NOT, the native token of Notcoin — a popular Telegram-based game — is the talk of the town in 2024. By late May 2024, the play-to-earn game had attracted over 35 million players, all while peaking at a 6 million-strong daily active user-base. So does that social and on-chain credibility translate into a bullish Notcoin price prediction?

This guide offers insights into Notcoin’s short and long-term price forecast, with relevant technical analysis, fundamental metrics, and more.

Methodology

The evaluation of the top cryptocurrency exchanges for trading Notcoin (NOT) was conducted over a period of six months. During this period, multiple exchanges were assessed, focusing on Notcoin-specific features and general platform capabilities. The final selection reflects the best options for trading Notcoin and includes:

- BingX

- Binance

- Bybit

Here’s why each exchange was chosen:

BingX

BingX was chose because of its extensive global support, which makes it ideal for global users to purchase LTC. It is available in more than 100 countries, supports over 70 fiat currencies, and the website is available in more than 20 languages.

Binance

Binance was selected for its comprehensive features, including advanced security measures, regulatory compliance, and extensive support for a wide range of cryptocurrencies. Binance’s user-friendly interface, robust customer support, and comprehensive educational resources further enhance its appeal for NOT traders.

Bybit

Bybit is recognized for its advanced derivatives trading capabilities, offering high liquidity for the NOT/USDT pair, which comprises over 11% of the total NOT trading volume. Bybit also provides perpetual futures for Notcoin, allowing traders to hold positions indefinitely with the potential for leveraged trading. The platform is designed to cater to both beginner and experienced traders, with a demo account feature for risk-free practice trading.

Evaluation criteria

The selection process was based on several key criteria to ensure the best trading experience for Notcoin (NOT) traders. These criteria included:

- Liquidity: High liquidity ensures smooth trading experiences with minimal slippage. Exchanges with significant Notcoin trading volumes were prioritized.

- Security measures: The robustness of security protocols, including two-factor authentication (2FA), cold storage, and regulatory compliance, was assessed.

- Trading features: The availability of advanced trading options, such as futures and margin trading, and the ability to leverage trades were considered.

- User experience: Platforms with intuitive interfaces, both on desktop and mobile, and user-friendly navigation were favored.

- Customer support: The quality and availability of customer support, including 24/7 access and multiple communication channels, were evaluated.

- Educational resources: The presence of educational materials to help traders understand the market and trading strategies was a significant factor.

- Global accessibility: The ability to serve a wide range of international users, including regulatory compliance across different jurisdictions, was considered.

By applying these criteria, the top exchanges for trading Notcoin were identified, ensuring that users have access to secure, liquid, and feature-rich platforms. Each selected exchange provides unique advantages, catering to various trader needs and preferences.

For further details about the verification methodology, please navigate to this link

- Where to buy Notcoin (NOT) today?

- BingX

- Binance

- Bybit

- Notcoin (NOT) long-term price prediction until 2035

- Notcoin (NOT) price prediction and technical analysis

- Notcoin (NOT) price prediction 2024

- Notcoin (NOT) price prediction 2025

- Notcoin (NOT) price prediction 2026

- Notcoin (NOT) price prediction 2027

- Notcoin (NOT) price prediction 2028

- Notcoin (NOT) price prediction 2029

- Notcoin (NOT) price prediction 2030

- How can Notcoin fundamentals influence the price action?

- Does Notcoin have a future?

- Frequently asked questions

Where to buy Notcoin (NOT) today?

Looking to buy NOT tokens before further price surges? Here are the top compatible exchanges to consider.

BingX

BingX supports more than 780 cryptocurrencies and is one of the top 20 exchanges in the world and top 15 markets for Notcoin (NOT). It has a high degree of liquidity and confidence score according to CoinMarketCap.

BingX supports over 20 languages, more than 100 countries, and services more than 10 million customers. This extensive support is further enhanced with its support of fiat currencies, which includes more than 70. This makes BingX suitable for trading NOT for customers globally.

The exchange also supports social trading and bot trading. You can trade both derivatives and spot trading. Customers can trade peer-to-peer as well, offering users a safe medium to trade with each other directly.

