The Chainlink (LINK) price has increased since August 17, breaking out from a descending resistance trendline in the process.

During this time, it reclaimed the $7.15 horizontal resistance area. Will LINK be able to reclaim $8 next?

Chainlink Confirms Horizontal Support

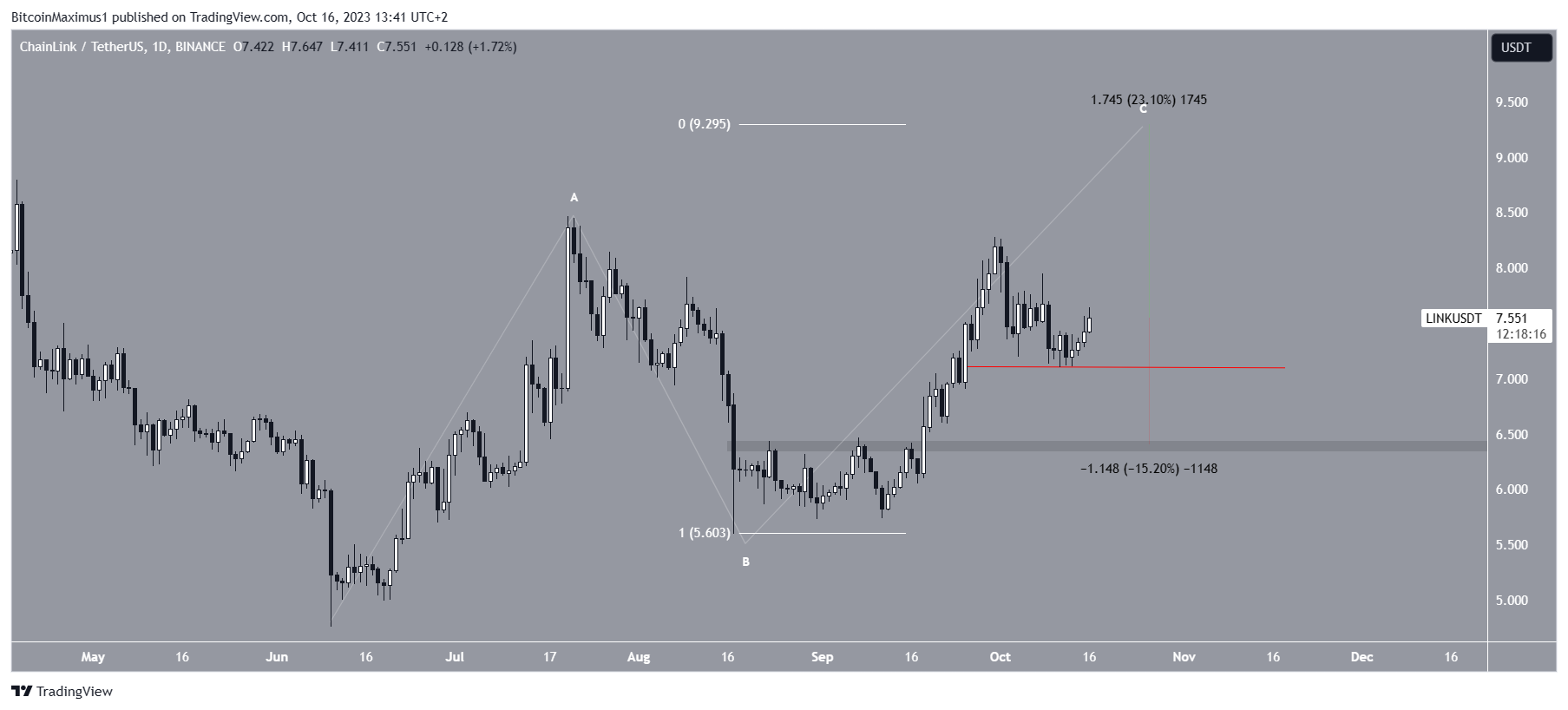

The daily timeframe technical analysis shows that the LINK price has gradually increased since August 17, when it had just reached a low of $5.60. The same day, it created a very long lower wick (green icon).

After creating a higher low on September 11, LINK broke out from a descending resistance trendline seven days later.

LINK accelerated its rate of increase after the breakout, culminating with a high of $8.28, slightly below the yearly high of $8.80.

During the increase, LINK cleared the $7.15 horizontal resistance area. The Chainlink bounce on October 11 validated it as support.

The daily RSI provides a bullish reading. When evaluating market conditions, traders use the RSI as a momentum indicator to determine if a market is overbought or oversold and to decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true.

The RSI just bounced at the 50 trendline (green circle) and is increasing, both signs of a bullish trend.

News for the Chainlink network is also positive. A report on the growing trend of real-world asset (RWA) tokenization suggests that Chainlink is ideally positioned to become a strong player in RWA.

Data from Santiment also shows that whale accounts have been accumulating over the past 30 days.

Finally, Chainlink announced that there were 9 integrations of 5 Chainlink services across different blockchains this week.

Read More: 6 Best Copy Trading Platforms in 2023

LINK Price Prediction: Will Price Reach New Yearly High?

Technical analysts employ the Elliott Wave theory as a means to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The most likely wave count aligns with the bullish RSI and Chainlink bounce. It suggests the price will continue increasing. It states that the Chainlink is in the C wave of an A-B-C corrective structure (white).

Giving waves A:C a 1:1 ratio will lead to a high of $9.30, 23% above the current price. The reaction once the cryptocurrency gets there will determine if LINK reaches a local top or if the increase is part of a longer-term bullish trend reversal.

Well-known trader Rekt Capital believes that the bullish trend reversal is still in its initial stages, and the price will increase well into double digits.

Despite this bullish LINK price prediction, a decrease below the October 11 low of $7.10 (red line) can cause a 15% drop to the closest support area at $6.40.

Read More: How To Make Money in a Bear Market

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.