Where should you store and trade your crypto? Which is the best option when it comes down to it — a crypto exchange vs. a crypto wallet? Should you use both an exchange and a wallet, or stick to just one for ease? Here’s an ultimate comparison of the pros and cons of each in 2025.

KEY TAKEAWAYS

➤ Crypto exchanges offer convenience and features but come with counterparty and regulatory risks, especially in bankruptcy scenarios.

➤ Non-custodial wallets give you full control and privacy but require technical know-how and strong security habits.

➤ Hot wallets are great for quick access but should be limited in use and value due to higher vulnerability.

➤ Cold wallets are the most secure option for long-term storage, though they sacrifice convenience for safety.

Crypto exchanges vs. crypto wallets: A quick comparison

A crypto exchange is where you purchase cryptocurrency, while a wallet is where you store cryptocurrency. However, both support overlapping features that blur the lines of their primary uses.

For example, in the past, an exchange’s sole purpose was a fiat on-ramp or facilitating swaps; today, wallets also support fiat-to-crypto exchanges and in-app swaps. Likewise, many people use exchanges to store their crypto assets despite having non-custodial wallets.

The question beckons: Why not use non-custodial wallets only? As you will see, there are a number of reasons that you may choose to use an exchange over a wallet and vice versa.

Here’s a quick side-by-side comparison.

| Crypto exchange | Crypto wallet |

|---|---|

| Provide a seamless user experience | Convenient for using web3 and DeFi services |

| Used to trade (spot, derivatives, etc.) | Stores digital assets (coins, tokens, NFTs) |

| Primarily inhibited by regulations | Constrained by blockchain protocols |

| Counterparty risk | User error risk |

| More features but limited by location | Less features, but more privacy and control |

| Comprehensive asset support for trading | Limited support offset by direct storage of assets |

What is a crypto exchange?

A crypto exchange is any platform that facilitates the buying, selling, trading, or swapping of cryptocurrencies. However, the legal definition of an exchange may differ from how most crypto users utilize the term.

The legal definition of an exchange can vary slightly from country to country, but in most jurisdictions, it refers to an organized marketplace where financial instruments are traded.

In the same way that cryptocurrency users have coopted the term crypto from cryptography, they have also done the same with the term exchange, causing some confusion. To put this into perspective, when you want to buy, sell, trade, or swap cryptocurrencies or other financial products, you can use various platforms:

- Exchanges (NYSE, CME, Binance, Bybit)

- Brokerages (eToro, Robinhood, Coinbase)

- Money Service Businesses (MSB) (PayPal, Venmo, MoonPay)

- Online trading/investment platforms, etc. (DriveWealth, Uphold)

Legally, these are all separate terms and platform types. In crypto, we typically refer to them all as exchanges, regardless of functionality.

Types of exchanges

In crypto, you will come across two types of exchanges: centralized (CEX) and decentralized (DEX).

A CEX is typically made with proprietary, closed-source technology off-chain, while a DEX is usually open-source and handles most, if not all, processes on-chain. Some centralized businesses will also operate a DEX, making these types of platforms hybrid exchanges, although, this term is seldom used.

Centralized exchanges

A centralized exchange (CEX) is a platform operated by a company where users trade cryptocurrencies. Some of the key features of CEXs include:

- An order book for matching trades

- Custodies users’ funds

- KYC/AML checks

- Not directly trading on-chain

| Pros | Cons |

|---|---|

| Typically, a better user experience | Counterparty risks |

| Faster trades | Takes custody of your crypto |

| Low fees | Restricts many services in certain regions |

How do CEXs work?

A CEX acts as a middleman between buyers and sellers. When you place a trade, you don’t directly interact with another user or the blockchain. Instead, you’re trading with the exchange’s internal system, and the exchange updates its own ledger to reflect changes in account balances.

When you buy crypto on a CEX, you are buying an IOU until you withdraw your crypto from the exchange. The exchange custodies your crypto, matches trades, and usually handles all deposits and withdrawals.

CEXs tend to offer more features than decentralized exchanges — including margin and derivatives trading (futures, options, etc.), staking, earn programs, customer support, NFT marketplaces, trading bots, etc.