Binance

Binance supports a vast selection of over 350 cryptocurrencies and more than 1,000 trading pairs, offering extensive trading options. For Notcoin (NOT), Binance provides trading pairs such as NOT/USDT and NOT/TRY. These pairs account for over 51% of NOT’s trading volume, reflecting their significance and popularity. The NOT/USDT pair, in particular, enjoys a high liquidity score of over 820, ensuring efficient and smooth trading with minimal slippage.

Additionally, Binance’s user-friendly interface caters to both novice and experienced traders, enhancing the overall trading experience. The platform also offers comprehensive customer support, available 24/7 through multiple channels, and a wealth of educational resources to help users make informed trading decisions.

By providing a secure, compliant, and user-friendly trading environment, Binance is a premier platform for trading Notcoin, ensuring reliability and efficiency for its users.

Bybit

Bybit supports a variety of cryptocurrencies, with a strong emphasis on derivatives trading. For Notcoin (NOT), Bybit offers the trading pair NOT/USDT, which comprises over 11% of the total NOT trading volume. This pair’s high liquidity ensures efficient trading with minimal slippage. Bybit also offers perpetual futures for NOT, allowing traders to hold positions indefinitely with the potential for leveraged trading, enhancing trading strategies and opportunities.

Additionally, Bybit provides a demo account feature, allowing users to practice trading in a risk-free environment. This is particularly beneficial for those new to cryptocurrency trading or looking to test new strategies without financial risk.

Bybit’s competitive fee structure, round-the-clock customer support, and advanced trading tools make it an excellent platform for trading Notcoin. The platform’s commitment to security, regulatory adherence, and user experience positions it as a reliable and efficient choice for NOT traders.

Notcoin (NOT) long-term price prediction until 2035

Before we dive deep into the year-on-year price prediction levels, here is a quick table to help you identify key levels all the up to 2035.

| Year | Maximum price of NOT | Minimum price of NOT | Average price of NOT |

| 2024 | $0.0350 | $0.0200 | $0.0275 |

| 2025 | $0.0470 | $0.0266 | $0.0368 |

| 2026 | $0.0330 | $0.0259 | $0.0295 |

| 2027 | $0.0245 | $0.0180 | $0.0213 |

| 2028 | $0.0330 | $0.0255 | $0.0293 |

| 2029 | $0.0410 | $0.0333 | $0.0371 |

| 2030 | $0.04900 | $0.02616 | $0.03758 |

| 2031 | $0.05635 | $0.04126 | $0.04880 |

| 2032 | $0.06480 | $0.05303 | $0.05892 |

| 2033 | $0.07452 | $0.06378 | $0.06915 |

| 2034 | $0.08570 | $0.07474 | $0.08022 |

| 2035 | $0.09856 | $0.08665 | $0.09260 |

Read further to discover how these levels were reached.

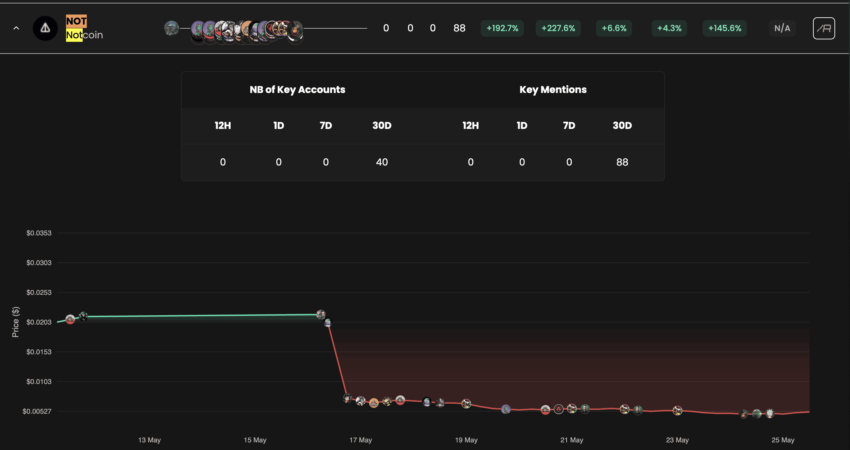

Notcoin (NOT) price prediction and technical analysis

Firstly, Notcoin is a relatively new project. Therefore, we do not have access to a huge amount of historical data. However, we have identified sufficient relevant data in order to analyze the price action of Notcoin (NOT) in the short- and long-term.

