Uniswap Gets Popular

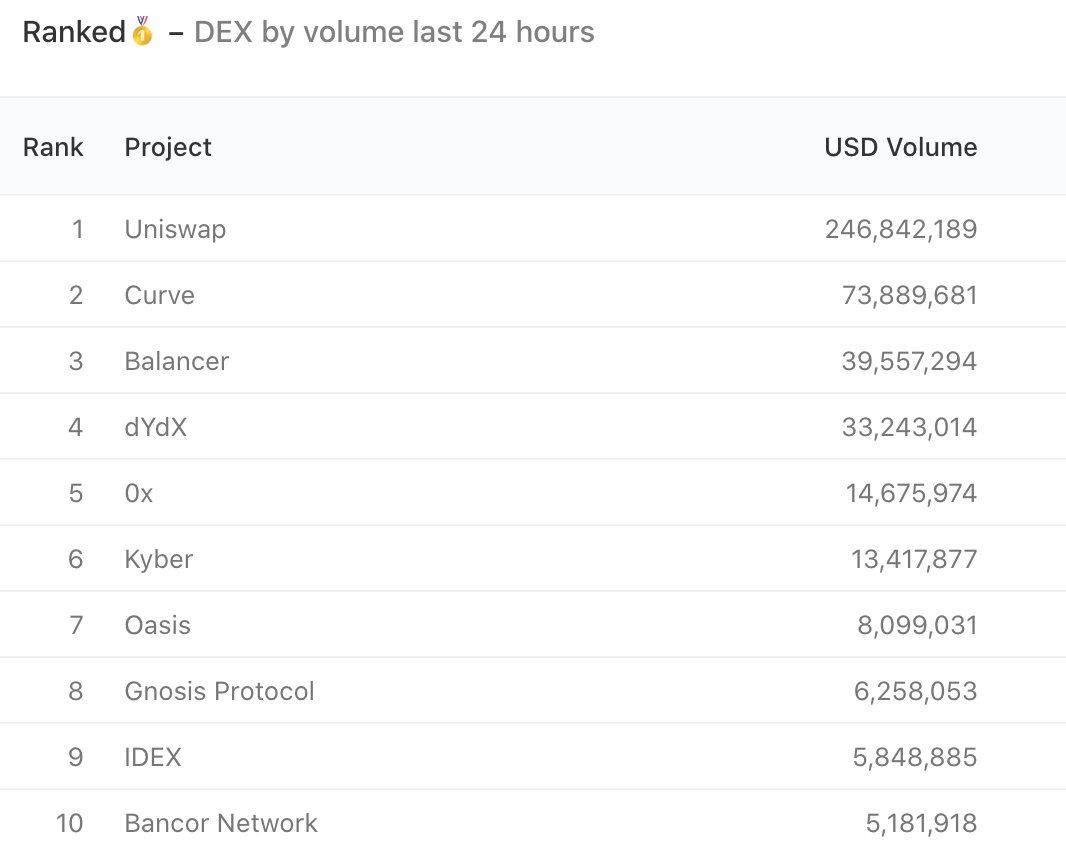

As BeInCrypto reported recently, Uniswap registered a massive increase in trading volume in the last few months. On the 10th of August, Uniswap’s daily trading volume peaked at $250 million, setting a new record for the exchange.

The Gas Price of Fame

As with any Ethereum-based platform, fees are a major sticking point. Due to the increase in trading volume, Ethereum’s network fees have become notably more expensive. This raises concerns, since if not addressed soon, many projects may become financially unviable.The problem comes just as Ethereum is releasing its Medalla testnet, which, in theory, will bring fees down. But Ethereum is not alone. Other protocols are ready to take advantage of discontented users.Uniswap is starting to become unusable with gas prices at 200+ gwei. The only reason people are still using it is that they think they will outperform the fees from flipping tokens (probably true). But if retail actually comes, Uniswap won't be usable for anyone but whales pic.twitter.com/2Ce01sKasO

— Larry Cermak (@lawmaster) August 12, 2020

Contenders Everywhere

If retail investors can’t join the fray, the issue may halt the impending bull run. However, it’s also creating several new businesses around it, like Dharma, whose value proposition is precisely to “pay zero gas fees” on Uniswap.Other projects like Tron and Polkadot are lingering in the shadows. JUST is Tron’s bet on DeFi, and Polkaswap is Polkadot’s version of Uniswap. Relatively newer blockchains like Algorand and Solana also have low-gas price DeFi projects in the works. One that’s gathering a lot of buzz at the moment is Serum, built on top of Solana.1/ Calling all DeFi traders — Dharma is proud to introduce *the most powerful way to trade assets in DeFi, right from your pocket.*

— Dharma (@Dharma_HQ) July 30, 2020

🔁 Trade all 2000+ tokens in @UniswapProtocol

⛽️ Pay Zero Gas Fees

🤑And for a limited time, we’re waiving our trading fee as well! pic.twitter.com/3sklUMTIqJ

It appears that gas price projects are now possibly an investment class of their own. The network that offers the cheapest, reliable, and fastest transactions may just win the multimillion decentralized exchange race.1) It's taken a huge effort from dozens of developers, designers, project managers, and community members; but things are coming together:

— SBF (@SBF_Alameda) August 11, 2020

I'm excited to say that the first trade on the Serum DEX will print this week.@ProjectSerum

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.