If you are looking for cryptos with a lot of potential in 2025, Kaspa may be of interest. This guide covers how to buy Kaspa and everything else you need to know, from staking to DApps and the best wallets for storing KAS.

KEY TAKEAWAYS

➤ Kaspa (KAS) is a proof-of-work blockchain utilizing a unique “blockDAG” structure for high scalability and efficiency.

➤ Kaspa can be purchased on multiple centralized exchanges, with KuCoin, Bitget, Bybit, MEXC, and Gate.io being top choices.

➤ Unlike traditional staking, Kaspa does not support native staking due to its PoW mechanism, but users can mine KAS.

➤ While Kaspa offers low transaction fees and a strong community, its long-term investment potential depends on factors like increased adoption.

How to buy Kaspa (KAS)?

To buy Kaspa (KAS), simply do the following:

- Sign up for an account on an exchange.

- Complete KYC.

- Buy KAS.

If you’re keen to buy KAS, look no further. This section demonstrates how to purchase the Kaspa crypto using KuCoin. Note that the steps are similar for most centralized exchanges.

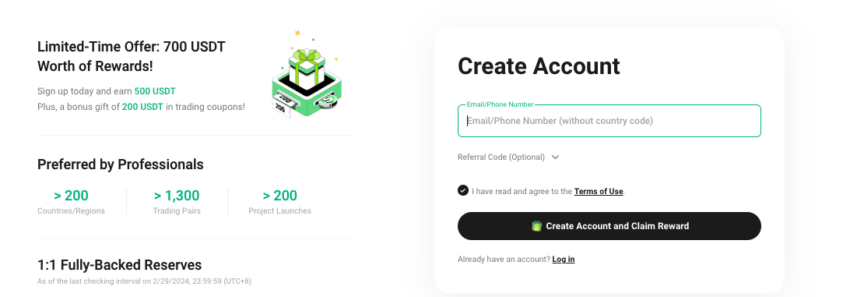

1. Account sign-up: Sign up for an account on KuCoin by providing your email address or phone number and setting a secure password.