Short-term analysis

To analyze the price action of NOT, in the short-term, we can track the hourly chart. Despite the 300+% surge over the past two days, (as of June 4, 2024) the NOT chart looks relatively neutral. Yes, NOT is trading inside a pennant, waiting for a confirmed breakout in any given direction. However, the RSI has fallen under the 14-period moving average, hinting at weakening momentum.

For the next leg of price action to go higher, NOT’s hourly RSI will have to cross above the 70 mark. The price action will need to breach past the upper trendline. However, if the opposite happens and NOT breaches the lower trendline instead, we can expect the prices to take support at $0.0178. But then, the prices can even correct all the way up to $0.008, as there aren’t many strong support levels in play for this newly listed coin.

The NOT craze:

Long-term analysis and chart evaluation

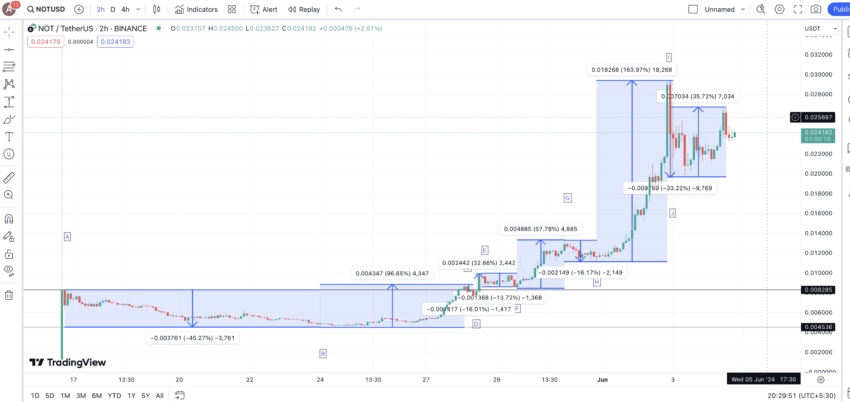

Even though there is no long-term data available for Notcoin, we can track the 2-hour chart and still notice the pattern of highs and lows. Barring the first candle, which can be attributed to listing gains and dumps, the first high can be taken at $0.0082. We can mark this point as A. From this point, NOT dropped all the way to B, followed by several higher high formations, all the way up to $0.029. After this level came the first lower high.

We can now track the price differences between all these points to chart the next leg of Notcoin’s price action.

Here is the table charting the values between the key levels:

| A to B | -45.27% |

| B to C | 96.65% |

| C to D | -16.01% |

| D to E | 32.66% |

| E to F | -13.72% |

| F to G | 57.78% |

| G to H | -16.17% |

| H to I | 163.97% |

| I to J | -33.22% |

| J to K | 35.72% |

Even though these price moves are identified in the very short term, they still give a reliable picture of NOT’s price action.

From the extracted data, we can calculate the average price hike and average price drop for NOT. These levels are 77.36% and 24.9%, respectively.

Notcoin (NOT) price prediction 2024

Outlook: Bullish

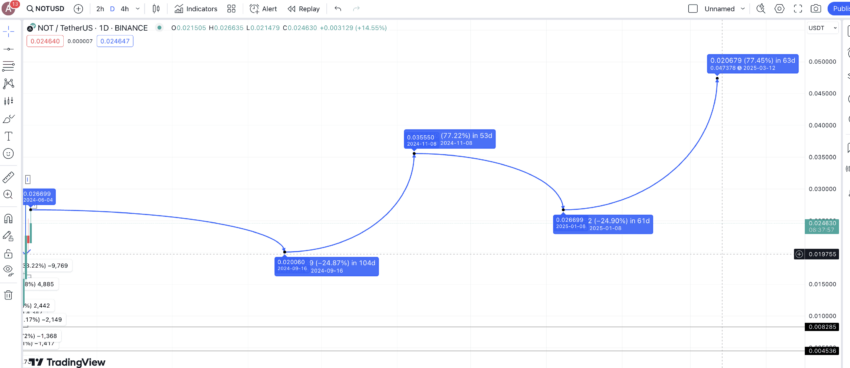

To calculate future movements, we can now switch to the daily chart of NOT.

