BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories on El Salvador’s plans to strengthen trade relations with Russia using Bitcoin, Binance’s survey of Latin American customers, Colombia’s efforts to develop a clear regulatory framework, and more.

Latam Investors Plan to Buy More Crypto, Says Binance

A Binance survey reveals that nearly all Latam investors intend to increase their crypto holdings in the coming year. The study interviewed around 10,000 Binance customers from Argentina, Brazil, Colombia, and Mexico. The participants, who had varying levels of investment, provided insights into their behavior and outlook on the crypto market.

According to Binance, 95% of surveyed customers plan to boost their cryptocurrency investments in the next 12 months. Of these, 42.2% expect to make purchases within the next three months, 17% within six months, and 35.7% within the year.

The research also highlighted the buying habits of investors. More than 54% purchase cryptocurrencies at least once a month. Notably, 6.6% buy more than once a day, 4.6% buy daily, 15.4% buy weekly, and 27.8% buy monthly.

When deciding which cryptocurrencies to buy, a third of the customers base their decisions on market conditions. Additionally, over 50% of the participants have been investing in cryptocurrencies for more than a year.

Read more: Best Crypto To Buy Now: Top Coins To Keep an Eye on in August 2024

The survey also explored the reasons behind their investments. Approximately 20.3% cited prospects of high profitability, 15.2% mentioned financial freedom, while 13.3% were motivated by money protection. Other reasons included innovation (12.5%), portfolio diversification (10.9%), and security and privacy (10.3%).

“Cryptocurrencies and blockchain technology offer an attractive proposition to meet concrete needs in the day-to-day lives of individuals and businesses in Latin America. With a smartphone and minimal requirements, anyone can begin to explore this world that offers lower access, costs, and transaction times. This research not only helps us to expose the current state of cryptocurrency adoption in the region but also allows us to provide insights into user behavior and expectations,” Guilherme Nazar, Binance’s regional vice president for Latin America, commented.

Worldcoin Executive Reveals Operations Without License in Ecuador

The Data Protection Superintendence of Ecuador denies receiving formal notification about Worldcoin’s operations, despite claims from Martin Mazza, regional manager for Latin America of Tools for Humanity (TFH).

For over a month, citizens in Guayaquil and Quito have had their irises scanned in exchange for cryptocurrencies via a mobile app. Users, often unaware of the terms and purposes of their biometric data usage, have received over $24 in crypto.

This raises concerns about compliance with personal data protection regulations. Fabrizio Peralta Díaz, Superintendent of Data Protection, noted the institution’s lack of resources for effective supervision, adding that he is the only official available for these duties. Peralta confirmed that contact with Worldcoin was limited to a briefing on June 17, 2024, not an official notification or request for authorization.

Read more: What Is Worldcoin? A Guide to the Iris-Scanning Crypto Project

Mazza claimed Worldcoin operates in Ecuador under a franchise model, without needing a local branch, and complies with applicable regulations, thus requiring no specific license. He stated that users can access information about the service at location centers.

The superintendence warned that if personal data processing irregularities are found, corrective measures could include ceasing data processing, as per Article 65 of the Organic Law on Personal Data Protection. However, Peralta emphasized that implementing these measures requires a technical report and due process, which are limited by the institution’s financial and human resource constraints.

JusToken Enters Brazil and Argentina

JusToken, a new global tokenization infrastructure company, is entering the real-world asset (RWA) space in Brazil and Argentina. The company aims to provide solutions in collaboration with various sector companies.

“Tokenization allows us to connect the real world with the digital world, creating a new universe of possibilities,” said JusToken’s CEO and co-founder, Eduardo Novillo Astrada. “To achieve this, a solid, scalable, and proven infrastructure that can adapt to diverse needs is essential. Justoken was born to tokenize, empower, and expand businesses. We offer solutions tailored to each industry’s needs, powered by blockchain, which gives us transparency, agility, speed, and security.”

Read more: How To Invest in Real-World Crypto Assets (RWA)?

JusToken comprises several firms, including Agrotoken, which tokenizes agricultural products; Landtoken, a farmland tokenization platform; Pectoken, a livestock tokenization platform; Enertoken, a global energy tokenization platform; and SAYKY, which offers carbon-based and ESG solutions.

The company’s goal is to convert physical assets into digital assets with liquidity and security through blockchain.

Chilean Congressman Investigated for Holding Millions in Cryptocurrency

Amid the investigation into an alleged mega-fraud involving former Maipú mayor Cathy Barriga, a new controversy has surfaced concerning her husband, Congressman Joaquín Lavín León.

