Open up the keg of powder, it’s time to lock and load. It’s alt season. In July, I predicted a bump of BTC followed by an open alt season. I was right. A perfect storm is bringing back memories of December 2017, and this time big money is looking to exit the U.S. dollar.

Duck Season? Rabbit Season? No, Alt Season.

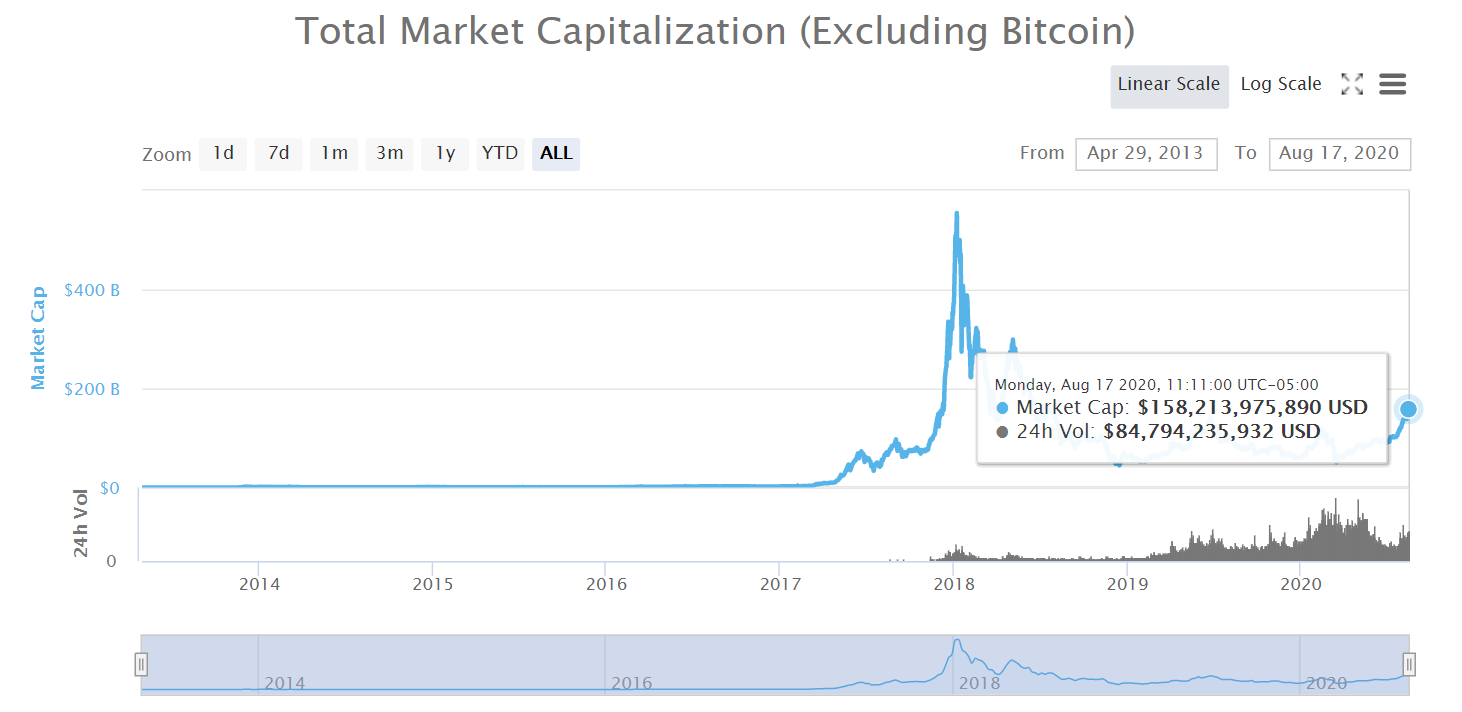

It’s official. Alt season is here, and non-bitcoin cryptos are doing what they do best: pump. Total crypto markets have seen a surge from $165 billion in March to almost $400 billion today. But this market is for the altcoins, which are nearing $160 billion of value. In other words, what in March was the total crypto market cap is now the entire altcoin market cap.