Keeping the last high at K or $0.026, we can expect the next correction to surface at a 24.9% dip. This level means NOT should take support at $0.2. From this level, the next surge could be 77.36%, per our earlier calculations. This puts the 2024 price of NOT at $0.035.

Projected ROI from the current level: 41.70%

Notcoin (NOT) price prediction 2025

Outlook: Bullish

Provided NOT manages to reach $0.035 in 2024, regardless of the time, the next low, in 2025, could surface at $0.0266. In case the prices of NOT follows the same trajectory, the next surge or high could be at $0.047.

Projected ROI from the current level: 90.28%

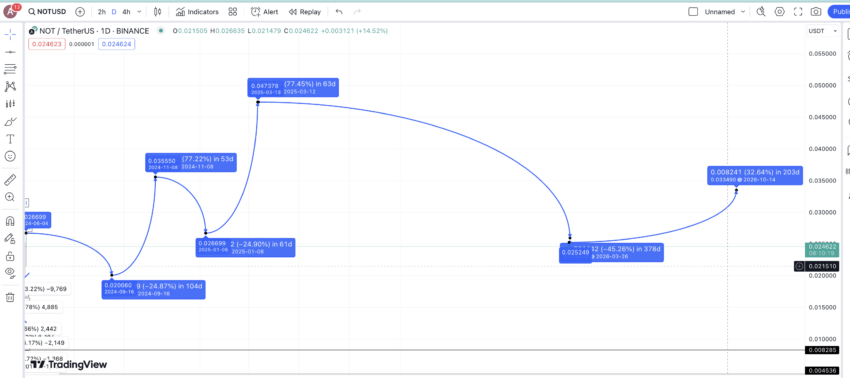

Notcoin (NOT) price prediction 2026

Outlook: Moderately bullish

By 2026, we can expect a more aggressive correction at NOT’s counter, led by the inflow of bears and the possible end of the bull run. The correction, therefore, could be -45.27%, the largest possible dip from the table above. This puts the possible price of NOT at $0.0259. The maximum price of NOT in 2026 could surge by 77.36% as the law of averages will kick in by then.

A more practical price rise percentage would be 32.66%, the lowest number from Table 2. That way, the maximum price of NOT in 2026 might surface at $0.033.

Projected ROI from the current level: 33.6%

Notcoin (NOT) price prediction 2027

Outlook: Neutral

Provided the bear market continues in 2027, the minimum price of NOT can go as low as $0.018. The maximum price can be expected to surface at $0.0245. Do note that by this time, NOT should be closer to completing its long correction cycle, like every other crypto asset.

Projected ROI from the current level: 0%

Notcoin (NOT) price prediction 2028

Outlook: Bullish

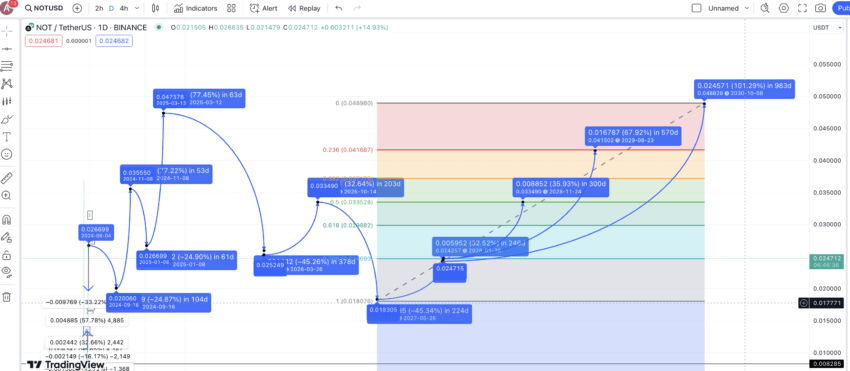

We can now use the Fibonacci retracement indicator to extrapolate the price of NOT all the way up to 2030. The 2027 low and high could act as swing levels. That way, the maximum price of NOT in 2028 can surface at $0.033.

