Solana’s price (SOL) has increased massively since June 10. The upward movement caused a breakout from both diagonal and horizontal resistance levels. This breakout strongly suggests that a new bullish trend reversal is likely underway.

The price movement and various indicators offer additional evidence to support the ongoing upward trend, enhancing the probability that the SOL price will continue its ascent in the near future.

Solana Price Attempts Breakout From Long-Term Resistance

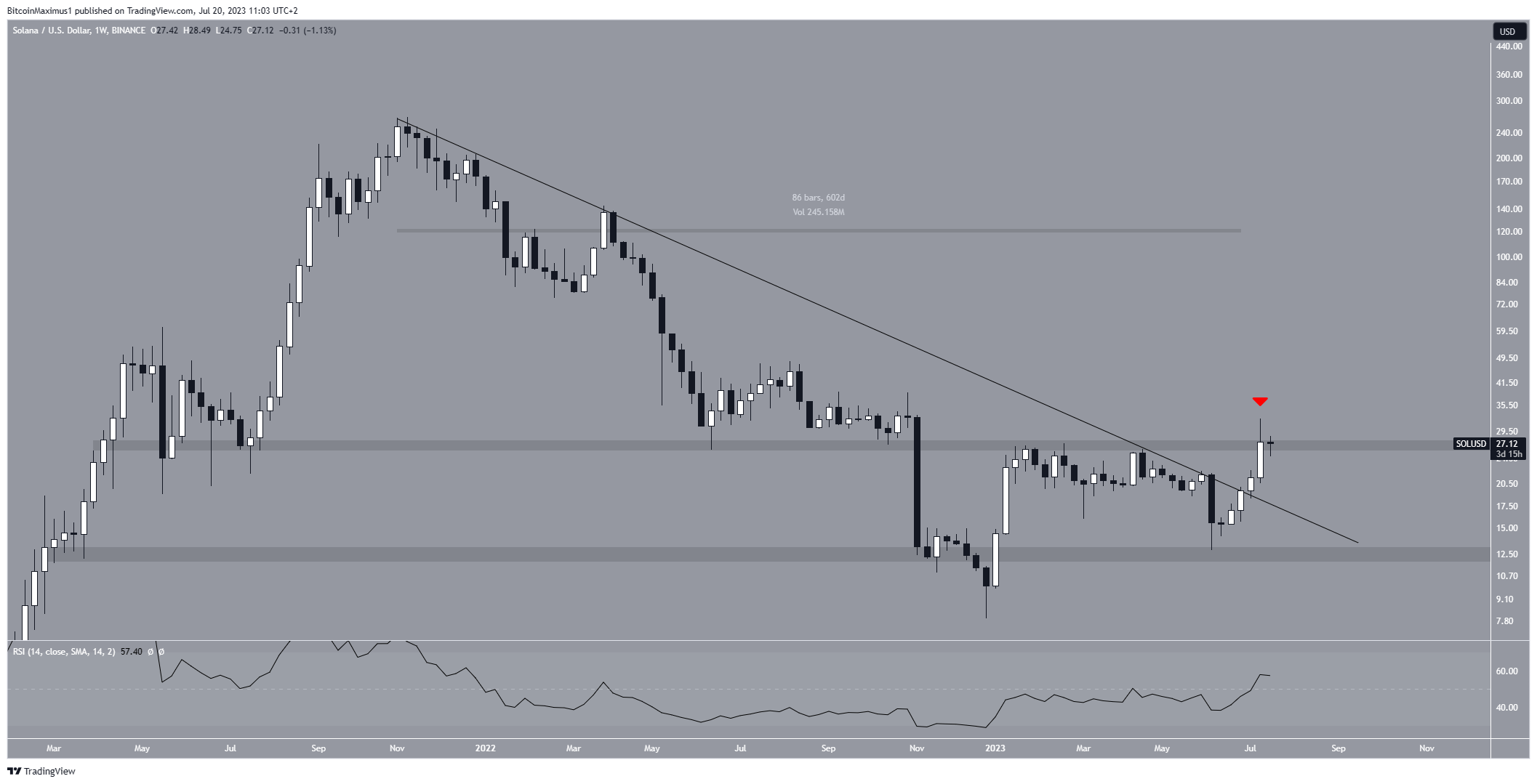

An examination of SOL’s weekly time frame reveals a significant breakthrough that occurred two weeks ago. During this breakthrough, SOL moved above a descending resistance line that had been in place since November 2021, covering a period of 600 days.

Breakouts of this kind often indicate the conclusion of the previous trend and the beginning of a new trend in the opposite direction. Therefore, it is likely that the SOL price has commenced a bullish trend reversal. This notion is further supported by the presence of four bullish candlesticks observed since the lows in June.

However, the SOL price failed to close above the $27 horizontal area. This created a long upper wick (red icon), considered a sign of selling pressure.

The breakout is substantiated by the weekly Relative Strength Index (RSI), a tool commonly employed by traders to gauge market momentum and determine if an asset is overbought or oversold, influencing their buying or selling decisions.

