stability, and faces security risks.

► Traditional banks provide secure, easy-to-use, insured funds but are centralized and vulnerable to interest rate changes and systemic risks.

► Collapses of both banks and crypto firms highlight interdependence because crypto firms need banking support while banks sometimes invest in blockchain tech.

► Neither crypto nor traditional banking is risk-free, but crypto’s decentralized technology positions it as a more innovative alternative.

- Investing in crypto: What, why, and how?

- Investing with banks: What, why, and how?

- Crypto market crashes that changed perceptions

- Banking collapse in 2023: It takes three to tumble!

- Crypto vs. banking: Should we blame crypto for the banking collapse?

- The crypto banking connect: The snowball effect?

- Crypto vs. banking: how are “purists” reacting to all of this?

- Crypto vs. banking: Do we have a winner?

- Frequently asked questions

Investing in crypto: What, why, and how?

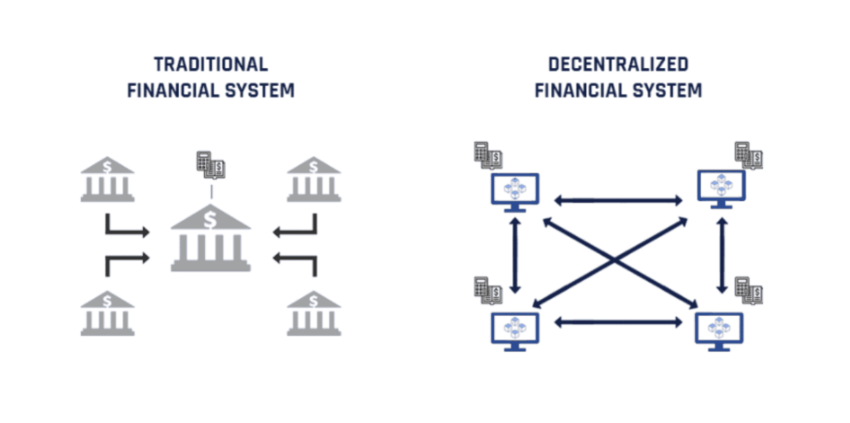

Crypto is the future. The tech, security, and transparency offered by DLT (distributed ledger technology) and blockchain are second to none. And unlike banks, they aren’t managed by centralized entities but by a decentralized network of participants running the specific ecosystem.

The most successful and the first commercial crypto, Bitcoin, has miners managing its network. Ethereum, the hotbed for smart contracts, has validators keeping the network secure. These ecosystems function as separate digital economies, with native currencies like BTC and ETH used to transact and pay for services within each economy.

Simply put, each crypto is the building block of its respective ecosystem. Essentially, this is what fiat currency is supposed to be for its respective economy (country).

Remember, we shall only be exploring the currency-based attributes of crypto to draw better comparisons with the legacy banking system as part of this crypto vs. banking discussion. Hence, we can leave DApps and smart contracts out of the equation for now.

Pros and cons

Crypto has a host of benefits that make it desirable to many. Let us explore a few.

| Pros | Cons |

|---|---|

| Decentralization | No insurance |

| Minimal human interactions | Volatility |

| Transparency | Cloudy regulations |

| Less censorship | Fiat-based ramps |

| Inclusive and borderless | Tricky UI/UX |

| Diversified offerings | Prone to attack vectors |

Benefits

There are a lot of benefits to using crypto. Here is a thorough overview of why many people choose to use crypto.

Decentralization

Decentralization means zero control by a single entity. Therefore, it is easier to use crypto for cross-border payments and remittances. Crypto transactions are secure, as they are also imprinted on a decentralized ledger, thanks to blockchain technology.

Additionally, decentralization paired with immutability can combat financial embezzlement. This is one of the reasons that Tradfi needs to work closely with blockchain technology, crypto, and DeFi.

Minimal human interactions

Cryptos can be programmed to move from one address to another. The concept of programmable money makes digital assets more reliable and less prone to human interactions and manipulations.

