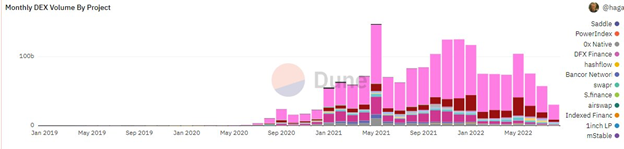

SushiSwap saw a further plunge in trading volume during July due to a decline in the demand for several altcoins listed on decentralized exchanges (DEXs).

SushiSwap hit a new low in July as the month proved to be one of the difficult periods in the history of the trading platform.

The exchange recorded roughly $1.53 billion in volume during July, according to data from Dune Analytics.

While this statistic may seem high compared to volume recorded by competing exchanges such as ShibaSwap, 1inch limit order protocol, Ox Native, and mStable, it was a 17% decrease from June.

SushiSwap volume for June was approximately $1.8 billion.

With the new low, SushiSwap also saw a 72% dip year-over-year in trading volume from July of last year.

In July 2021, SushiSwap trading volume was in the region of $5.65 billion.

Overall, the latest metric was also $8.36 billion below volume from the yearly high of $9.89 billion in January.

What caused the drop in volume?

The bearish market trends which extended to July impacted SushiSwap negatively since the exchange supports low-cap digital assets which see lower daily trading volumes.

Aside from SushiSwap, DEXs which recorded more volume, such as Uniswap, DODO, Curve, Balancer, and Synthetix, also plummeted to new lows.

SUSHI price reaction

SUSHI opened on July 1, with a trading price of $0.9878, reached a monthly high of $1.66, tested a monthly low of $0.946, and closed the month at $1.45.

Overall, despite a fall in volume, there was a 46% increase between the opening and closing price of SUSHI in July.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.