Decentralized exchanges

A decentralized exchange (DEX) is a blockchain-based protocol that lets users trade directly with each other using smart contracts without giving up custody of their assets. Some of the features of DEXs include:

- No centralized operator

- Smart contracts handle trade execution

- No KYC; users connect their own wallets to trade

- On-chain settlement

| Pros | Cons |

|---|---|

| Non-custodial, direct control over your crypto | Limited fiat currency support |

| Privacy-preserving | Smart contract risk |

| Peer-to-peer trading | Degraded user experience (MEV/slippage/chain reorgs) |

How do DEXs work?

DEXs work by allowing you to trade directly from your crypto wallet. This entire process is non-custodial, meaning you never give up ownership of your crypto assets before a trade is placed.

DEXs use smart contracts to facilitate trades and transactions that are recorded publicly on a blockchain (rather than recorded on an exchange’s private internal system). Exchanges will use transparent order books and liquidity pools (which are smart contracts) to match trades between users.

Because every part of the order flow on a DEX is transparent, you can see if you truly received a fair trade. Since you do not have to KYC, you also enjoy a certain level of privacy, and exchange features are not inhibited by your location.

What is a crypto wallet?

A cryptocurrency wallet is any software or hardware that stores the keys to access and control your cryptocurrency. Wallets do not actually store the cryptocurrencies themselves.

Crypto wallets allow you to send, receive, and manage your cryptocurrency assets, including coins, tokens, and non-fungible tokens (NFTs). Unlike exchanges, they typically do not support advanced trading features (e.g., advanced trading interfaces, special order types, etc.). However, they can:

- Store your private keys

- Let you send and receive crypto assets

- Show your balances and transactions

- Allow you to interact with DApps

Types of crypto wallets

As you may be aware, there are also different types of crypto wallets. These include hot wallets, cold wallets, custodial wallets, and non-custodial wallets.

| Type | Storage | Examples |

|---|---|---|

| Hot wallet | Online | MetaMask, Phantom |

| Cold wallet | Offline | Ledger, Trezor |

| Custodial wallet | Counterparty controls keys | Wirex Wallet |

| Non-custodial wallet | You control the keys | MetaMask, Ledger |

While these categories may sound overwhelming, the differences between them are mostly marginal. The most important thing to understand is the distinction between hot and cold wallets since every wallet ultimately falls into one of these two categories.

Hot wallet vs. cold wallet

A hot wallet is a crypto wallet connected to the internet, used for quick and easy access to your funds. It can be custodial, like an exchange wallet, where someone else holds your keys, or non-custodial, like MetaMask, where you control the keys yourself.

In contrast, a cold wallet stores your private keys completely offline, offering stronger protection against hacks. Examples include hardware wallets like Ledger or Trezor. Hot wallets are great for everyday use, while cold wallets are better for long-term, secure storage.

Custodial wallet vs. non-custodial wallet

A non-custodial wallet is a type of crypto wallet where you hold and control your own private keys, giving you full ownership and responsibility over your funds — examples include MetaMask, Trust Wallet, and Ledger.

In contrast, a custodial wallet is one where a third party (like an exchange or service provider) holds your private keys on your behalf, managing security and recovery for you. Common examples include wallets on Binance or Kraken (although just to confuse things a little more, some exchange-linked wallets can separately be non-custodial, such as the Coinbase Wallet).

Non-custodial wallets offer more control and privacy, while custodial wallets offer convenience and easier recovery at the cost of personal custody.

Wallet platforms

There are also different wallet platforms, such as hardware and software wallets, mobile wallets, desktop wallets, browser extension wallets, and browser wallets (progressive web apps).

- Hardware wallet: A physical device that stores your private keys offline (like Ledger or Trezor).

- Software wallet: An app or program that runs on your device, such as MetaMask or Trust Wallet.

- Smart wallet: A subset of software wallets, smart wallets are crypto wallets built using smart contracts.

- Mobile wallets: Applications designed for smartphones or tablets.

- Desktop wallets: Crypto wallets installed on computers.

- Browser extension wallets: Exist inside your web browser (Chrome or Brave browsers) for easy DApp access (examples include MetaMask or Rabby).