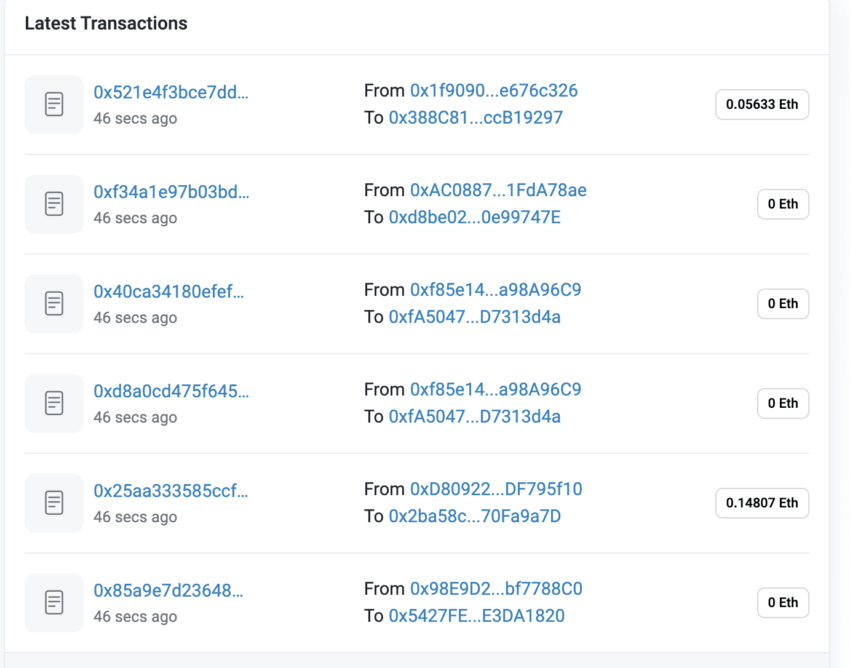

Transparency

Light clients, nodes, and platforms like Ethersan allow you to track the movement of digital assets across addresses. This means anyone can gain visibility on crypto transactions made by whale and shark addresses. In simple terms, every crypto transaction is trackable if done on-chain.

Less censorship

As digital currencies are decentralized, censoring or blocking them on the chain is very difficult. Unless the ecosystem has a pre-programmed code in place for detecting suspicious behavior (which then flags a specific type of transaction), there are few opportunities for censorship.

Inclusive and borderless

Crypto can be sent to anyone across the world without having to go through the hoops of commissions or exorbitant fees. So with fewer entry barriers, crypto increases accessibility.

Diversified offerings

Crypto, despite being a nascent space, offers several financial opportunities. While you can always trade crypto like traditional securities, the world of DeFi opens up options like yield farming, flash loans, liquidity pooling, and more.

And with blockchain technology, it is possible to access a wide range of financial services without relying on intermediaries like central banks.

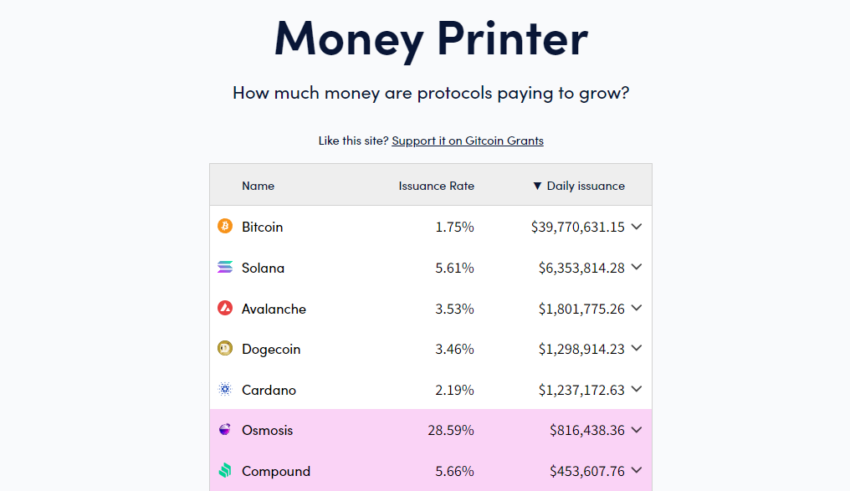

While these are some of the more generic benefits of looking at crypto to hold your money, a more plausible reason would be the clarity of their financial models. Moreover, cryptos have quantifiable token economics, with some digital assets like Bitcoin having limited supplies. And we all know how valuable things become when they are scarce and popular.

Even the cryptos with inflationary tokenomics models offer clarity regarding the inflation rate, burn rate, and more. And anything with quantifiable figures is certainly worth a look.

Drawbacks of crypto

Despite the plethora of benefits, the crypto realm is far from perfect. Here are some of the drawbacks, specific to the crypto space, in regard to storing funds or even investing.

No insurance

Unlike banks where your funds are insured by the FDIC or any other country-specific body, any amount parked in crypto wallets or in DeFi protocols does not come with guaranteed fund protection. A few exchanges buck this trend with certain guarantees in place, but crypto customers are generally less protected than when interacting with TradFi.

Volatility

Even though every high-beta asset is volatile, cryptos are often driven by market sentiments and narratives. Note that this makes the price action highly speculative at times. Here is how Dogecoin (a well-known memecoin) responded to Dogefather Elon Musk completing his Twitter acquisition.

The heightened volatility makes DeFi investments prone to liquidation risks. Smart contracts are specifically coded to liquidate assets if the concerned collateral falls under a given threshold.

Cloudy regulations

Starting from the mining ban in China to stringent taxation in countries like India, the extent of adoption and the clarity of regulations haven’t been uniform globally. The erratic viewpoints of countries regarding crypto have stalled its rise to the top. However, the concerns aren’t unfounded, as some economies are trying to weed out crypto crimes — an issue that continues to be a cause for concern.

Fiat-based ramps

Crypto isn’t widely accepted as a method of payment and remittance. So, investors still need to rely on fiat-specific on-ramping and off-ramping to interact with the ecosystem. Regardless of the crypto affinity, users still need fiat currency to buy daily essentials. And that means converting crypto to fiat.