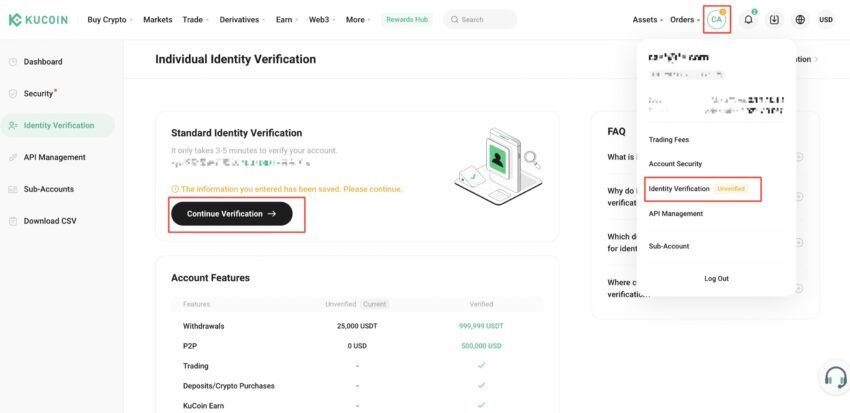

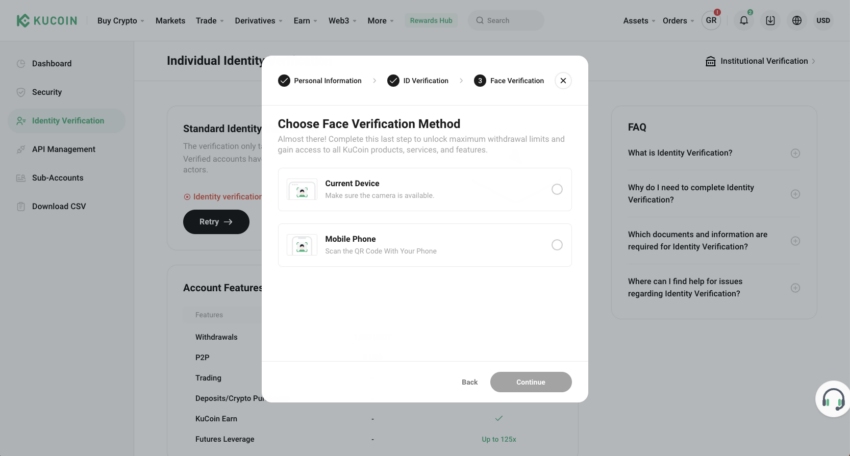

2. Complete KYC: Undergo the Know Your Customer (KYC) verification by submitting necessary ID documents, including personal details, ID photos, and face verification. By completing the KYC, you unlock additional benefits. Ensure all your information is accurate to avoid issues with your review. You’ll be notified of the outcome of the review via email.

3. Finalize facial verification: After uploading your photo, click “Continue” to start facial verification. Choose your device, then follow the prompts to finish the process. The system will then submit your information for review automatically.

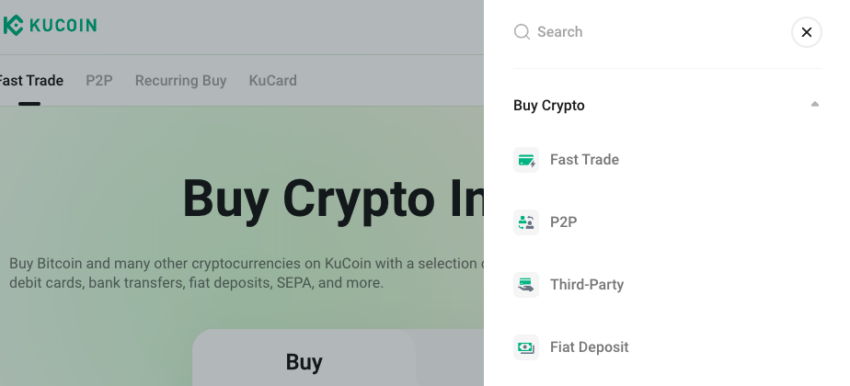

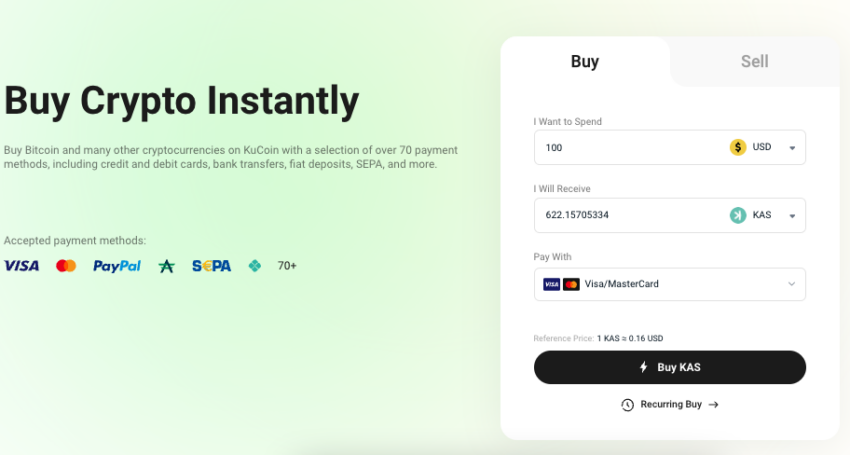

4. Navigate to fast trade: Go to the “Buy Crypto” section and select the “Fast Trade” option for a swift buying process. Choose the fiat currency you wish to use to buy KAS from the available options.

5. Choose KAS and enter the amount: In the search bar or the list of cryptocurrencies, find and select KAS as the cryptocurrency you want to purchase. Put the amount of fiat currency you wish to spend or the KAS you want to buy. The system will automatically calculate the equivalent amount.

6. Select payment method and review details: Pick your preferred payment method from the options provided (e.g., credit card, bank transfer). Double-check the transaction details, including the total cost and the amount of KAS you’re buying.

7. Confirm purchase: Agree to the terms and click the button to confirm your purchase. Once the transaction is complete, visit the “Assets” section to verify that the KAS has been added to your wallet. Do note that the Fast Trade option is designed for quick and straightforward transactions, ideal for users looking for an efficient way to buy Kaspa on KuCoin.