- Browser wallets: These run in your browser without requiring a download (also called progressive web app wallets) and offer a lightweight, app-like experience (Frame or WalletConnect’s web client).

Trading on a crypto exchange vs. crypto wallet

In terms of trading, crypto wallets and exchanges diverge pretty clearly in terms of experience.

Exchanges

The exchange trading experience is on almost on par with counterparts in traditional finance, especially if you use a beginner-friendly CEX. Exchanges tend to provide traders with a suite of features, including:

- Spot and derivatives trading

- Trading bots

- Copy and social trading

- Special order types (limit, stop-limit, etc.)

- Ultra-fast order execution

Many also have advanced interfaces. With the right expertise, these can be a game-changer. You can set multiple trading signals, view order books live, use drawing tools, and edit charts to help you trade.

Wallets

Trading with wallets is more difficult if you are looking for a streamlined experience, although it is more convenient for storage. Wallets are better for portfolio management as opposed to trading. While you can buy, sell, and swap assets, you do not get the advanced trading interface with signals.

However, you can bridge assets and send and receive crypto without needing approval or adhering to transaction minimums or maximums. Moreover, wallets are excellent for interacting with applications across multiple blockchain networks.

Crypto exchange vs. crypto wallet: Pros and cons

Let’s be honest: whether you store your cryptocurrency in an exchange or a wallet, there are many tradeoffs, and each solution has its own strengths and weaknesses. This can become even more complex when you consider the many types of exchanges and wallets. Let’s start with exchanges.

DEXs do not typically hold user’s assets. So, this analysis will be relegated to CEXs.

Exchanges

CEXs offer a better user experience than wallets do. They generally have better interfaces, more features, customer support, and educational content to support users. However, the biggest risk of using a CEX is counterparty risk.

Pros and cons

| Pros | Cons |

|---|---|

| Better operational security (usually) | Bankruptcy risk |

| Possible reimbursement/recovery of stolen funds | Risk of hacking |

| Better technology to protect assets | Segregated structure may not ensure bankruptcy protection |

When you use a CEX, there is a subtle expectation that if the company goes under, your assets will be seized and filed in bankruptcy proceedings.

A segregated assets clause will greatly improve your legal standing for asset recovery during a CEX bankruptcy, but it’s not a silver bullet. However, even legally segregated funds can be at risk if the company fails to operationally uphold that segregation.

One upside to using a CEX is that a company with better resources employing (theoretically) tighter operational security practices than yourself is protecting your crypto.

Many professional exchanges will hold a majority (typically about 90%) of users’ funds in cold storage. Some exchanges, like Coinbase and Gemini, store cold wallets in geographically distributed vaults, sometimes with armed guards, biometric access, and 24/7 surveillance. These vaults often resemble high-security banks or military storage facilities.

Additionally, CEX multi-signature (multisig) wallets require multiple private key holders to authorize a transaction or institute time delays for added security.

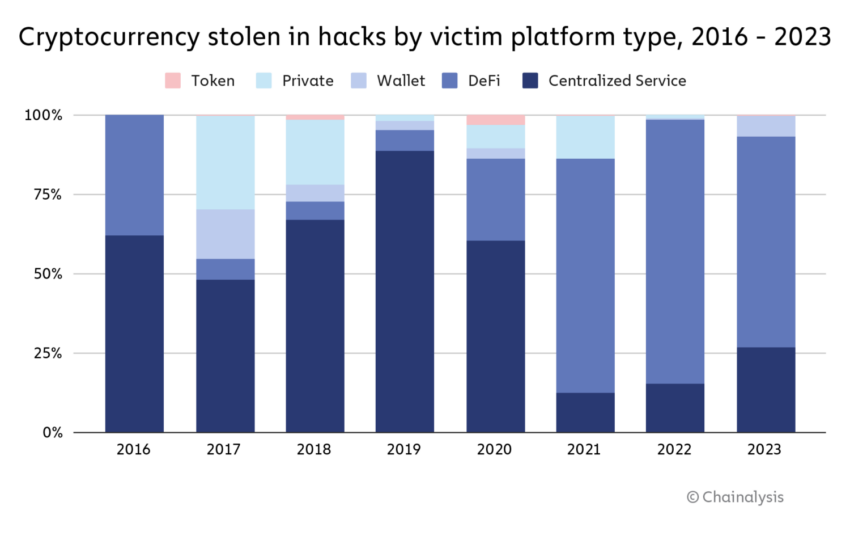

However, CEXs are still vulnerable to hacks. The good news is that, unlike with self-custody, there is a slight chance that the exchange may reimburse you in such cases. However, this is not the norm, and exchanges are typically not legally obligated to do so.