Between 2018 and 2021, Lavín reportedly invested over $48 million in cryptocurrencies through the Buda.com platform. The substantial volume of these investments caught the attention of authorities, especially after the platform requested information on the origin of the funds. Lavín’s failure to respond led to the temporary blocking of his account.

Cathy Barriga’s lawyer, Cristóbal Bonacic, has defended the legitimacy of these investments, asserting that all the money in question comes from Lavín’s legitimate income. Bonacic explained that Lavín’s lack of response to the source of funds request was due to him no longer making investments on Buda.com, not due to any lack of clarity about the funds.

Read more: Complete Guide to Filing Cryptocurrency Taxes in 2024

Suspicion also surrounds a $12,600 transaction made in September 2018 by Vicente González, Barriga’s eldest son. Vicente, who was 19 at the time, made the transaction from his Buda.com account before he began his relationship with the Internal Revenue Service.

Neither Cathy Barriga nor Joaquín Lavín have made additional statements. Bonacic concluded that there is no objection to the Public Prosecutor’s Office investigating thoroughly, maintaining that there has been no irregular or illegal action in the context of these investments.

El Salvador Willing to Pay Russia in Bitcoin for Bilateral Business

El Salvador, having already legalized Bitcoin as legal tender, is now prepared to use cryptocurrencies for trade with Russia. Alexander Ilyukhin, first secretary of the Russian Embassy in Nicaragua and head of the branch in El Salvador, announced this during an interview with local media outlet Izvestia.

Given that El Salvador’s official currency is the US dollar, Ilyukhin mentioned that the country faces challenges with payments. To address these issues, El Salvador proposes that Russia adopt cryptocurrencies for transactions.

This initiative symbolizes a move toward alternative international payment methods amid sanctions and restrictions. However, the practical benefits of such declarations are often negligible, even if implemented.

Read more: Who Owns the Most Bitcoin in 2024?

In recent years, El Salvador and Russia have been strengthening trade relations. At the St. Petersburg International Economic Forum, El Salvador’s Vice President Felix Uyoa confirmed a commitment to expand trade ties with Russia, especially with innovation-driven companies. Russian Foreign Minister Sergei Lavrov also noted the potential for increased trade, emphasizing the need for direct contacts between the business communities of both countries.

Despite these efforts, current trade volumes between the nations are minimal. In the fourth quarter of 2023, Russia exported goods worth approximately $1 million to El Salvador, while imports from El Salvador did not exceed $20,000. El Salvador mainly exports coffee and its substitutes to Russia, while Russia supplies fertilizers and machinery to El Salvador.

