The largest losses due to crypto firm failures this year actually occurred before FTX, according to a recent Chainalysis report.

The dramatic development of the FTX scandal dominated headlines, as police in the Bahamas arrested founder Sam Bankman-Fried. SBF was charged with several counts including fraud by federal authorities, including the U.S. Department of Justice, the Securities & Exchange Commission, and the Commodity Futures Trading Commission.

Additionally, the firm’s current Chief Executive Officer John Ray recently described Bankman-Fried’s conduct as “old-fashioned embezzlement” to the House Committee on Financial Services.

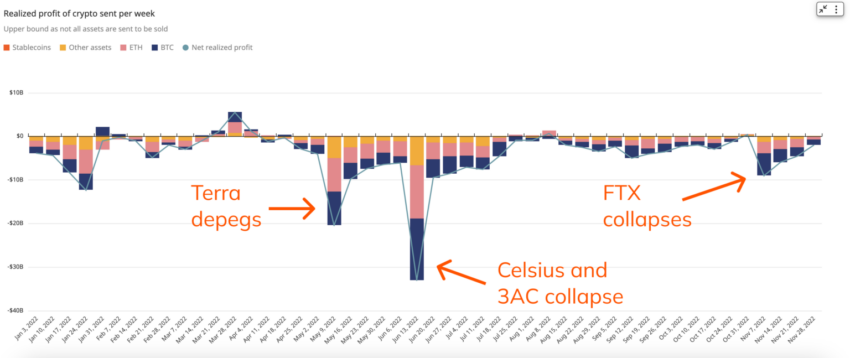

Despite becoming the highest-profile case of crypto fraud so far, has the FTX collapse actually been the costliest? Through calculating weekly realized gains and losses, Chainalysis performed an analysis to determine which events cost the most this year.

Worst of Crypto Winter Before FTX

To perform its analysis, Chainalysis established a metric for realized gains and losses, “by measuring the value of each wallet’s assets at the time they were acquired, minus the value of any portion of those assets sent to another wallet.”

The blockchain forensics firm also accounted for pricing differences at different times the cryptos were acquired.

Applying this metric on a weekly basis, the data reveals that the largest losses from companies collapses in the crypto market occurred before FTX. In addition to precipitating further events, it turned out that earlier failures had also sustained the largest losses for crypto investors.

When Terra LUNA’s UST stablecoin collapsed after losing its peg to the dollar, investors subsequently lost $20.5 billion. This major event triggered a cascade of further failures, including Celsius Network and Three Arrows Capital (3AC).

Together, the collapse of the latter companies cost investors $33 billion. Meanwhile, FTX seems to have only lost investors $9 billion so far.

A report from crypto analytics firm Nansen, also details that major losses at FTX were also due to Terra’s implosion.

Charges Against SBF

Sam Bankman-Fried is facing an eight-count federal indictment. These include charges of wire fraud on customers and lenders, conspiracy to commit commodities and securities fraud, one count of money laundering, one count related to campaign finance laws. If convicted and given the maximum sentence, SBF could spend up to 115 years in prison, as a conviction for even a single count of wire fraud is punishable by up to 20 years.

Federal prosecutors accuse Sam Bankman-Fried of duping both customers and investors into channeling billions of dollars into his other ventures. They also say he bears a heavy responsibility for the collapse of FTX and the impact on the crypto market.

In addition to facing federal charges, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have also charged Bankman-Fried with fraud.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.