The ability to borrow against your crypto holdings has become a game-changer for investors and enthusiasts. Whether you want to leverage your digital assets for financial opportunities or need quick access to funds without selling your crypto, the right platform can make all the difference. In this guide, we explore the best platforms to borrow against crypto, offering a glimpse into the sector of crypto loans, their benefits, and where you can find the most reliable options to meet your financial needs.

- How do crypto loans work?

- What are the best platforms to borrow against crypto?

- 1. Figure Markets

- 2. Wirex

- 3. Coinbase

- 4. YouHodler

- 5. Nexo

- 6. Binance

- 7. Bake

- Can I get a loan with crypto?

- Benefits of getting a crypto loan

- Can I borrow crypto without collateral?

- What is the best platform to borrow against crypto?

- Frequently asked questions

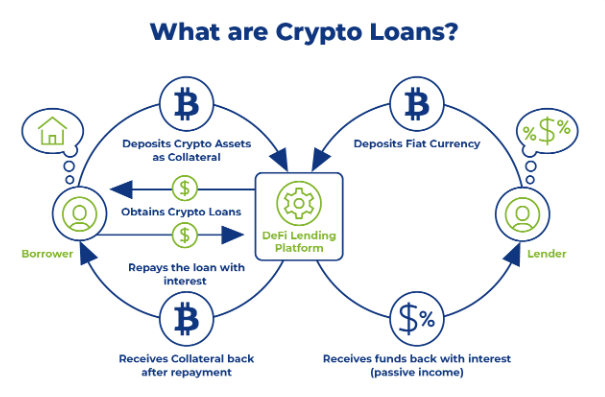

How do crypto loans work?

Crypto loans fall into two main categories: custodial (CeFi) and non-custodial (DeFi). Custodial loans involve a central entity holding your collateral and controlling your assets’ private keys, limiting your access. In contrast, DeFi loans use smart contracts to enforce terms, letting you keep control unless you default. Decentralized loans are transparent but often have higher interest rates.

Unlike traditional loans, crypto loans don’t require credit checks. Collateral, usually cryptocurrency, secures the loan, and the platform automatically enforces loan terms. Over-collateralization is common to protect lenders and reduce market volatility risk.

There are also crypto loans without collateral. These are the flash loans, which involve borrowing and repaying tokens within seconds for specific transactions. Be cautious and research carefully, as this space is still evolving and can attract scammers. If an offer seems too good to be true, it probably is.

What are the best platforms to borrow against crypto?

1. Figure Markets

Figure Markets is a distributed custody exchange with zero-fee trading regulated yield products, and transparent borrowing. The company was founded by June Ou and Mike Cagney, co-founder of SoFi, one of the largest fintech loan companies in the U.S.

Figure markets allows you to borrow cash with BTC and ETH as collateral without a credit score and with transparent terms. Additionally, you can borrow, earn, and trade, all from within the same account.

- Borrow without selling ETH and BTC.

- Instant liquidity

- No repayment penalties or rehypothecation.

- Borrow up to 75% LTV (up to 90% for some).

- Only available for BTC and ETH.

- Geographic restrictions may apply.

• Regulatory risk

• Volatility

• Liquidation risk

2. Wirex

Wirex Credit empowers you to access credit without the need to sell your cherished crypto assets. You can borrow stablecoins by pledging your BTC or ETH. And you have the flexibility to repay the loan on your terms, with interest only accruing on active days.

Wirex also offers a convenient in-app loan health checker that lets you monitor your loan’s status in real-time. Easily assess your loan-to-value (LTV) ratio and receive immediate notifications of any changes, providing you with complete transparency and control over your finances.

- Interest starting at 0%

- Instant approvals

- Digital assets hold in cold storage

- Real-life stablecoin spending

- High fees for exchanging between crypto and fiat

- Need to complete KYC to access account

• Liquidation

• Counterparty risk

• Regulatory risk

• Volatility

3. Coinbase

Coinbase offers a unique opportunity to borrow cash against your Bitcoin without selling it, thus avoiding potential taxable events. With an LTV ratio of up to 40% and a loan limit of $1,000,000, Coinbase is a valuable tool for those needing urgent cash without liquidating their crypto assets. The platform ensures a straightforward process with no hidden fees or credit checks.

The service offers a seamless process for accessing borrowed funds, with options to have cash instantly deposited to PayPal or transferred via ACH to your bank account. It also provides a flexible repayment plan, allowing you to manage your finances effectively without pressure.

- High APR

- No need to sell Bitcoin, preventing taxable gains or losses

- No additional fees or credit checks

- Instantly deposit borrowed cash to PayPal or bank account

- Flexible repayment schedule tailored to borrower's convenience

- High borrowing limit up to $1,000,000

- Limited to Bitcoin as collateral

4. YouHodler

YouHodler is a custodial crypto lending platform that offers fast crypto borrowing. With a selection of over 50 cryptocurrencies to use as collateral, borrowers can access loans worth up to 90% of their collateral’s value. Note that the exact LTV and loan asset offered depends on the provided collateral. Depositing bitcoin as collateral offers a 97% collateral.

- Advanced trading tools

- Good customer service

- Fast borrowing process

- Unavailable in the U.S.

- High APRs on loans

• Volatility

• Counterparty risk

• Regulation risk

• Smart contract risk

5. Nexo

Choose Nexo to borrow against your crypto if you want simplicity and accessibility. No applications or credit checks; you qualify based on your deposited assets. You can borrow as little as $50 for stablecoin loans or $500 for fiat loans, with daily limits of up to $2 million. Interest rates vary from 0% for Platinum users with low Loan-to-Value (LTV) ratios to 15.9% for base users with higher LTVs.