How to sell Kaspa (KAS)?

Yo sell Kaspa (KAS), do the following:

- Login in to your exchange account.

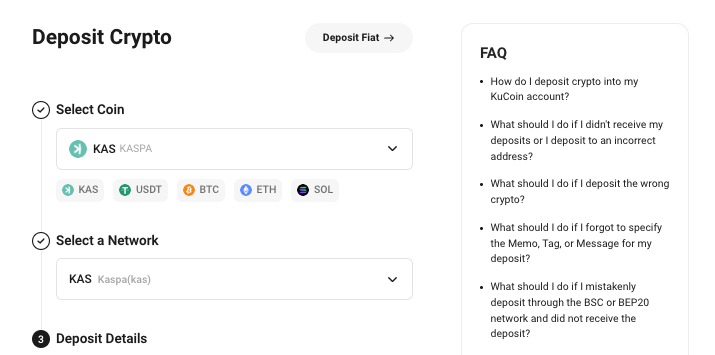

- Deposit KAS.

- Sell KAS.

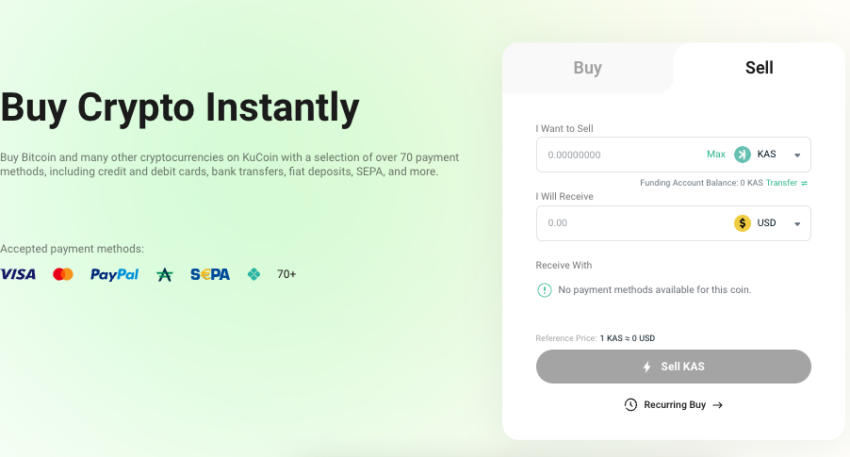

Selling KAS (Kaspa) on KuCoin using the Fast Trade option is fairly easy. Here are the key steps:

1. Log in to your KuCoin account: Open the KuCoin website or mobile app and log in with your credentials. If you do not have an account, you must register and complete the necessary KYC (Know Your Customer) verification (see above example).

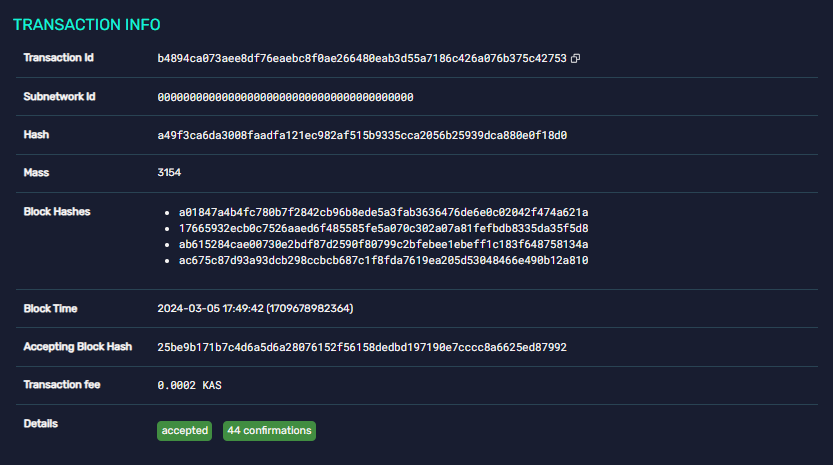

2. Deposit KAS: Navigate to the “Assets” section and select “Deposit.” Choose KAS (Kaspa) from the list of available cryptocurrencies. You will be provided with a deposit address. Transfer KAS from your external wallet or another crypto exchange to this address.