Google and Itaú Brazil Integrate Central Bank Digital Payments

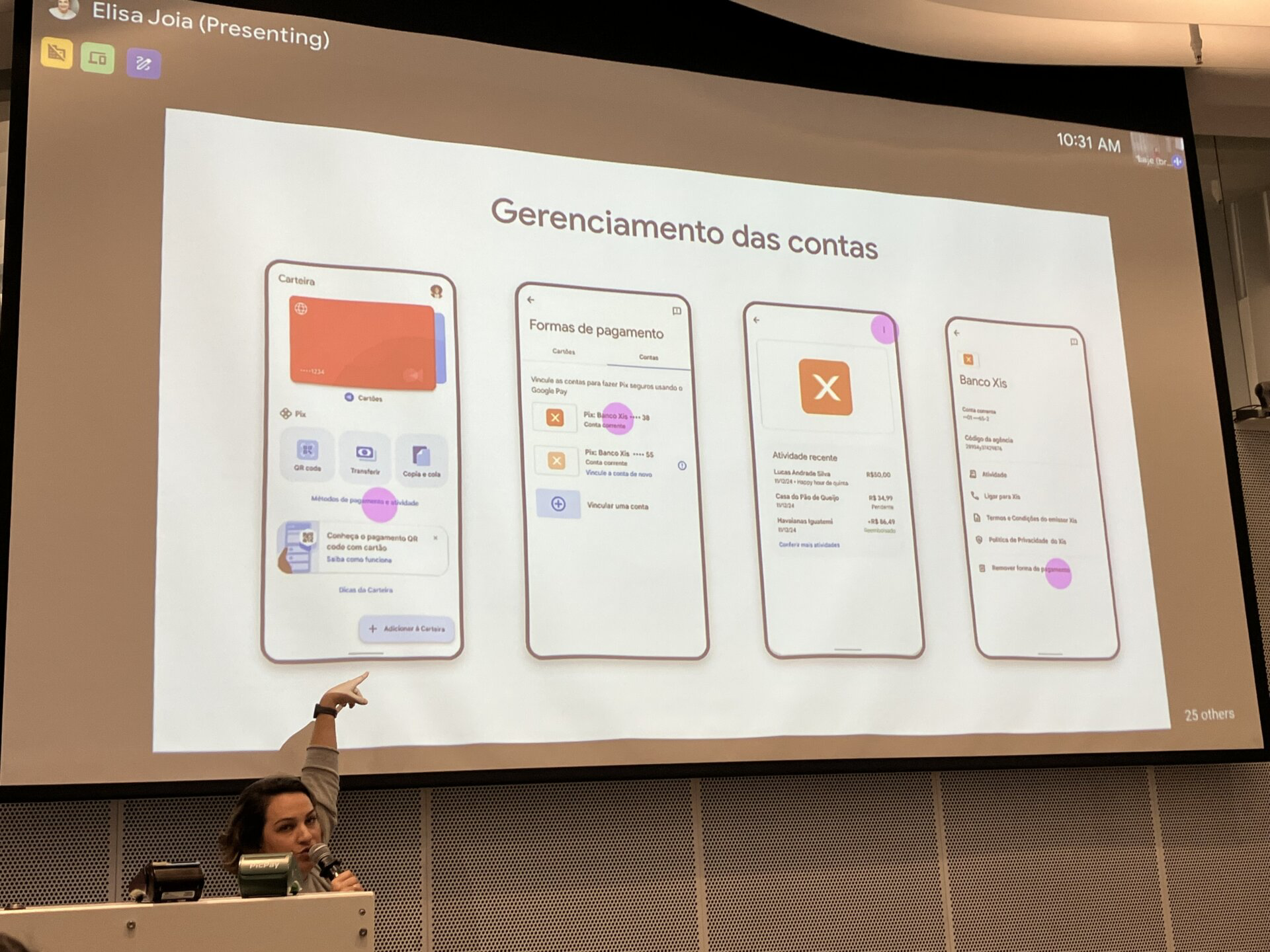

On July 30, Google announced the integration of Pix, Brazil’s instant payment system, into its digital wallet. This new feature aims to simplify transactions, allowing users to make payments and transfers quickly and securely without needing to open their bank’s app.

To enable this integration, Google obtained a specific payment indicator license from the Central Bank. Users can now add their Pix keys to Google Wallet, making payments at merchants and online stores that accept Pix. Additionally, they can send and receive money from friends and family instantly, 24/7.

Google Pay, the tech giant’s platform for online and contactless payments, will ensure transaction security with encryption and two-factor authentication. Google highlights that Pix in Google Wallet offers a convenient way to make payments without cash or cards.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

The functionality will launch gradually, initially available only to C6 Bank and PicPay customers. Elisa Jóia, Google’s head of payments operations for Latin America, stated that this first stage aims to test the functionality and gather user feedback.

“The idea is to do a small launch, so we can understand what the user feedback will be like, to ensure as much security as possible,” Jóia said.

Integrating Pix into Google Wallet will create a fully digital wallet, offering users the choice between credit, debit, and Pix. With the popularity of Google’s digital wallet and Pix’s wide acceptance, this new feature has the potential to drive financial inclusion and simplify transactions for millions of Brazilians.

Colombian Banks and Regulators Consider Cryptocurrency Law

Colombia is positioning itself as a leader in crypto adoption in Latam but faces significant regulatory challenges concerning cryptocurrencies and digital assets. To address these issues, banking entities are pushing for regulations that would make the Colombian Financial Superintendency’s Sandbox more practical and extensive.

Despite the absence of a clear regulatory framework, local media such as Portafolio report that Colombian financial institutions are advancing in their integration of cryptocurrencies. Bancolombia, Davivienda, and Itaú have begun to develop their own exchange platforms despite regulatory uncertainties. For instance, Bancolombia has launched Wenia, a platform designed to facilitate cryptocurrency transactions, backed by a stablecoin pegged to the Colombian peso.

Davivienda has demonstrated its technological capabilities and is awaiting a more mature regulatory environment to fully enter the crypto market. However, these initiatives face the obstacle of an unstable regulatory framework. The recent LaArenera ‘sandbox’ stage, created by the Superintendencia Financiera to test new technologies in a controlled environment, highlighted the limitations of the current regulations.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Although the pilot involved alliances like Banco de Bogotá with Bitso and Davivienda with Binance, progress toward widespread cryptocurrency adoption remains slow.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.