Bored Ape Yacht Club saw a significant decline in unique buyers throughout August, mostly due to decreased profitability in holding non-fungible tokens.

Bored Ape Yacht Club (BAYC) has surpassed CryptoPunks as the NFT collection with the second most all-time sales volume. BAYC achieved this feat in less than two years after hitting the digital collectibles market in April 2021. Much of this milestone came from an increasing number of unique buyers who believed in Yuga Labs’ (creators of the NFT) project.

Unfortunately, the negative market sentiment that affected global NFT market sales and unique buyers has been detrimental to the fortunes of one of the most popular collections in the space today.

Throughout August, BAYC saw 263 unique buyers. This was the lowest number of new buyers in 2022 as well as a 16-month low.

Unique buyers continue to impact sales negatively

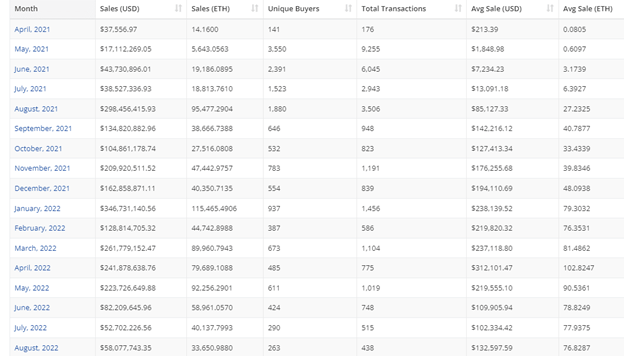

Unique buyers play an integral role in the assessment of the demand for a particular NFT collection. After 141 buyers purchased BAYC NFTs in April of last year, its status as the new golden goose in the digital art space was cemented by a 2,418% spike in unique buyers to 3,550 in May 2021.

It was during this time that several cryptocurrencies such as Ethereum (ETH) and Internet Computer (ICP) reached new highs.

The result of the spike was an increase in sales volume to approximately $17 million from a relatively smaller volume of $37,557 from the month of its launch.

While unique buyers correlate with sales, the history of BAYC shows that it has formed a new relationship with the average sale value. There were months when unique buyers were below the milestone of May 2021 but sales volume remained higher.

A great example can be attributed to January 2022, when Bored Apes had 937 unique buyers who made 1,456 transactions.

The average sale value for the period was $238,140. This was a 12,780% rise from the $1,850 recorded in May of last year.

Bored Ape Yacht Club sales retested correlation with unique buyers in August

In the past three months, declining unique buyers have resulted in decreasing sales volume. When we observe the number of new buyers, we found a reduction from 611 in May 2022 to 424 in June. This led to a drop of 63% in sales from $223 million to $82 million.

A further drop in unique buyers to 290 in July and then 263 in August has led to sales falling below $60 million in the past two months. August 2022’s volume was approximately $58 million.

Declining unique buyers and sales were reflected in APE’s price

ApeCoin (APE) the native blockchain asset of the Bored Ape project, has also continued to decline from its peak in its opening month in March 2022. APE traded in the range of $4.61-$7.68 throughout August.

Overall, APE shed 29% of its market value during this time.

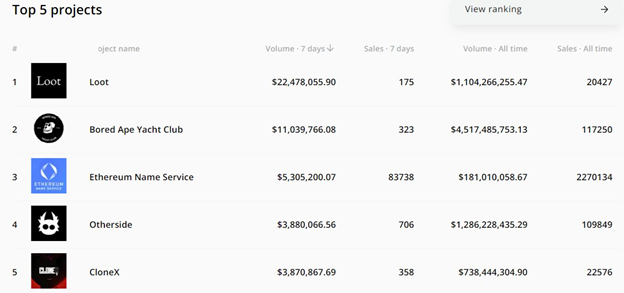

BAYC still a top 5 collection in weekly sales

Bored Ape Yacht Club trailed only Loot, a collection of 8,000 NFTs expressed as images of white text on a black background in the highest selling NFT category in the last seven days. BAYC had sales of approximately $11 million within the period. Ethereum Name Service, Otherside, and CloneX also filled out the ranks.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.