3. Go to Fast Trade: On the KuCoin homepage, click “Fast Trade.” This feature allows users to execute trades quickly without navigating the traditional exchange interface.

4. Select KAS and the pair: Within the Fast Trade section, select KAS as the cryptocurrency you wish to sell. Then, choose the pair you want to trade with (e.g., KAS/USDT, KAS/BTC) based on the currency you wish to receive in exchange for your KAS.

5. Enter sell details: Enter the amount of KAS you wish to sell. The Fast Trade option typically provides a pre-calculated conversion based on the current market rate, showing you how much of the selected currency you will receive. Take a moment to review the conversion rate and the amount of cryptocurrency you will receive. This step is crucial to ensure you agree with the trade’s terms.

6. Confirm the sale: Finally, if you are satisfied with the trade details, confirm the sale. The Fast Trade feature will automatically match your sell order with a buy order at the best available rate.

Top 5 platforms to buy Kaspa (KAS)

If you’re looking to buy Kaspa, you need first to choose a crypto exchange. The good news it that a number of leading centralized and decentralized platforms support KAS. Here are five of the best options on the market in 2025.

1. KuCoin

KuCoin is a global cryptocurrency exchange founded in September 2017, based in Seychelles. It offers a variety of features, including spot and futures trading, margin trading, staking, and a lending platform. The exchange is known for its user-friendly interface, a wide range of supported cryptocurrencies, and its own native token, KCS (KuCoin Shares).

2. Bitget

Bitget is a cryptocurrency exchange founded in 2018, based in Singapore. It offers various features, including spot trading, futures trading, copy trading, and a staking service. The platform is known for its comprehensive security measures, user-friendly interface, and a wide selection of trading pairs.

3. Bybit

Bybit is a global cryptocurrency exchange based in Dubai. Ben Zhou, a forex trader, started Bybit in 2018. The platform can handle up to 100,000 transactions per second. It offers a variety of tools, including spot trading, derivatives trading, trading bots, Earn goods, and more.

4. MEXC

MEXC, established in 2018 and headquartered in Singapore, is a leading global cryptocurrency exchange known for its wide range of trading options, including spot and derivatives trading. It stands out in the crypto space for its user-centric features such as copy trading, enabling users to replicate the trading strategies of seasoned traders with just one click. Moreover, MEXC’s extensive futures trading offerings, commitment to user security, and an intuitive interface have made it a favorite among cryptocurrency traders worldwide.

5. Gate.io

Gate.io is a cryptocurrency exchange platform offering a range of trading services for a variety of digital assets. It is based in the Cayman Islands. Some of its features include spot trading, margin trading, futures trading, staking services, and a wallet service. The platform is known for its wide selection of cryptocurrencies and security measures to protect users’ assets.

Exchanges to buy Kaspa compared

| Exchanges | Supported countries | Fees | Payment methods | Bonus |

|---|---|---|---|---|

| Kucoin | 200+ | 0.1% | Crypto and third-party payment processors | Up to 700 USDT |

| Bitget | 190+ | 0.1% | Crypto and third-party payment processors | 1000 USDT of spot trading coupons |

| Bybit | 100+ | 0.75% | Bank, third-party processors, and crypto | Up to $30,000 |

| MEXC | 170+ | 0% (maker)/ 0.2% (taker) | Crypto and third-party payment processors | Up to 1000 USDT and 10% off trading fees |

| Gate.io | 100+ | 0.2% | Crypto and third-party payment processors | $100 bonus |

Based on the criteria, KuCoin, Gate, Bybit, Bitget, and MEXC were selected as the best platforms to buy KAS due to their strong emphasis on security, usability, liquidity, positive community feedback, reputable partnerships, and promising future prospects. To learn more about BeInCrypto’s verification methodology, click here.

What is Kaspa (KAS)?

Kaspa is a high-performance, high-throughput blockchain that was created in 2021. It is the product of DAGLabs, a research and development company.