Wallets

Non-custodial crypto wallets solve some of the vulnerabilities associated with CEXs, such as bankruptcies. On the other hand, the biggest downside to wallets is the possibility of hacks, user error, and possibly a large learning gap.

Pros and cons

| Pros | Cons |

|---|---|

| Not subject to KYC or geo-restrictions | Require technical expertise to remain safe |

| Wallet hacks have diminished over the years | Hardware wallets are not ideal for frequent actions |

| Hot wallets are more susceptible to hacks | Zero chance of reimbursement/legal recourse when hacked |

Crypto wallet technology has significantly improved since the early days of crypto, and major wallet hacks stemming from poor design have almost disappeared over the years. Most of the drawbacks associated with self-custodial (non-custodial) wallets arise from the complexities of blockchain protocols and security.

For instance, the $1.5 billion Bybit hack was the result of an unverified function selector and raw transaction calldata. This is a perfect example of the complexities of wallet security because exchanges and custody services don’t usually give their crypto to other exchanges to keep safe; they use wallets themselves.

Consumer wallets do give immediate access to web3 applications and DApps (with the exception of cold/hardware wallets), making them more vulnerable when used by less technically-capable users.

However, this feature is balanced by the privacy features of non-custodial wallets. On most exchanges, you will have to give up custody of your crypto and personally identifiable information in order to enjoy all of the platform’s services.

With non-custodial wallets, you do not have to give private information, there is no counterparty risk, and you typically aren’t subject to geographical restrictions on decentralized applications and services.

Crypto exchange vs. crypto wallet: Final verdict

The reality of using an exchange or wallet is not cut and dry. Blockchain technology, in its current state, still has a long way to go, and the complexity of blockchain protocols can diminish user experience.

Non-custodial wallets are almost always better because they don’t have counterparty risk. However, CEXs offer a better user experience and can be safer for non-technical users in many cases.

So, how do you know when and which one to use? Here is a quick summary:

- It is more advantageous for some users to use a CEX. However, if that CEX goes bankrupt, the odds are you will lose your funds.

- CEXs may have better security, more features, segregated assets, and an overall better experience for novice and technical users, but this does not guarantee safety.

- You should limit the amount of funds you leave on CEXs regardless of your technical ability.

- All crypto users should prioritize using non-custodial wallets over all other options and should also learn how to use them.

- Hot wallets are less safe than hardware wallets. Therefore, you should limit the amount of capital you store in them, limit their usage, limit the number of DApps you connect them to, and cycle through them frequently.

- Cold or hardware wallets are the gold standard for wallet security, but they are inconvenient for frequent on-chain transactions.

The power is in your hands

Cryptocurrency exchanges and wallets have their place in the crypto world. Neither is a panacea — it all depends on your personal needs and proficiency. Both solutions need improvement in their current implementations. Whether an exchange or wallet, it is ultimately up to you to do the due diligence and research to protect your crypto assets. The power is in your hands.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always do your own research (DYOR).

Frequently asked questions

Crypto exchanges are better for non technical users and overall user experience. Wallets are better for privacy and connecting to decentralized applications. Each has their own strengths and weaknesses.

Exchanges, particularly centralized ones, are businesses. Therefore, they can get hacked, freeze your accounts, or go bankrupt and sweep your assets into bankruptcy court. Moving crypto to your personal wallet mitigates many of these problems.

An exchange is where you go to buy, sell, or trade crypto. Wallets are applications or devices made simply for storing cryptocurrency assets. Although many have the features of both, these are there primary use cases.

Wallets are safer than exchanges in certain events, particularly asset seizures from legal proceedings. However, they are not necessarily safe from hacks. Exchanges are generally safer from hacks arising from user error.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.