Tricky UI/UX

Even though user-centric protocols like ERC-4337 are slowly on the way, the crypto user-onboarding schema is still wallet and seed-phase-based. The tricky user interface and the prospect of a learning curve for many users often put crypto on the back foot.

Additionally, users may find that fragmented liquidity makes for a horrible user experience. For example, you can have ETH on the Ethereum blockchain. But you can also bridge ETH to other chains.

This creates multiple versions of ETH, depending on the bridge you use. An application may or may not accept that particular version of bridge ETH. This makes it difficult to use protocols and even more complicated to assess the risks of protocols in totality.

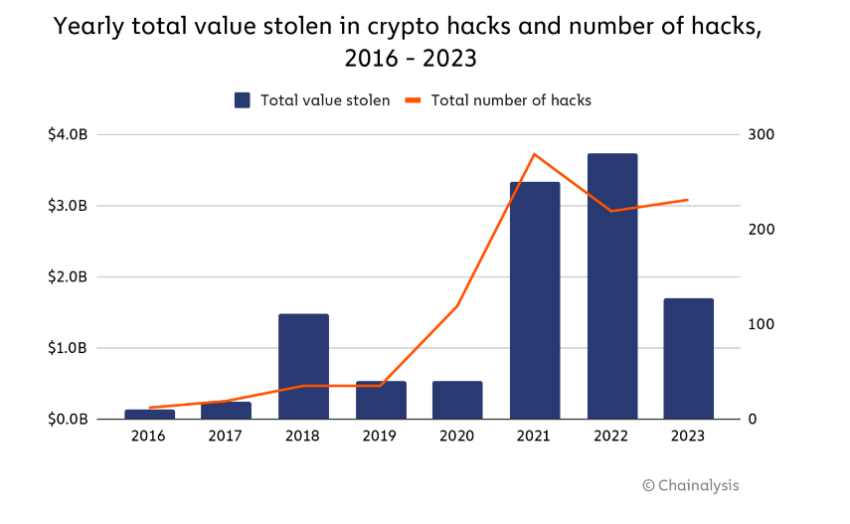

Prone to attack vectors

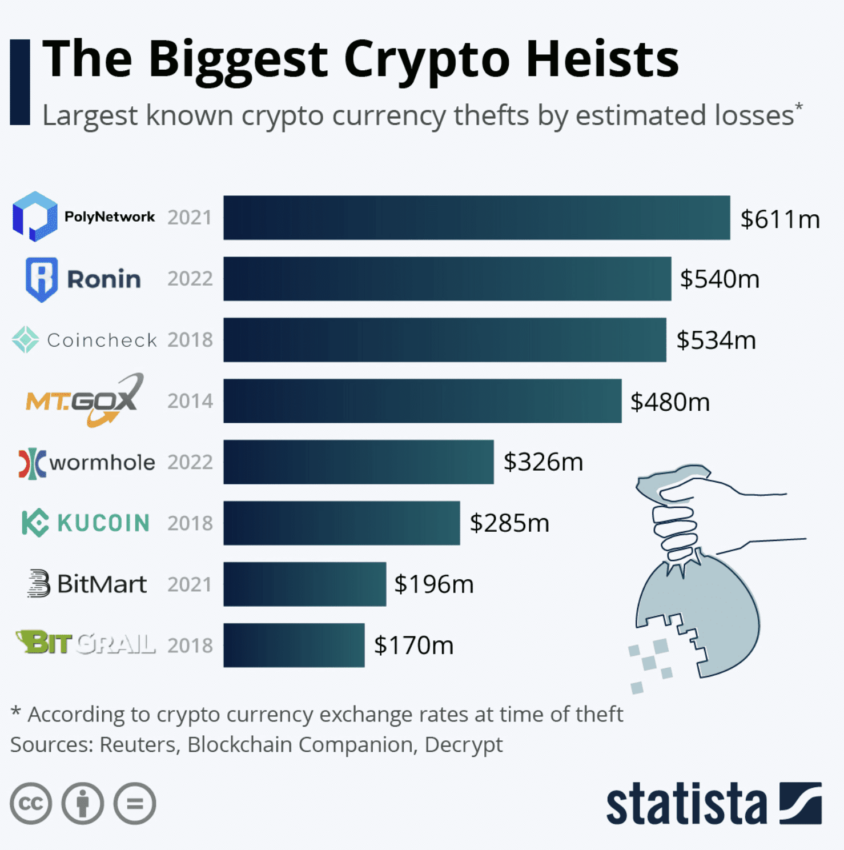

From buggy smart contracts to rug pulls and malware, crypto — being programmable money — often falls victim to illicit predators. Notably, Wormhole Bridge, Nomad Bridge, Ronin Network, and others fell foul of hacks in 2022.

While most were busy delving deeper into the Silicon Valley Bank crisis, Euler Finance, an Ethereum-based lending protocol, experienced a flash loan attack. Funds to the tune of $195 million were compromised.