DAGLAbs was founded in 2017 as a fintech startup. It focused its research on DAG-based (directed acyclic graphs) protocols to scale blockchains. The research company would eventually cease its operations. However, the Kaspa project continued, leaving most of its marketing and development to its loyal community.

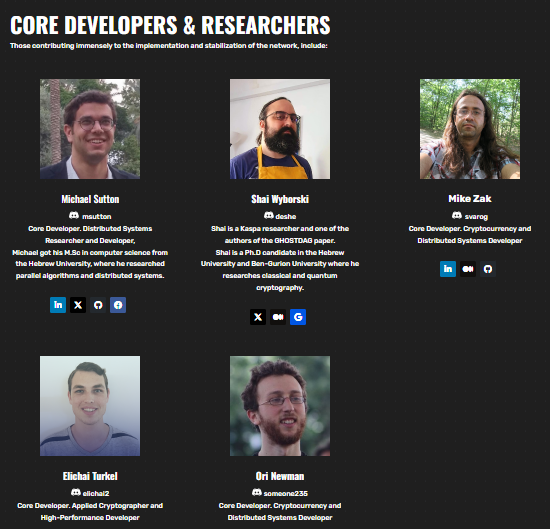

Yonatan Sompolinsky founded DAGLabs and Kaspa with a group of developers. He also invented the GHOSTDAG protocol (Kaspa’s consensus mechanism) with his former Ph.D. adviser, Aviv Zohar.

Sompolinsky holds a doctorate and researches protocol transaction ordering and MEV. Along with Yonatan, Michael Sutton, Shai Wyborski, Mike Zak, Elichai Turkel, and Ori Newman also helped develop Kaspa.

How does Kaspa (KAS) work?

Kaspa is a proof-of-work (PoW) blockchain. Many cryptocurrency projects have used a blockchain or a DAG to update its database — not Kaspa. Kaspa uses its proprietary “blockdag.” In other words, it uses a hybrid form of a blockchain and a DAG.

At the heart of the blockdag is the PHANTOM protocol, the real-world implementation of GHOSTDAG. In traditional blockchain systems, blocks of transactions are added sequentially, creating potential scalability and speed limitations. DAG-based systems, like Kaspa, instead use a graph structure where multiple chains of transactions can coexist and converge.

Here’s how PHANTOM works:

- Directed acyclic graph (DAG): PHANTOM uses a DAG structure, unlike traditional blockchains. In this graph, each “vertex” represents a transaction, and each edge represents a dependency (i.e., one transaction must precede another). This allows the protocol to process transactions in parallel for a higher throughput.

- Ordering of transactions: The PHANTOM protocol provides a way to order transactions that have been concurrently added to the DAG. It does this through a mechanism that categorizes transactions into two types: those that are part of the main chain (the ‘backbone’ of the graph, determined based on the cumulative weight of their approving transactions) and those that are not. The main chain is determined using a greedy algorithm that selects the heaviest (most approved) sub-DAG.

- Consensus and security: The PHANTOM protocol ensures that despite the parallel nature of DAG, the network can reach a consensus on the order of transactions. It uses sophisticated algorithms to prevent attackers from influencing the order of transactions or double-spending. PHANTOM also introduces a parameter called the “k-parameter,” to balance between security and speed. It represents the level of tolerance the network has for forks (diverging paths in the DAG).

Why is Kaspa (KAS) popular?

Kaspa is popular partly because the Ethereum whitepaper mentions the GHOST consensus mechanism. LMD-GHOST is the fork-choice rule for Ethereum (later combined with Casper to create Gasper for Ethereum 2.0) and was based on the GHOST consensus mechanism, specifically the greediest chain rule.

GHOST (Greedy Heaviest Observed Subtree) is the precursor to GHOSTDAG. Both were co-authored by Yonatan Sompolinsky and Aviv Zohar.

As described by Sompolinsky and Zohar, GHOST solves the first issue of network security loss by including stale blocks in the calculation of which chain is the “longest”; that is to say, not just the parent and further ancestors of a block, but also the stale descendants of the block’s ancestor (in Ethereum jargon, “uncles”)

Vitalik Buterin, Ethereum whitepaper

In addition to its revolutionary consensus mechanism, Kaspa is also a popular choice for users who value low fees. Fees on Kaspa are a fraction of a KAS, the native coin. This amounts to fractions of a cent.

