Major crypto companies have seen millions wiped off their stock value following the recent market crash. MicroStrategy, Silvergate Capital, Marathon Digital Holdings, Coinbase, and Galaxy Digital Holdings have all experienced large drops in value.

Market analyst Caleb Franzen spoke of the massive drop that these companies have faced in the recent market crash, offering some evidence that the crypto market may be in for a strong bear run.

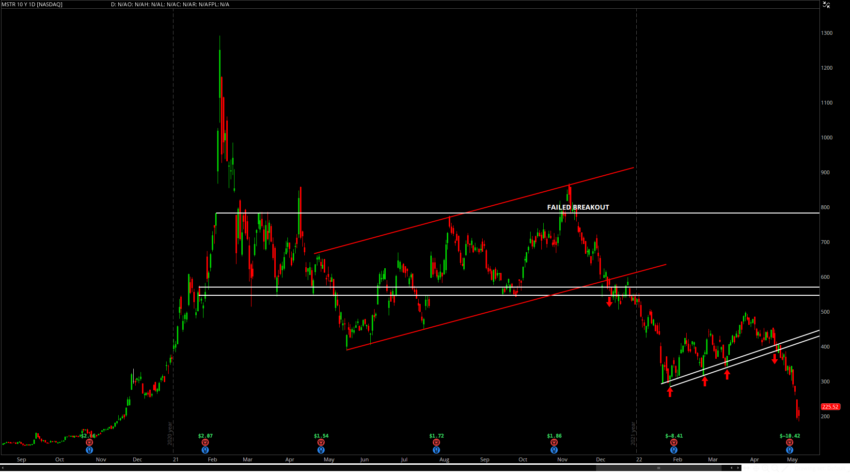

MicroStrategy’s stock is down by 58% year-to-date (YTD) and 83% down from its all-time high. Similarly, Silvergate is down 42% YTD, Marathon is down 64% YTD, Coinbase is down 71% YTD, and Galaxy Digital is down 55% YTD.

These companies are big proponents of bitcoin and the crypto market. MicroStrategy, which has made huge purchases in bitcoin, is now facing the fact that its investments might turn negative.

MicroStrategy’s margin call levels are at $21,000, which would lead to it selling some bitcoin. Company officials have said as much.

“As far as where bitcoin needs to fall, we took out the loan at a 25% loan-to-value, the margin call occurs [at] 50% loan-to-value. So essentially, bitcoin needs to cut in half or around $21,000 before we’d have a margin call,” MicroStrategy CFO Phong Le said in an earnings call.

The correlation between crypto and the stock market, especially big tech, has become a point of concern for some. Still, those in the market, including Saylor, have been posting memes about it and saying the future looks fine.

Will crypto bounce back quickly?

The crypto market slump alongside the stock market has led to some investors becoming pessimistic about the near-term future. If the correlation is true, then a quick revival of crypto prices is unlikely to happen soon.

The market crash has led to several notable incidents, including the de-pegging of stablecoins. The Luna Foundation Guard had to use $1.5 billion of its reserve to maintain the peg of the UST stablecoin.

Market enthusiasts simply see this as a blip in bitcoin’s journey. And history shows there could yet be a huge push to new highs this year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.