That sums up the advantages and disadvantages of holding funds in crypto or crypto-related protocols. Do note that there can be other crypto-specific concerns, from embezzlement to money laundering, as well as security risks linked to crypto wallets.

Investing with banks: What, why, and how?

Enough about crypto! Let us now shift our attention to the legacy TradFi institutions — otherwise known as banks. While many crypto purists never let an opportunity to belittle the banking system pass, the crypto vs. banking battle is hardly one-sided.

The two are intrinsically linked, and crypto onboarding still relies heavily on traditional banking systems and financial institutions. Let us take a closer look at why banks have been, and remain, popular.

Pros and cons of banking

| Pros | Cons |

|---|---|

| Security of funds | Centralized |

| Easy to use | Depends on interest rates |

| Tangible infrastructure | Systemic risks |

Benefits

Here are some advantages of relying on traditional financial avenues like banks to park your funds. This section will help us make better sense of the crypto vs. banking debate.

Security of funds

Banks have insurance plans in place to safeguard a certain portion of user funds. If you are reading this in the U.S., the FDIC or the Federal Deposit Insurance Corporation provides a standard insurance coverage of $250,000 to each depositor. Even though the nature of deposits matters, standard money deposits up to $250,000 are covered.

In case something drastic happens with banks, like the current SVB crisis, regulators can step in to make institutions whole via bailouts.

Easy to use

Banking services like transactions are easier to understand and use. You simply need to submit your KYC details and set up an account. Plus, account recovery is also easier than handling crypto wallets with seed phrases.

Tangible infrastructure

Some users still prefer connecting with financial institutions with brick-and-mortar setups. You can talk to actual people to resolve any issues with your account. As banks are globally present, they ensure that fiat currency is accepted almost everywhere for payments.

Drawbacks of TradFi and banks

For years, investments in banking products like CDs (Certificate of Deposits), money market accounts, high-yield savings accounts, and IRAs have been considered relatively stable.

However, investors and depositors were reminded of fragilities reminiscent of 2008 when major U.S. banks, Silvergate and SVB, started falling apart in mid-March 2023. And that brings us to the drawbacks of the traditional banking system.

Centralized

Banks are regulator-controlled. Therefore, these traditional financial systems can block or choose to discontinue any user association at any time.

Plus, bank transactions are recorded with the banks or central banks — something that doesn’t actually fit with the ethos of transparency. Bank transactions might feel peer-to-peer, but centralized bodies’ control and constant tracking indicate otherwise.

Dependent on interest rate changes

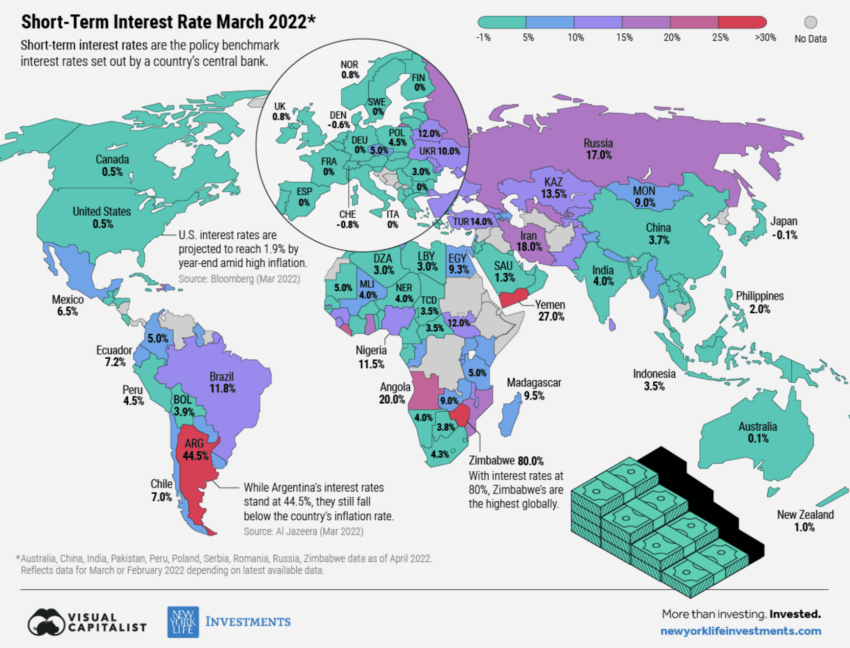

Even banks need to hold user money elsewhere. And in most cases, this is done through fixed securities like bonds and treasuries. However, if a government changes, reduces, or hikes interest rates, it significantly impacts the bank’s invested money and valuation. In case of a recession or even a bank run, the changing value of investments is not always good news.

But that’s just one way of looking at the interest rates. Note that banking institutions offer low interest rates to customers — sometimes not sufficient enough to beat inflation.

Systemic risks

There are times when one bank parks its money with another bank. Or there can be inter-bank borrowing and lending terms in place. Therefore, if one bank falters or faces insolvency, other dependent financial institutions can also start falling through, disrupting financial services at scale.