Kaspa vs. other cryptocurrencies

Numerous cryptocurrencies promise higher transaction throughput, faster finality, and so on. But do they actually deliver? Let’s take a look at how both Kaspa and Bitcoin stack up.

Kaspa vs Bitcoin: The ultimate comparison

Despite their different designs, Kaspa and Bitcoin can be compared across several parameters. For this comparison, we will specifically focus on security assumptions and tokenomics.

| Kaspa | Bitcoin | |

|---|---|---|

| Fees | Fractions of a cent | $1-$30 |

| Block speed | 1 block per sec. | 1 every 10 min. |

| Cost to attack for one hour | $61,153 | $7.6 billion |

| Max supply | 28.7 billion KAS | 21 million BTC |

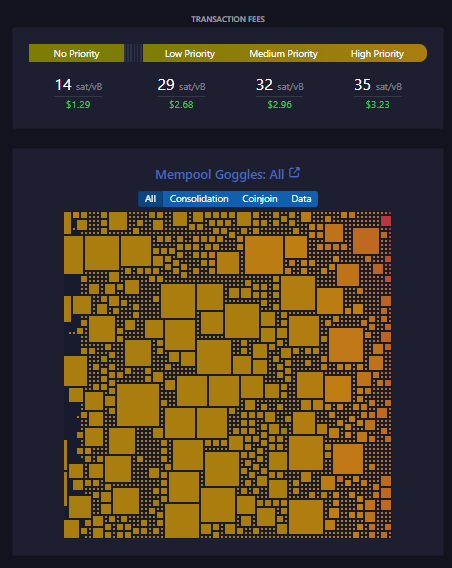

Fees

Firstly, fees are a large concern for users. As mentioned earlier, Kaspa fees are a fraction of a cent. On the other hand, Bitcoin fees tend to fluctuate based on network activity. They can be as low as a couple of dollars or as high as $20 to $30.

It is particularly important to note that the highest Bitcoin fee ever paid is currently over $3 million. This is astonishing in comparison to Kaspa. Note that fees are also an important metric for network security.

To put it simply, transaction fees are the cost to attack the network (at least one of the costs). Cryptocurrency networks with high fees pay a security stipend to their operators (stakers or miners) to protect the network. On the other hand, networks with low fees offer significantly less security (in some aspects).

In terms of the block rewards, Kaspa comes in at 123.47 KAS per block, as per Kaspa documentation. The network produces one block per second. In contrast, Bitcoin produces one block every ten minutes and has a coinbase of 6.25 Bitcoin per block. In other words, mining Bitcoin is significantly more profitable.

Security

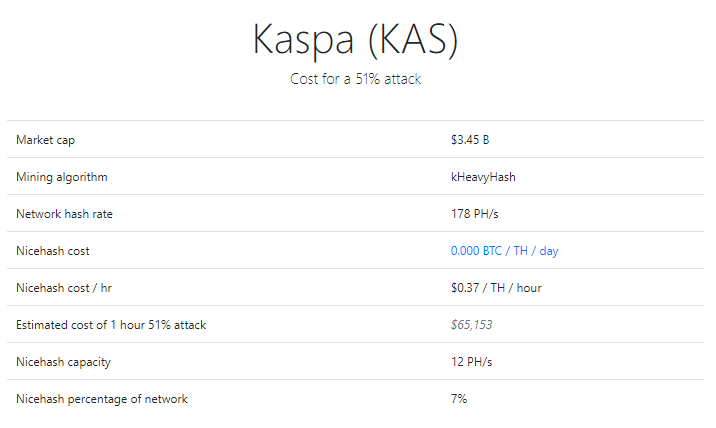

Security is defined in many ways. Here, we will define it as the total cost of a 51% attack. Remember that determining the cost of an attack is quite the Herculean feat and does not always bode well for the future. In this case, we used two different sources to determine the theoretical cost of an attack.

