BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories on Bancolombia’s partnership with Chainlink, Helium’s expansion in Mexico, and more.

Bancolombia’s Wenia Partners with Chainlink for Transparent Stablecoin Backing

Wenia, part of the Bancolombia Group, has launched its COPW stablecoin in Colombia, leveraging Chainlink’s Proof of Reserve (PoR) to enhance transparency. COPW, backed 1:1 by the Colombian Peso, aims to expand across other countries and Web3 platforms.

This partnership enables Wenia’s users to access Chainlink’s secure on-chain PoR data, ensuring clarity on the reserves backing COPW. The integration guards against infinite mint attacks by linking PoR directly to the stablecoin’s minting process. Wenia users can now trade COPW for Bitcoin, Ethereum, MATIC, and USDC through the Wenia App.

“This initiative is pivotal for Colombia’s digital asset landscape. On-chain Proof of Reserve ddata is a critical component to digital asset adoption, serving as a stepping stone toward increasing consumer confidence in using stablecoins and other tokenized assets. We chose Chainlink for its industry-leading platform, and we’re excited by the potential of its technology to increase transparency, utility, and accessibility for our users now and in the future,” Pablo Arboled, Wenia CEO, stated.

Read more: A Guide to the Best Stablecoins in 2024

Colombia has seen significant crypto growth, especially in late 2023, with stablecoins comprising 31% of crypto transactions. Monthly crypto transactions in Colombia are around $200 million, ranking it 32nd globally and fourth in Latin America for crypto adoption. COPW addresses the demand for stablecoins and the associated OTC market costs.

“Chainlink is excited to provide end-to-end transparency for Wenia’s Colombian Peso stablecoin reserves and help to protect its users from infinite mint attacks. Underpinned by Chainlink’s highly secure and reliable services, these digital asset initiatives from Wenia, a part of Bancolombia Group, can profoundly impact the lives of millions of Colombian citizens in a very powerful way,” Angela Walker, Global Head of Banking and Capital Markets at Chainlink Labs, noted.

In addition to providing on-chain PoR data feeds, the collaboration is expected to expand to include Chainlink Price Feeds for accurate, reliable market data and CCIP for secure cross-chain interoperability.

Brazil’s Central Bank Plans ‘Super App’ Integrating AI and CBDC

Brazil’s Central Bank President, Roberto Campos, recently announced plans to develop a “super app” that integrates the country’s central bank-issued digital currency (CBDC), “Drex,” with AI and the instant payment system, Pix. This initiative follows Brazil’s continued commitment to the CBDC project, expected to roll out by 2025.

Campos explained the potential of a “super app” to unify various financial services, including AI functionalities similar to those seen in OpenAI’s ChatGPT. At the Blockchain Rio forum, he highlighted the importance of financial inclusion and security, suggesting Brazilians maintain “multiple wallets” and access a unified platform for comprehensive financial management.

“We can expect that the introduction of a superapp will mostly address financial inclusion by combining instant payments — PIX — with the DREX platform and a Brazilian Real CBDC, making banking services accessible to more people, including those without traditional bank accounts. The failed experiment of open finance in Brazil might finally have a chance to succeed and facilitate the lives of millions of Brazilians. With a horizontally scalable platform and the support of the local financial sector, led by the Central Bank, Brazil could transform itself into one of the most technologically advanced countries,” Noel Hatem, Founder of Blockchange, told BeInCrypto.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

The concept of this “super app” aligns with global trends towards digital financial solutions. Italo Borssatto, an advisor at the Bank for International Settlements (BIS), praised Brazil’s Drex initiative as one of the most innovative in Latin America, drawing parallels with CBDC projects in Hong Kong and South Korea. He noted Brazil’s transparency and ambitious timeline for the Drex rollout.

Despite the forward momentum, regulatory discussions continue. The Brazilian Senate recently delayed voting on PL 2338/23, a bill concerning AI regulation in the country, postponing further debates until after municipal elections. This delay reflects ongoing considerations around privacy and data sharing, critical aspects of the Drex project and the proposed “super app.”

HIVE Digital Announces 100 MW Bitcoin Mining Center in Paraguay

HIVE Digital Technologies Ltd. plans to build a 100 megawatt (MW) Bitcoin mining center in Paraguay, confirming its commitment to sustainability and energy efficiency. This new facility will use hydroelectric power, aligning with HIVE’s operations in Canada, Sweden, and Iceland.

The expansion in Paraguay aims to boost HIVE Digital’s global Bitcoin mining capacity to 6.5 Exahash per second (EH/s). The facility will feature advanced technology and state-of-the-art ASIC miners, known for their high efficiency and processing power.

“This potential opportunity is expected to add an additional 6.5 Exahash per second (EH/s) to our Bitcoin Mining Operations, increasing our global EH/s to 12.1 EH/s. This represents an important milestone in our diversified growth strategy and supports our commitment to expand our global footprint with data center operations in Canada, Sweden, Iceland and now Paraguay,” Frank Holmes, CEO of HIVE Digital, commented.

Read more: Is Crypto Mining Profitable in 2024?