Nexo also provides flexibility with no prepayment fees, although repaying within 30 days may result in a higher interest rate. Your borrowing capacity depends on collateral assets, and you can easily monitor your available credit on your dashboard.

- Instant access to Nexo Borrow

- Nexo Pro for precision trading with low fees

- Free withdrawals (limited by loyalty level)

- NEXO token requirement to qualify for loyalty levels

- Several key products not available in major markets such as the U.S.

- Minimum withdrawal limits (0.001 BTC, 0.01 ETH)

• Volatility

• Regulatory uncertainty

• Technical vulnerabilities

6. Binance

Binance is flexible and allows you to choose from various loan terms (seven, 14, 30, 90, and 180 days) with interest calculated hourly. You can repay your loan early without penalty fees and utilize borrowed funds across the Binance ecosystem or withdraw them for external use

Additionally, Binance offers the option to stake collateral, generate crypto rewards, and reduce loan interest fees. It’s a convenient and versatile platform for borrowing crypto funds.

- Access loans instantly

- Borrowers get lower interest rates with a crypto-secured loan.

- Lower LTV than other loan platforms

- 2% late repayment fee

• High risk of liquidation depending on your collateral

• Smart contract risk

7. Bake

Bake is an attractive platform for borrowing crypto. You can borrow DUSD, a stablecoin, and use various cryptocurrencies (BTC, ETH, DFI, USDT, or USDC) as collateral, with over-collateralization ensuring the safety of your loan. There are no strict loan terms, allowing flexibility in loan duration, and the fees, including a 5% APR interest rate and a 0.5% origination fee, are competitive. Importantly, Bake provides a mechanism to prevent liquidation, allowing borrowers to top up their collateral if needed.

- Customer deposits are kept separate

- Loans are flexible

- Interest is paid when you close the loan

- 0.25% deposit fee

- Only one asset available to borrow

- Lower LTV than other platforms

• Liquidity risk

• Volatility

• APR may vary based on loan amount and collateral

• Specific collateral options may have varying risks

Can I get a loan with crypto?

Yes, you can get a loan with crypto. Some platforms allow you to use your cryptocurrency as collateral to borrow money or stablecoins. This means you don’t have to sell your crypto and can get funds while keeping your digital assets.

Remember, it usually involves certain terms and conditions, like repaying the loan with interest and maintaining enough collateral to cover it. So, while it’s possible, make sure you understand how it works before getting a crypto loan.

Here is how to get a crypto loan:

- Choose a crypto lending platform and create an account by completing the KYC process

- Deposit collateral (Transfer your chosen cryptocurrency assets to the lending platform as collateral)

- Apply for a loan (Select the loan amount and terms you want)

- Receive funds (crypto or fiat)

- Use the funds (trading, investment, or other financial needs)

- Monitor collateral to ensure it remains above the required level to avoid liquidation

- Repay the loan and interest, and your collateral will be returned to you

Benefits of getting a crypto loan

Taking out a loan with crypto offers several unique benefits that traditional loans may not provide. Here are the advantages of opting for a crypto loan:

- No credit check: Lenders typically do not require a credit check since you secure the loan with your crypto assets.

- Quick approval: You can often get approval and process the loan faster than traditional loans.

- Retain ownership: Using your crypto as collateral allows you to retain ownership and benefit from potential appreciation.

- Flexible terms: Many crypto lenders offer flexible repayment terms and interest rates to fit your financial needs.

- Access to liquidity: A crypto loan provides liquidity without forcing you to sell your assets, enabling you to leverage your holdings for other investments or expenses.

Understanding how to take out a loan with crypto helps you maximize these benefits while maintaining control over your digital assets.

Can I borrow crypto without collateral?

Yes, you can borrow crypto without collateral, but it depends on the lending platform. Some platforms offer unsecured spot crypto loans where you don’t need to provide collateral, but they might have stricter eligibility criteria or higher interest rates than collateralized loans.

Flash loans are a type of uncollateralized loan that is available only on decentralized apps (DApps). Look for platforms with the best DeFi rates.

Unlike traditional loans, where you need to provide collateral, flash loans allow you to borrow a cryptocurrency instantly without putting up any collateral. You must repay the loan with flash loans in the same transaction you borrowed. It doesn’t go through if you can’t repay the loan within that transaction. This means you need to have a specific plan in place to use the borrowed funds for a profitable purpose, like arbitrage or other trading strategies, to repay the loan quickly.

Flash loans are a way for experienced cryptocurrency users to access significant amounts of capital for a very short period. They can be a powerful tool for financial strategies in the crypto sector. However, they come with high risk and require a good understanding of the markets and how they work.

What is the best platform to borrow against crypto?

Various factors, including loan terms, interest rates, and collateral requirements, must be evaluated when considering the best platforms for borrowing against crypto. Some platforms offer the convenience of crypto loans without collateral, making them accessible to a broader audience.

Additionally, factors like loan disbursement speed, lender reputation, and fees are crucial in choosing the right platform for your crypto borrowing needs. Ultimately, selecting a platform that aligns with your financial goals and risk tolerance is key to a successful borrowing experience in the crypto space.

Frequently asked questions

Are unsecured crypto loans safe?

How do crypto loans work?

How to get a free bitcoin loan without collateral?

Can I get a crypto loan without collateral on Binance?

Can I get a loan on my cryptocurrency?

How to get a flash loan?

When should I get a crypto loan?

What are the benefits of a crypto loan?

Can I get a crypto loan without collateral on Coinbase?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.