Cause Célèbre

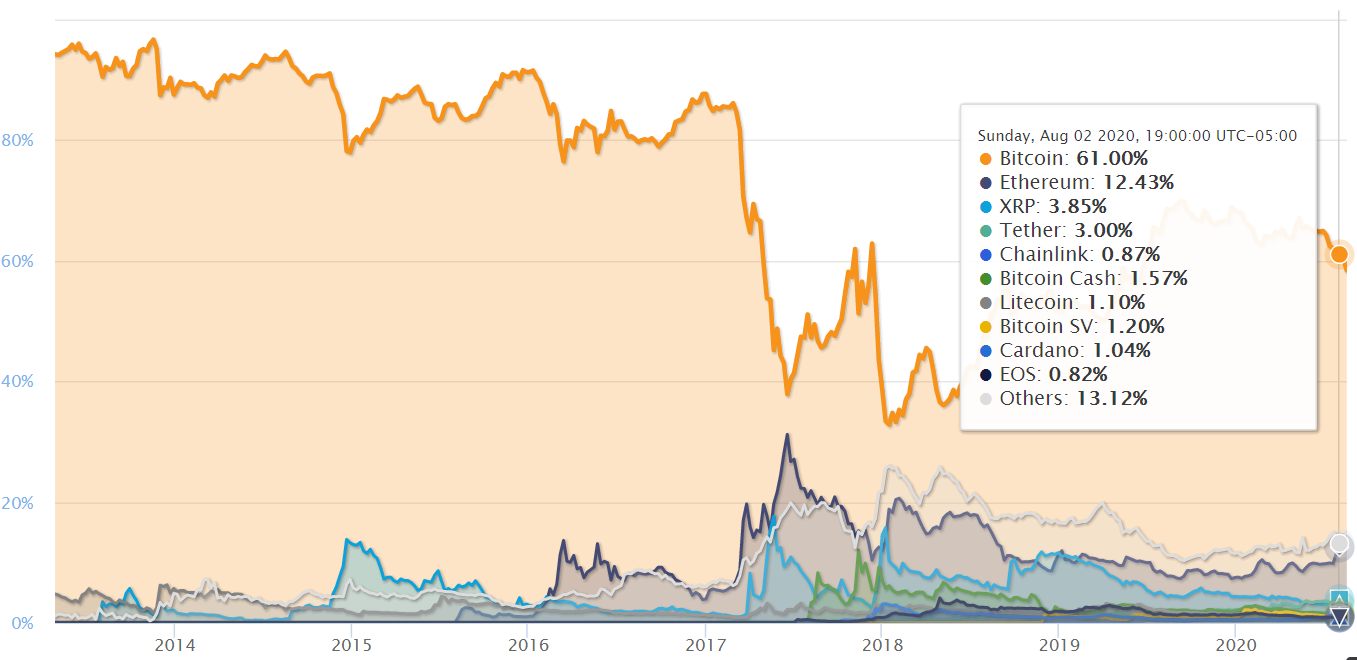

Justified or not, money is now in alts. On the other hand, the macro perspective still looks good. People are distrustful of the bubbling stock markets. The U.S. Federal Reserve jammed liquidity into the markets by printing more cash. Institutional investors are finally looking beyond the dollar to store their wealth. Perhaps the most significant indicator is Bitcoin dominance, which dropped below 60% this week. BTC dominance has not seen these levels in a year. The last major dips in BTC dominance happened with the outperforming run-up in altcoins.

Careful What You Wish For

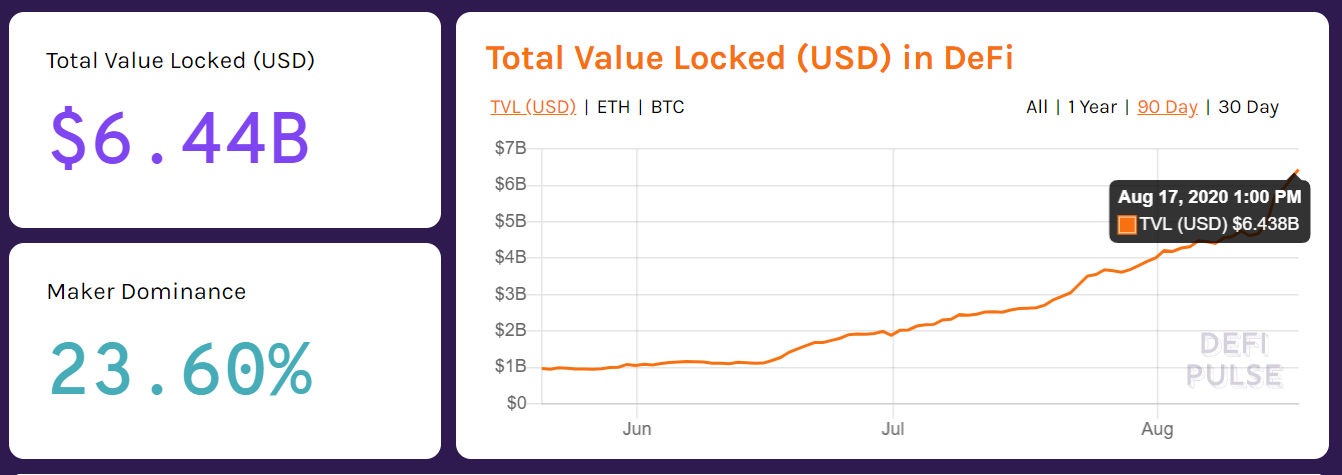

Some small-cap altcoins have seen great excitement, especially if the word ‘DeFi’ is attached. Some coins like LID and CNS promise insane daily dividends but are not transparent about who’s in their team. Others like SUKU offer a special blockchain-driven standard seal of approval, but the technology doesn’t stand out from other supply-chain authenticator coins. The fact is that many of these projects will fail, just like so many ICOs did in 2017 and 2018. Others might even do what they do well. But some have no revenue outside of seed capital and coin price. Some are just unlucky.It is exciting. And with that excitement comes crazy money. Making it and losing it. The total crypto market cap is still half of the last peak, and even ETH is still 70% from its all-time high. There is definitely room for growth and higher long-term support. Exuberance is great, but this market is not regulated. 10x’ing your money is one thing. Selling it before it crashes is another. Hopefully, the attention this brings will take crypto closer to adoption. Disclaimer: The opinions in this article do not necessarily reflect the views of beincrypto.com.If you're losing money in this market you should probably reevaluate

— Empty (@Fullbeerbottle) August 17, 2020

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Harry Leeds

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

READ FULL BIO

Sponsored

Sponsored