In addition to these drawbacks, traditional financial systems in the world are also prone to issues like low transparency (courtesy of shadow banks), currency risks (such as are present with carry trades), and even limited access (courtesy of non-operational weekends).

Crypto market crashes that changed perceptions

As mentioned, crypto isn’t perfect. Decentralized digital currencies have had a fair share of highs and lows, to put it mildly. While we did discuss a few, let us take a closer look at the major black swan events relevant to crypto. Knowing them better will help us understand the wider context around this ongoing crypto vs. banking conundrum.

Event 1: The Terra collapse

Even though quite a few hacks and DeFi exploits preceded the Terra collapse, this was the first major black swan event to happen in crypto, precisely in May 2022. Here is a quick overview of what happened, why it happened, and exactly how it happened.

It all started with a dollar-pegged synthetic derivative, “UST.” As it was an algorithmic stablecoin, its peg was hinged on a demand-supply mechanism or rather a burn-mint mechanism involving LUNA — the native crypto of the Terra ecosystem.

However, when the yield-generating Anchor protocol, synonymous with the Terra ecosystem, saw people selling UST to cash out — courtesy of unsustainable and lower yield than promised — the UST supply rose sharply, deviating from its $1 peg.

A large amount of LUNA was introduced to the system to offset the massive UST supply (LUNA minted to burn UST), pushing the price of LUNA down. Yet, the massive selling pressure overwhelmed the ecosystem — causing a bank run of sorts.

Even though the team behind LUNA sold BTC to protect the algorithmically set peg, it wasn’t enough. With LUNA losing value at a clip, UST’s peg of $1 fell under 30 cents. As LFG (LUNA Foundation Guard) started selling BTC, the exchange inflow shot up, and the broader market felt the ripples and corrected alarmingly.

Event 2: The FTX collapse

Another massive black swan event was the FTX collapse, which exposed the vulnerability of centralized exchanges.

In Nov. 2022, FTX was the fourth-largest exchange by volume. However, trouble began when the balance sheet of Alameda Research (a trading firm founded by SBF, who also founded and ran FTX) came to light.

A majority of Alameda’s assets were in FTT — the native token of the FTX exchange. This revelation had a cascading effect on the fortune of FTX. Binance CEO Changpeng Zhao tweeted about wanting to sell off Binance’s FTT holdings.

This triggered a monumental move, causing a rapid decline in the price of FTT. The sheer size and exposure to FTX meant that the fallout impacted other key assets like BTC and ETH, pushing the market lower.

Customers started withdrawing, putting additional stress on the FTX coffers. Incidentally, the withdrawals were paused, and eventually, the company had to declare bankruptcy.

Sam Bankman Fried, the self-proclaimed altruist and the brain behind this fiasco, was sentenced to 25 years in federal prison for defrauding FTX customers.

Event 3: The lending platform crisis

Once FTX collapsed, several other exchanges and lending platforms exposed to FTX started to feel the heat, courtesy of the systemic risks of centralization in crypto. Weeks after FTX was wiped out, BlockFi, a reputed crypto lender and exchange, followed suit and filed for bankruptcy on Nov. 28, 2022.

BlockFi was already rendered weak following the Terra collapse due to the falling prices of key crypto assets. FTX had jumped in as a savior, increasing the company’s exposure to this now-defunct exchange.

Despite alleging to have no material exposure to FTX or FTT, even Genesis felt the heat due to the FTX contagion due to the falling crypto prices. Another now-bankrupt crypto lender, Celsius, mentioned on Nov. 11, 2022, that it had connections to both FTX and Alameda Research.

Something similar happened to the now-bankrupt lender Voyager. Rather than bailing the company out, FTX inadvertently locked $3 million of Voyager’s balance.

And these are just a handful of crypto collapses that surfaced in 2022. Even though these were crypto fallouts, a clear trend was visible. The failed entities saw massive withdrawals — or bank runs — on their holdings. With a majority of customer funds locked elsewhere or misappropriated, there was no way to stay on course with the withdrawals, leading to eventual collapse.

These crypto firms relied too much on centralization, token-based valuations, and unrealistic yields. Ultimately, they couldn’t survive panic selling and rampant liquidations. Simply put, too many centralized connections, combined with human greed, led to these black swan events in crypto.

