The Japan Government Pension Investment Fund (GPIF) could drive Bitcoin inflows after the central bank increased interest rates to 0%.

The state pension fund published a request seeking “basic information” on the investment philosophy of illiquid alternatives to domestic bonds, domestic stocks, foreign bonds, foreign stocks, real estate, infrastructure, and private equity.

Why Japan Could Drive Bitcoin Demand

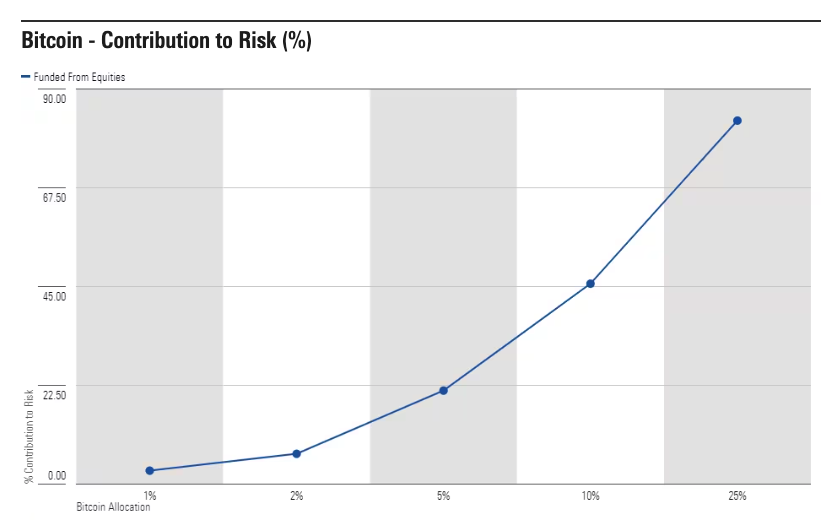

The institution is considering gold, Bitcoin, farmland, forests, and other alternatives to include in a low-yield portfolio. GPIF is currently the world’s largest pension fund, with $1.4 trillion in assets under management.

Bitcoin has been a popular hedge against currency volatility in Japan since the US Federal Reserve hiked interest rates in March 2022. Research firm Kaiko reported a six-monthly crypto exchange trading volume increased from 69% to 80% in 2023, while the volume of trades conducted in the BTC/JPY trading pair rose from 4% to 11% in the same period.

Additionally, institutional demand could follow if the country’s regulators allow crypto allocations in pension portfolios. Such a trend was recently witnessed when one of the largest companies investing in Bitcoin, BlackRock, witnessed net inflows of $7 billion into its spot Bitcoin exchange-traded fund (ETF).

While some of the money came from participants using high-frequency and algorithmic trading strategies, a significant portion came from retail investors looking to access crypto through retirement accounts, according to Grayscale’s director of research, Zach Pandl.

“The buyers of these things are primarily individual investors looking to access crypto through their tax-advantaged retirement accounts and brokerage accounts,” Pandl said.

Read more: Crypto Portfolio Management: A Beginners Guide

Bitcoin’s price consequently rose to an all-time high above $70,000, suggesting that Japanese pension funds could create a similar demand source. Three-decade-high wages will mean employers must set aside more money for pension contributions. South Korea’s public pension added Coinbase’s COIN shares, and some US states, such as Virginia, already use crypto in their pension funds.

Japan’s consideration of Bitcoin for pension investments will unfold against a new interest rate policy. In this week’s meeting, the Bank of Japan increased interest rates to between 0% and 0.1%, ending over a decade of negative rates. The country had previously refused to use a central bank digital currency (CBDC) to combat the negative rates.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.