Taxes on cryptocurrency can be a daunting topic. You have to pay cryptocurrency taxes just like in the traditional investment market. This must be done based on each individual trade, and, of course, the price in which each trade was made.

- Do I have to pay taxes on cryptocurrency?

- FIFO and LIFO

- Why you must pay cryptocurrency taxes

- Hard forks, airdrops, and other unique cryptocurrency cases

- How to pay taxes on Bitcoin and other cryptocurrencies

- The best crypto tax software to help you pay taxes on crypto

- The critical role of crypto tax payments

- Frequently asked questions

Do I have to pay taxes on cryptocurrency?

The short answer is yes, you must pay cryptocurrency taxes. The long answer is that the Internal Revenue Service (IRS) treats cryptocurrencies as property, despite them recognizing it as a tradeable, digital currency with varying value. It isn’t treated as a currency in the eyes of the IRS.

The act of selling your cryptocurrency to convert into fiat is taxable. Converting one cryptocurrency to another, like Bitcoin to Ethereum, is taxable. Making a payment with cryptocurrency is a taxable event. This could be anything from rent to salaries paid in these digital currencies.

Yes, that means if you’re an employer or an employee who pays or receives payment in cryptocurrency, you must pay a tax on that event. Also, if you attempt to use Bitcoin or other cryptocurrency in a traditional way. Buying groceries is a taxable event, for example.

However, not every cryptocurrency transaction is taxable. For instance, transferring cryptocurrency between wallets or exchanges is not taxable, though you will likely pay some transaction fees to different exchanges. Also, purchasing an asset with fiat isn’t taxable – only if you do something with it.

This can all appear tedious to keep track of, though there is software that can assist you, which we’ll go over later in this post.

Detailing taxes on cryptocurrency

As stated previously, the IRS classifies cryptocurrencies as property. Traders are to pay income tax on their holdings, be it gains or losses. This means that to pay taxes on cryptocurrency, one must track the price at which the asset was purchased.

Of course, day trading cryptocurrency taxes are a little different. If you day trade, you must keep track of all of these prices, and when you sold or converted assets as well. Losses, of course, can be written off.

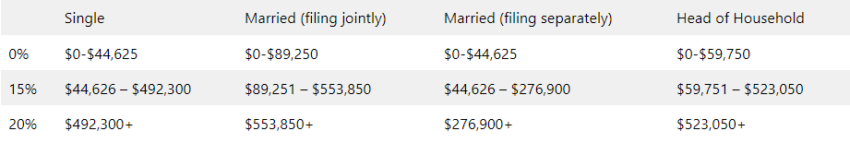

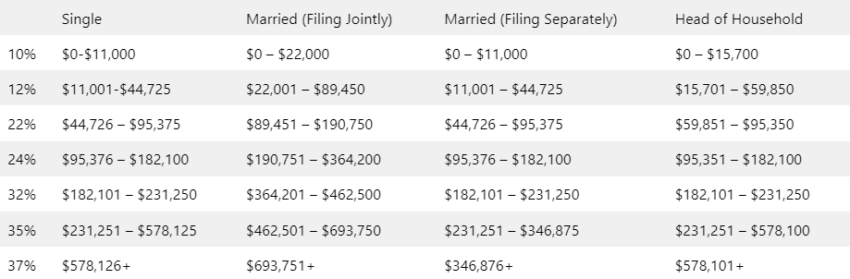

Then we have something called short-term or long-term gains. Short-term gains are when you hold an asset for less than a year or sell it for a profit. However, holding cryptocurrency for over a year makes it a long-term gain. These result in lower tax rates for a trader, meaning those who hold will pay less to the government overall. This ranges from 0% to 20%, depending on your tax bracket.

Short-term crypto gains on purchases held for less than a year are taxed at the same rates as other income: 10% to 37%, depending on your federal income tax bracket. Regardless, unlike those who hold assets for less than a year, those who hold for over 365 days must pay capital gains tax on that cryptocurrency. This is declared on Form 8949 by the IRS.

Ordinary vs business income

Mining and staking cryptocurrency is a whole other beast. Those who mine should know that rewards are technically classified as ordinary income. It’s important to note down the exact value the asset is released and put into your wallet. Staking is the same process. Then, if you trade or sell that mined cryptocurrency, it falls under the capital gains and losses tax rules.

Of course, mining as a business means reporting it as business income, while hobby mining is considered “other income.” Users into decentralized finance must also pay taxes. If you receive a cryptocurrency loan, profit from interest on providing a loan in cryptocurrency, or something similar, you must also pay an income tax on it.

However, it’s important to distinguish that this is only if you do this with cryptocurrency as the main form of transaction. If you take a loan against your cryptocurrency, this isn’t taxable. Interest, of course, must be paid, but there’s no form of capital gains tax.

FIFO and LIFO

There are two main ways to track your cryptocurrency taxes: FIFO and LIFO. FIFO stands for First In First Out, meaning that you should sell the first asset you bought. From here, you can look at the amount this asset was at purchase, and subtract that number from the price you sold it at, making it easy to figure out your capital gains on Bitcoin and other cryptocurrency.

LIFO, which stands for Last In First Out, works similarly. This means you sell the last asset you bought first, and subtract the selling price from what you just bought. This can help you keep track of any losses made.