Instances when crypto felt similar to legacy markets

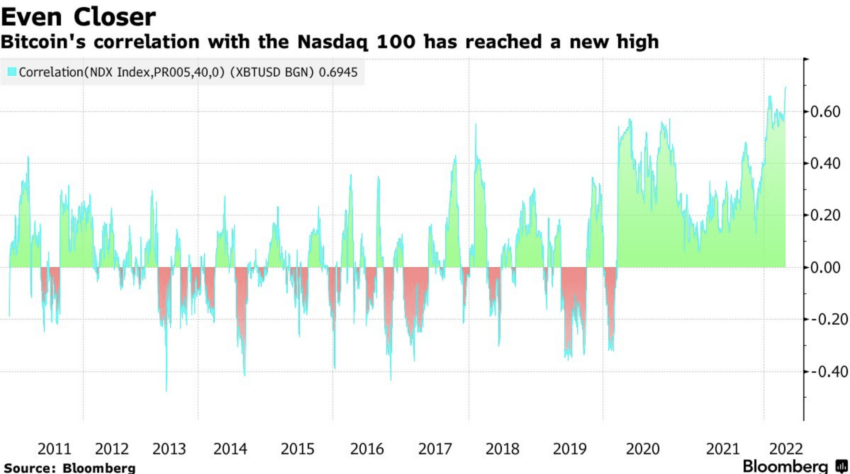

Strangely, the real issue with crypto was shrouded by these black swan events discussed above. Ever heard the statement “Bitcoin is a hedge against inflation”? Bitcoin was supposed to beat the likes of stocks and securities as a means to combat inflation.

However, between 2021 and 2022, the correlation between BTC and stocks and ETH and stocks (S&P) went as high as 0.33 and 0.38, respectively.

Do note that the closer the correlation moves to 1, the higher the indications of the two asset classes moving together.

Till 2021 (from 2016), the correlation of BTC and ETH with stocks was 0.08 and 0.04. It was during this time when the “hedge against inflation” narrative started gaining traction. When the correlation increases, it paints BTC and other cryptos as risk assets and not a hedge against inflation. The correlation needs to be lower if the narrative is to make sense again. Here is a tweet that places BTC as a macro asset.

However, there is an element of hope. Bitcoin, at present, is more of a hedge against monetary debasing. Unlike traditional banking systems, where money can be created at little or no cost, BTC has a fixed supply of 21 million and a very manageable yearly inflation rate of under 2%.

Hence, if we keep the scarcity bit intact (courtesy of fixed supply), Bitcoin works like a hedge. Yet, there is still a long way to go before living up to that fully.

Banking collapse in 2023: It takes three to tumble!

With central banks supposed to be at the center stage of the global financial system, their failure can cause a domino effect on every other financial service in sight. Here are the three key events that rocked the global financial system in 2023, all within a month:

Event 1: The Silvergate collapse

The Silvergate collapse didn’t come as a surprise. In January 2023, the firm reported that deposits from crypto firms had dropped to $3.9 billion from $11.9 billion in under 90 days. Even though most of its worries were due to the collapse of FTX, the loss in foothold pushed away clients, including Coinbase, Paxos, and Circle (issuer of USDC).

The impact was eventually felt by the SEN network — Silvergate’s on- and off-ramp solution for inter-exchange transfers. Eventually, on March 8, 2023, Silvergate officially announced it was closing its doors. And it dented crypto-banking associations majorly in the process.

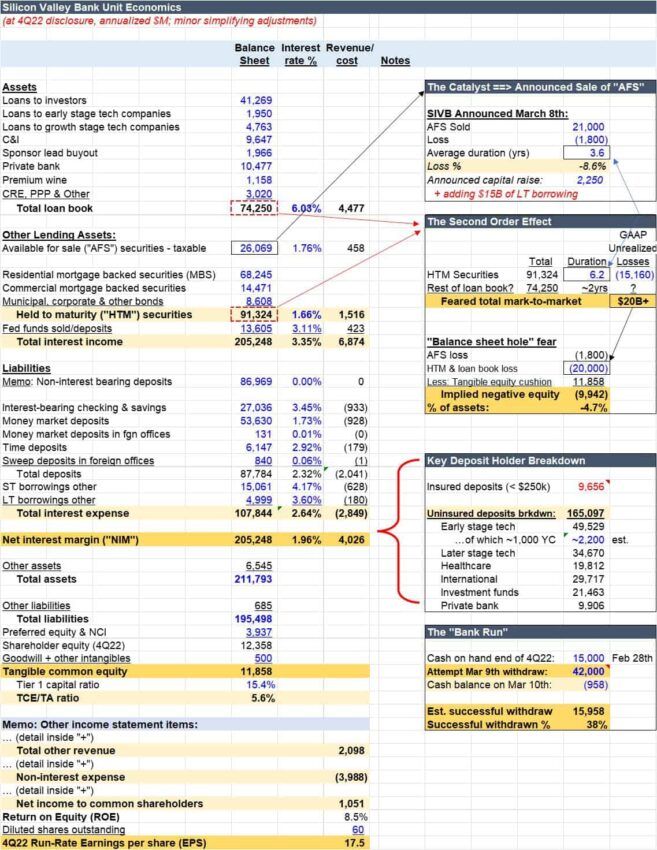

Event 2: The SVB collapse

The next big bank to fail was SVB, Silicon Valley Bank. The go-to bank for tech startups failed to manage its assets and diversify. It further failed to predict the intensity of user withdrawals. The compounding effects of these concurrent failures forced the bank to shut down. Here is a quick overview of why and how this happened.

Interest rates were increased in 2023. With the rates being high at the time, the bond yields increased, making the value of existing government bonds or Held-to-Maturity bonds drop in value.