In our analysis, the Bitcoin attack cost calculation focuses on direct operational costs, primarily electricity, based on ownership or access to mining hardware. According to the paper “Breaking BFT: Quantifying the Cost to Attack Bitcoin and Ethereum,” the cost to attack (TCA) Bitcoin for one hour is about $7.6 billion.

In contrast, the Kaspa attack cost estimate relies on the market price for renting hashing power. This is a method that could be more accessible but is dependent on third-party services and does not consider the total hardware capability or additional operational costs.

According to this metric, the cost to attack Kaspa for one hour is significantly lower than Bitcoin, coming in at about $61,153. On the other hand, when you use the metric for renting hash power to calculate Bitcoin’s cost to attack, it comes in at about $2.8 million, according to the Crypto51 website.

It is important to note that both methods and costs to attack are theoretical. Additionally, neither methodology explicitly considers the block rewards that the attacker might receive, which could significantly offset the cost of the attack.

Market analysis

Kaspa has a maximum supply of 28.7 billion KAS, while Bitcoin has a maximum supply of 21 million BTC. Bitcoin dominates the crypto market, making up about 50% of its market capitalization alone. Kaspa, on the other hand, has a negligible dominance of the cryptocurrency market.

Similar to Bitcoin, Kaspa also has a halving event, but it occurs every year instead of every four years. Unlike Bitcoin, Kaspa also constantly halves throughout the year until it reaches its target.

Kaspa (KAS) wallets

If you’re looking to buy Kaspa, you will need somewhere to store it. In terms of wallet selection, KAS holders have a number of options to choose from. For a more extensive list of Kaspa wallets, check out our guide to the best Kaspa wallets in 2025. In the meantime, here is a brief list of the hot and cold wallets that support KAS:

Mobile wallets

- Kaspium: This wallet provides an easy-to-use interface for KAS coin management on both Android and iOS platforms. As a non-custodial wallet, it ensures users retain full control over their coins and private keys.

- Chainge Wallet: Serving as a multifunctional non-custodial wallet and DeFi application, Chainge Wallet facilitates sending, receiving, storing, and handling of KAS coins alongside offering a range of DeFi services.

Desktop/Web wallets:

- Kaspa Web Wallet: Utilizing Progressive Web App (PWA) technology, this wallet is recognized for its user-friendly interface and heightened security, making it a leading choice among web-based wallets for Kaspa.

- KDX: A desktop wallet that streamlines the setup and configuration of Kaspa’s full-node software and wallet, designed to simplify user experience on desktop systems.

Hardware wallets:

- OneKey: Known for its commitment to open-source software, OneKey offers a diverse range of products, including hardware and cold storage solutions, alongside various applications for browsers, mobile devices, and desktops. Its hardware wallets support multiple third-party applications.

- Tangem Wallet: Designed to withstand harsh conditions, Tangem’s card-sized hardware wallets offer durability against dust, water, and extreme temperatures, complemented by an open-source mobile application for operation.

Kaspa (KAS) DApps

While Kaspa does not support smart contracts, developers are working on a solution to institute smart contract functionality. While there has yet to be a definitive solution, multiple approaches have been suggested. The two most prominent options are using Ethereum and layer-2 solutions.

Kaspa (KAS) staking

As stated previously, Kaspa is a proof-of-work network. Therefore, you can not stake Kaspa natively on the blockchain. There may be crypto exchanges that allow you to deposit and earn a yield on your KAS, but this is technically not considered staking. More than likely, you are lending your crypto to the platform in such cases.

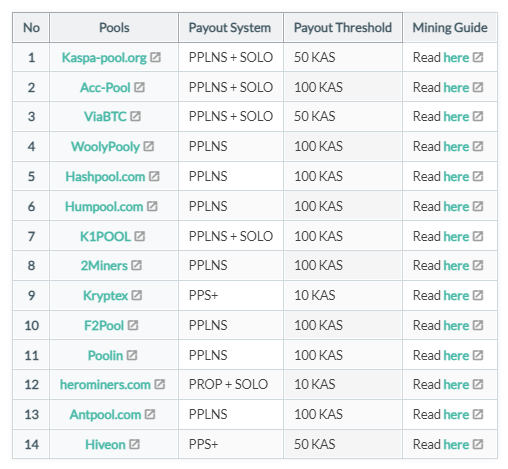

Contrarily, you can mine KAS. Kaspa mining has evolved significantly from its early days. Initially, enthusiasts could mine the currency using basic GPUs, CPUs, or even smartphones. However, this situation has shifted dramatically due to the dominance of ASICs. ASIC miners now command the majority of the network’s mining power.