Why you must pay cryptocurrency taxes

You may think that because of the anonymous nature of cryptocurrencies, you can get away with avoiding paying taxes on cryptocurrency. This is absolutely not the case. After all, some cryptocurrency exchanges in the United States, like Coinbase, are required to report to the IRS regarding their cryptocurrency purchases for traders who have transacted over $20,000 in one go.

They will likely extend this to everyone over time – not just big profiteers. On top of this, even if the exchange didn’t report you, blockchain networks aren’t as anonymous as one may think. Bitcoin’s network, for example, is a public ledger. It’s not impossible for experts to track an address and figure out the identity behind it.

Keep in mind that the IRS has also sent letters to a variety of cryptocurrency taxpayers, asking them to pay back taxes on assets they didn’t report in the past. They’re not stupid, and chances are they will find evaders. According to CNBC, you can go to prison and be fined up to $250,000 for not paying taxes on your cryptocurrency transactions.

Hard forks, airdrops, and other unique cryptocurrency cases

While the IRS Bitcoin and IRS cryptocurrency tax rules have been in place since 2014, it wasn’t until 2019 that the group said anything about airdrops and hard crypto forks. Fortunately, it doesn’t add too much confusion.

It has been classified that hard forks that don’t provide airdrops aren’t necessarily a gross income, meaning that they are not taxable events. However, hard forks with airdrops are another story. These scenarios mean that wealth was created, and traders must pay income tax on the fair market value at the time of the airdrop since an asset with value was essentially created at that time.

How to pay taxes on Bitcoin and other cryptocurrencies

To streamline the process, the IRS has made it so that paying taxes on Bitcoin and other cryptocurrencies is actually built into Form 1040 under the additional income and adjustments to income sections. This was implemented for the 2019 taxpaying season and reads: “At any time during 2019, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?”

That said, this doesn’t exactly make things clear, as you need to report the numbers somewhere else – on the W-2 form. Fortunately, the previously mentioned crypto tax software can help you do this.

The best crypto tax software to help you pay taxes on crypto

Unfortunately, while they’re great for trading, buying, and selling cryptocurrency, exchanges aren’t great at helping your report your taxes on Bitcoin or other cryptocurrencies. This is where cryptocurrency tax software comes into play.

Cryptocurrency tax software helps you import your transactions for the year and assists you in generating reports for your transactions such as buy and sell prices. The best crypto tax software comes with transaction importing and automatic report generation and allows for a reasonable amount of transactions.

1. CoinLedger

The service CoinLedger is one of the more simplistic cryptocurrency tax software on this list, and that isn’t a knock on it. An easy-to-use software with a streamlined interface, CoinLedger ensures you can pay a Bitcoin tax with little to no effort required.

CoinLedger will create a tax report and break it up into documents like an audit trail report, a cryptocurrency income report, a short & long-term sales report, and more. This software should provide Any document you need, as it supports FIFO, LIFO, and HIFO.

Finally, when filing your taxes, you can simply import the information into something like TurboTax or even send it to your accountant or someone else doing your taxes. From there, your cryptocurrency taxes are done.

It’s also worth noting that the platform’s pricing only starts at $49 per season, meaning it’s quite affordable for anyone needing the software. However, that plan only handles up to 100 trades. If you’re more of a day trader and need to track up to 1,500 or even 5,000 trades, you’ll need to jump up to the $99 or the $199 per season plans, respectively.

2. TaxBit

Developed by cryptocurrency tax attorneys and top blockchain CPAs, this cryptocurrency tax software is compatible with over 100 cryptocurrency exchanges. It complies with the United States tax code regarding cryptocurrency, provides audit trails and analytics, and supports over 4,200 cryptocurrencies.

If you’re a frequent trader of altcoins, this is the software for you. Not only does it provide the forms you need to report your taxes, but it also gives you detailed metrics for your portfolio, history, and performance, allowing you to make more accurate trades based on your history. Plus, TaxBit allows you to integrate your crypto wallets as well as your exchanges.

TaxBit even provides you with personalized information regarding your refund, with information based on the state tax rate, your long-term gains, and your short-term gains. It looks at federal and state laws, your capital gains and losses, and more, ensuring you have a full view of what you owe and what the government owes you. It also does this throughout the year, not just when its tax-paying time.

3. Koinly

Much like CryptoTrader.tax, Koinly is a cryptocurrency tax payment software that’s quite easy to use. Not only does it provide a fiat overlook on top of your return on investment, but the platform even takes into account your cryptocurrency lending, your mining, and your staking, among other forms of cryptocurrency investments.

The platform’s API connects to various accounts on multiple exchanges, and even allows you to import wallets. If you happen to do margin trading or futures trading, Koinly can even assist you there when it comes to tax reporting. Though keep in mind this type of trading falls under capital gains tax.

The critical role of crypto tax payments

You must pay cryptocurrency taxes, as the IRS classifies them as property. The agency actively seeks out tax evaders, having already contacted some for unpaid taxes on unreported assets. To manage this, consider using crypto tax software like TaxBit and Koinly, simplifying reporting and ensuring compliance. By staying informed and using the right tools, you can navigate crypto taxes efficiently, keeping your investment journey smooth and compliant. Ultimately, always remember that you should never invest more than you can afford to lose.

Frequently asked questions

What happens if you do not pay crypto taxes?

How is cryptocurrency taxed?

What is a capital gains tax?

What is an ordinary income tax?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.