Bond yields and bond prices are inversely related.

SVB held a large percentage of its assets in these bonds, and plunging prices led to significant paper losses. As the interest rates grew, startups that had chosen to park money at SVB decided to withdraw and venture out for better yields. Consequently, there was a bank run of sorts, which SVB didn’t have a lot of AFS or “Available for Sale” assets to counteract.

SVB also sold the AFS portfolio at a $1.8 billion loss and even tried raising funds from the investors to handle withdrawals. Shareholders of SVB eventually sued the bank.

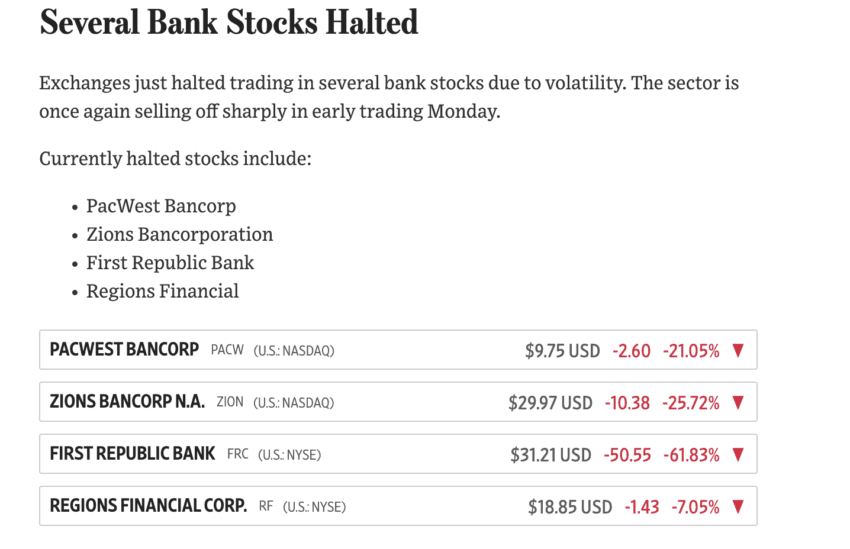

The government announced a backstop and assured that the depositors would be made whole. Yet, markets saw most banking stocks dip rapidly, with the NYSE eventually having to halt most of them from trading.

Here is a tweet that sums it up pretty well:

Event 3: Signature gone

On March 13, 2023, the regulators wiped another large pro-crypto bank out of existence. The FDIC insurance limit of $250,000 stands. Yet Signature’s closure impacts the global financial system and comes as a deadly blow to crypto-banking relations.

Coinbase, a reputable centralized crypto exchange, had funds to the tune of $240 million with Signature. Circle, the issuer of USDC, also felt some impact due to the closing of Signature. However, Circle eventually changed its banking partner.

Signature Bank was closed, with regulators citing systemic risk — something that could derail the entire financial system. However, some significant Twitter accounts have hinted at other motivations behind the shutdown:

The collapse of these traditional financial institutions illustrates a crucial finding. For now, the axe seems to be falling on crypto-friendly central banks.

Crypto vs. banking: Should we blame crypto for the banking collapse?

Crypto is following traditional markets and seeing bank-run-like events. Meanwhile, banking collapses are being pinned on crypto by experts. The link between crypto and the banking space is undeniably deep.

Silvergate’s closure reignited the crypto vs. banking debate. Notably, Senator Sherrod Brown stated that the overreliance on cryptocurrencies caused Silvergate to implode. Former congressman Barney Frank believes that digital currency is the potentially destabilizing element that has spurred the banking failures.

Frank also claims that regulators made Signature Bank an example to discourage crypto transactions or exposure to any form of crypto in relation to banking. This event has been speculated as being politically motivated among many Twitter users:

Christopher Whalen of Whalen Global Advisors counteracted the narrative, claiming that Signature Bank’s collapse is a crypto story. Whalen states that veteran bankers made an error by focusing on digital currency.

But the more vocal tweets have an entirely different story to tell:

The truth about SVB’s failure

In the “Face of Nation” broadcast, Janet Yellen, Treasury Secretary, mentioned that SVB’s failure isn’t due to overexposure to the tech sector. Instead, the assets held lost market value as treasuries lost their value due to the hiked interest rates.

Here is another interesting take on the banking failure:

The crypto banking connect: The snowball effect?

By now, it is clear that it isn’t as simple as choosing sides in this crypto vs. banking discussion. Instead, all of our findings readily establish a crypto-banking connection. Banks and crypto might seem to be at loggerheads and placed at the extremes of a global financial system. Yet, the current state of affairs doesn’t actually allow us to choose one.

Here is a fun take by Elon Musk:

To further illustrate this described codependency, here is how the banking collapses have affected the crypto market.