Projected ROI from the current level: 33.60%

Notcoin (NOT) price prediction 2029

Outlook: Bullish

Using the same kind of extrapolation, we can expect the 2029 high for NOT to surface at $0.041. Do note that the actual price can differ.

Projected ROI from the current level: 66%

Notcoin (NOT) price prediction 2030

Outlook: Bullish

The extrapolated graph puts the maximum price of Notcoin (NOT) at $0.49 in 2030. If Notcoin makes decent strides in the crypto space, a half-a-dollar price point could be possible by 2030.

Projected ROI from the current level: 98.38%

How can Notcoin fundamentals influence the price action?

The price action, as shown by the technicals, looks aggressive. However, before we read further into these figures, here are some key fundamentals to keep in mind.

Tokenomics

- Maximum supply: 102,719,221,714 NOT tokens.

- Circulating supply: A significant portion is distributed through the initial game-based mining phase.

“What’s good about this token, if you guys have not yet seen, is 100% of the tokens are already in full circulation. This means you’re not going to get any token emissions, inflation, or token dilution, which effectively reduces the value and unit cost of a token.”

Jacob Bury: Creator of Jacob Crypto Bury: YouTube

- Distribution: The token distribution model is designed to be fair, with no venture capital allocations or unlocks, which enhances trust among retail investors.

- Conversion rate: In-game Notcoins are converted to NOT tokens at a rate of 1000:1 upon the token generation event (TGE).

Did you know? During the initial game-based mining phase, users earned in-game Notcoins, which were later converted to NOT tokens at a rate of 1000 in-game Notcoins to 1 NOT token.

Use cases

Notcoin serves as the native currency within its ecosystem, rewarding users for various activities such as playing games, participating in web3 projects, and contributing to the community. This model aligns well with the decentralized ethos, making it attractive to a broad base of investors.

Community and adoption

- Holder base: Notcoin boasts 1.3 million holders, surpassing many other popular cryptocurrencies, reflecting a strong and engaged community.

- Social sentiment: Positive social sentiment and active engagement on platforms like Twitter have significantly boosted Notcoin’s visibility and credibility.

Platform and ecosystem

- Blockchain: Notcoin operates on the TON blockchain, benefiting from its high scalability, security, and efficiency. The integration within the TON ecosystem supports a vast array of transactions and applications.

- Exchange listings: Listed on major exchanges such as Binance, KuCoin, Bybit, and others, enhancing its accessibility and liquidity. Once the market cap increases, these listings can have a significant impact on the prices.

While these are the fundamental elements and the primary reasons for NOT’s sudden price surge, here are some extrapolations of the said aspect that can aid the aggressive price movements in days to come (as of June 5, 2024).

- Limited supply: A finite maximum supply creates scarcity, which can drive demand and price increases.

- Fair distribution: No venture capital allocations, preventing large-scale sell-offs and fostering trust among retail investors.

- Airdrop events: Successful airdrops can increase holder base and market interest, leading to price surges.

Unique selling propositions (USPs)

- Viral engagement model: Originated from a popular Telegram game, attracting millions of users.

- Community-Driven: Strong community support with over 1.3 million holders.

- Integration with TON ecosystem: Benefits from the high scalability and efficiency of the TON blockchain.

- Innovative mining mechanic: Tap-to-earn model engaging users in web3 projects.

Does Notcoin have a future?

Based on this detailed Notcoin price prediction, the gaming project does look poised for significant success. However, for prices to continue to hit new all-time highs throughout the bull cycle and beyond, the TON ecosystem needs to keep growing. Notably, as a game-based cryptocurrency, Notcoin’s unique engagement model provides resilience against broader market downturns, which could ensure continued user activity and interest.

Frequently asked questions

What factors have influenced Notcoin’s price surge?

How does the airdrop structure of Notcoin work?

What is the connection between Notcoin and the TON blockchain?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.