Paraguay is an attractive location for cryptocurrency mining due to its abundant, low-cost hydropower and favorable regulatory environment. This project not only strengthens HIVE’s market position but also addresses investors’ increasing demand for sustainable practices. Other companies have also recognized Paraguay’s potential, making significant investments in the region.

Brazil, Chile, and Argentina Lead Cryptocurrency Trading in Latam

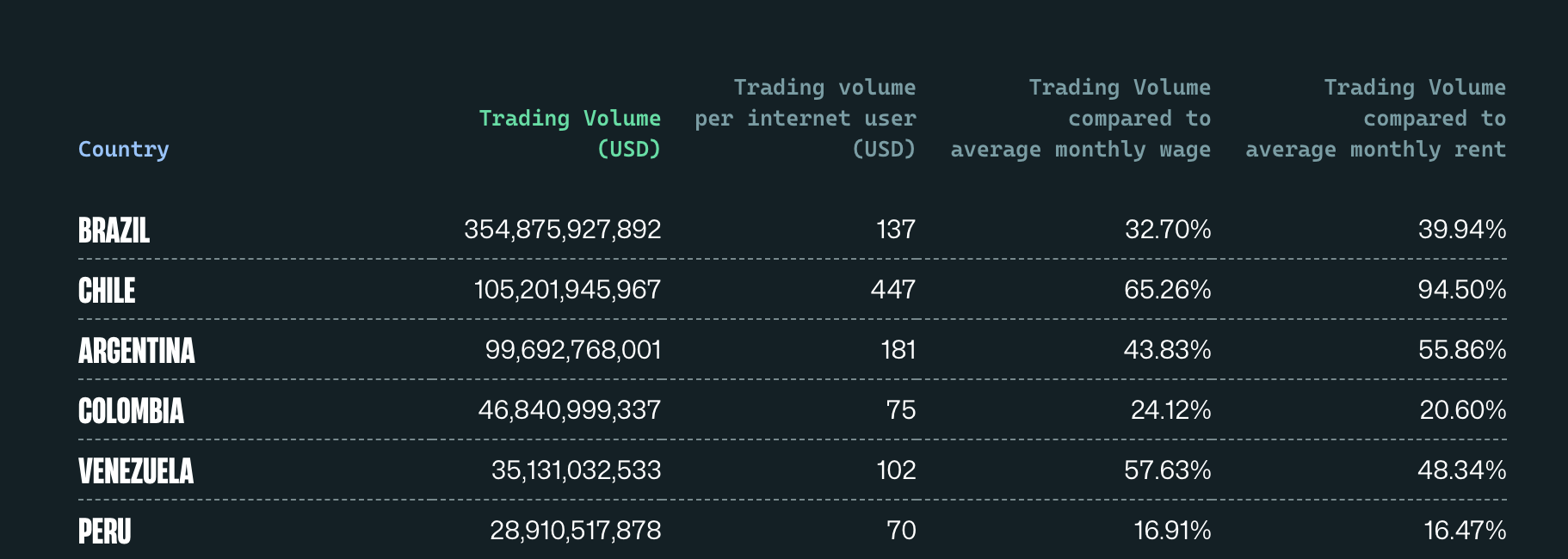

The latest report from CoinWire reveals that Brazil, Chile, and Argentina are the top three countries in Latin America for cryptocurrency trading volume.

Brazil leads the Latam market with a projected trading volume of over $354 billion in 2024, driven by growing adoption. Chile follows with a trading volume exceeding $105 billion, where each holder invests approximately $447 per month in crypto, accounting for 65% of their monthly income.

Argentina also shows significant activity with a trading volume of $99.692 billion, followed by Colombia at $46.840 billion. The most popular cryptocurrency exchanges in the region include Binance, OKX, Coinbase, and Bybit.

Read more: Best Crypto Exchanges With the Lowest Trading Fees

The company projects that global cryptocurrency trading volume will surpass $108 trillion in 2024, a 90% increase from 2022. Latin America’s share of this market is expected to reach $7.82 trillion, up from $2.29 trillion in 2022. This region accounts for 7.09% of global crypto transactions, compared to 37.32% in Europe and 36.17% in Asia.

Helium Mobile Expands Decentralized Wireless Network Across Six Mexican States

Helium Mobile, a Solana-based decentralized wireless network, has announced the expansion of its coverage in Mexico, extending to six new states. Building on the success seen in Oaxaca, Helium aims to bring its wireless blockchain technology to more regions.

The expansion includes new Helium Network service locations in historic districts and high-traffic areas such as parks, historic centers, and school zones. The targeted states include León (Guanajuato), Tijuana, Guadalajara, Puebla, and Toluca, along with further expansion in Oaxaca, where the network has already been operational.

“Today, to continue to expand coverage beyond the US and bring more service providers to Helium Network, we have begun to push for new locations in Mexico! These enhanced locations will target historic districts and areas where higher foot traffic is anticipated,” Helium team explained.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

This move highlight Helium’s commitment to closing the connectivity gap in Mexico and highlights the potential of decentralized wireless technology in revolutionizing telecommunications.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.