The depegging saga

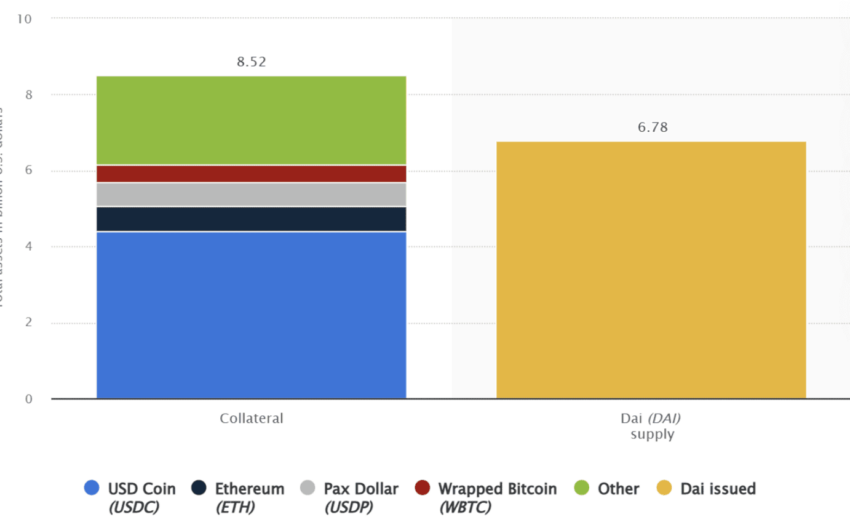

Circle, the issuer of the second largest stablecoin by market cap, USDC, had 8.25% of its stablecoin-backed reserves with SVB. Hence, before the government announced it would be making depositors whole, the loss of access was a troublesome piece of news for many. On March 11, 2023, the depeg went as low as 89 cents, making USDC lose almost $6 billion in market cap.

Things are now back to usual, as the peg has been restored to $1.

Notice how evident the collateral presence of USDC is in regard to DAI’s supply:

Crypto firms with banking connections: Where do they go next?

With major banks falling and regulation by enforcement in the U.S., crypto firms were left to fend for themselves. Here are some of the directly impacted crypto firms.

Ripple, the company behind XRP, had exposure to SVB — more like a banking partner. BlockFi, the now-defunct crypto lender, also had some uninsured $227 million worth of funds in a money market fund with SVB.

VC Pantera Capital, AVAX creator Avalanche Foundation, NFT-focused Yuga Labs, and NFT leader Proof also had exposure to Silicon Valley Bank.

Some of the tweets mentioned above reveal that the closing of U.S. banks could have been a political crackdown on pro-crypto TradFi institutions. And the supposed apathy of U.S. regulators might push crypto firms toward Asia, Europe, and other offshore banking services.

Switzerland seems like an obvious choice as SEBA Bank, Switzerland started seeing an uptick in its website traffic after the U.S. banks collapsed. Elevated interest was experienced by SEBA’s offices in Abu Dhabi, Singapore, Hong Kong, and, obviously, Switzerland.

Traditional banks venturing into crypto

Despite some U.S. banks closing down, the overall crypto-banking connection seems to hold strong. Leading traditional financial institutions have invested significantly in blockchain technology and crypto-focused firms. Below is a list from Blockdata showing the key investments made by the likes of BNY Melon and Citi, among other banks.

Crypto vs. banking: how are “purists” reacting to all of this?

Traditional asset evangelists like Barney Frank blame crypto for the banking sector collapse, especially that of Signature. Meanwhile, crypto — or rather Bitcoin —purists believe that the only way forward is via Bitcoin. But that isn’t the correct lens through which to look at this crypto vs. banking debate.

The purists are wrong. Banking institutions with crypto exposure have been around for years. And with experienced individuals on the banking board, the responsibility to diversify and plan investments shouldn’t be difficult. It’s not that they made a crypto transaction and lost billions. They weren’t even rug-pulled.

As for crypto purists, Mt. Gox is still fresh in the minds of Bitcoin OGs, as theft and mismanagement made the once-largest global Bitcoin exchange lose 850,000 customer BTCs. Then, there was the supposedly revolutionary project OneCoin of 2014, which soon revealed its true nature as a glorified pyramid scheme.

Add in the DeFi hacks that show up occasionally, exploiting smart contract bugs and other attack vectors. Understandably, views on the state of affairs are mixed.

If someone mentions that Bitcoin or any other crypto is the solution to these banking woes, here is a more balanced take to consider:

Crypto vs. banking: Do we have a winner?

In the end, it’s still money that needs to be moved around. So, the crypto vs. banking debate doesn’t necessarily stand. Centralized crypto firms continue to require banking support and on-ramp /off-ramp access.

Both crypto and banking have their flaws. Yet, crypto is more reliant on technology, which many banks are now attempting to integrate, in effect playing catch up. Neither is without risks. But crypto is intrinsically more forward-thinking and disruptive, less reliant on legacy technology and outdated ideologies. And the more decentralized the global financial system becomes, the better it will be for crypto.

Frequently asked questions

Is crypto better than banks?

Why is crypto better than traditional banking?

Can crypto replace banks?

Is crypto safer than banks?

Is it better to keep money in crypto or a bank?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.