Notably, the RSI has displayed a higher low and is currently positioned above 50. Last week’s close above 50 was the first occurrence of this since the end of 2021.

SOL Price Prediction: Is the Bullish Reversal Confirmed?

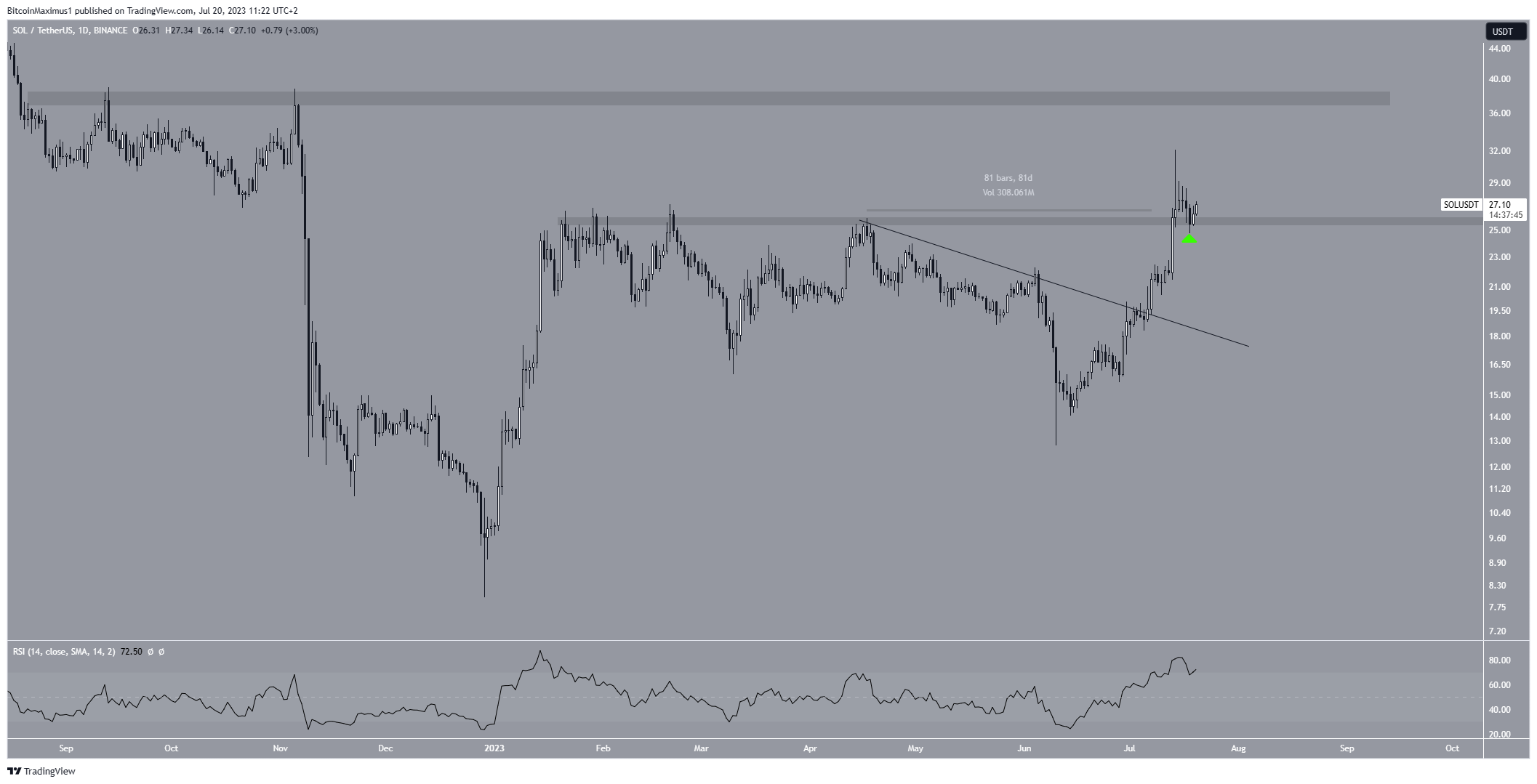

The technical analysis of the daily time frame indicates that the SOL price has experienced a rapid increase since June 10. This surge led to a breakout from a descending resistance line that had been in place for 81 days, suggesting that the upward movement marks the beginning of a new trend reversal.

This aligns with the bullish readings from the weekly time frame. The bullish scenario was further reinforced when the price of Solana reclaimed the $26 horizontal area, which is now expected to act as a support level (green icon).

On July 14, SOL reached a new yearly high of $32.13. Although it retraced afterward with a long upper wick, it still remains above the $26 area.

The daily Relative Strength Index (RSI) confirms a bullish trend, as it is ascending and above the 50 level. While it has entered the overbought territory, no bearish divergences are signaling a potential drop.

As a result, there is a possibility that the price increase will continue toward the next resistance area at $38.

However, it is crucial to monitor the situation closely, as a close below $26 could invalidate the breakout and potentially lead to a drop to $20.

Nevertheless, apart from the long upper wick, no other signs currently indicate such a scenario.

Read More: Best Upcoming Airdrops in 2023

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.