While mining Kaspa using GPUs or CPUs remains technically feasible, such practices are economically impractical. Users have the option to choose between solo mining or pool mining.

Typically, solo mining may offer higher rewards since sharing profits with a pool is unnecessary. However, pools might reduce the variance in mining rewards. Using a Kaspa mining calculator, miners can evaluate the expected daily earnings and the frequency of block discovery when opting for solo mining.

Should you buy Kaspa?

Kaspa takes an impressive approach to the blockchain trilemma. But should you invest? The reality is Kaspa is simply a payment ledger at the moment. This means that it has to compete with other blockchains like Bitcoin, Ethereum, or Hedera Hasgraph that have either:

- Captured a network effect

- Offer more features

- Can offer faster transaction throughput in addition to having more features

This may affect Kaspa negatively when individuals decide which cryptos to purchase based on performance and functionality.

The Kaspa network will also need to increase its usage. The downside of low transaction fees is that mining is difficult to make a profit. If the network can increase its usage, miners can accrue more fees in KAS.

Nonetheless, there may be a light at the end of the tunnel. Kaspa compensates for the lack of fees by offering significantly less competition in terms of mining compared to networks like Bitcoin. Moreover, any user can start mining KAS with the relevant equipment, giving it a certain level of decentralization.

Is Kaspa (KAS) a good investment for you?

For starters, KAS has a low (and thus accessible) price. This means that investors can scoop up a considerable amount before the price rises (although price rises are not guaranteed).

Additionally, KAS has made higher highs since its inception. On Feb. 20, 2024, it reached its all-time high at $0.18. Moreover, the Kaspa community is strong and self-funded. Many developments are being made to improve the coin.

All of the aforementioned points could signal a bullish trend in the upcoming months. Taking this into account, some other factors at play are not necessarily Kaspa-specific. Note that this article does not constitute formal investment advice. Always DYOR, and never invest more than you can afford to lose. Crypto is volatile, and profits are never guaranteed.

Stay safe and HODL

All in all, if you want to buy Kaspa, the process is straightforward. Whether Kaspa is worth buying constitutes an entirely different question. As always, you should conduct thorough research and make investment decisions based on your financial situation. Beyond this, stay safe and HODL.

Frequently asked questions

The easiest way to buy Kaspa is to go to an exchange like KuCoin. You will have to create an account and KYC. After this you will be able to buy KAS. This process is similar on most exchanges.

To buy Kaspa in the U.S., you will need to find an exchange that offers KAS. You will need to KYC and provide legal documents to use most exchanges’ services. After this, simply link a payment method and purchase KAS.

There are many exchanges that sell Kaspa (KAS). Some of these include KuCoin, MEXC, Bybit, and many others. Many of these exchanges service users globally and accept a variety of payment methods.

Kaspa has a lot of potential as a good investment. It is a community managed project that has continued to development throughout the years. It is also significantly cheaper than the dominant cryptocurrencies.

The Kaspa community has consistently maintained the protocol. Following recent upgrades, Kaspa is primed to have smart contract functionality in the future. Due to this, the Kaspa community has a planned future for the protocol.

Kaspa has consistently made higher highs since its inception. Taking this, Kaspa could potentially reach over $0.20 by 2025 according to our experts. However, market is difficult to time. Therefore, investors should exercise caution.

Kaspa is a decentralized proof-of-work cryptocurrency. There is not a single individual that controls the network. DAGLabs was the former research and development company that maintained the protocol. However, the company has since ended operations and the Kaspa community currently maintains the protocol.

There could be a multitude of reasons why Kaspa is not on Binance. Exchanges need a significant amount of volume to justify offering a cryptocurrency. This is because exchanges make profit based on the fees from trades.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.