CoinGecko’s Q1 2021 report offers several insights into the market from this past quarter. The review includes details on Binance Coin’s (BNB) dominance and DeFi’s continued growth.

CoinGecko has released a market report for Q1 2021. It reveals both expected and surprising insights. The report covers several topics, including non-fungible tokens (NFT), the incredible BNB rally, and a detailed analysis of the decentralized finance (DeFi) sector’s performance.

The report dives into market performance over the quarter, which has been one of its strongest yet. The top-30 cryptocurrencies saw their collective market cap grow by 146%.

Trading volumes also grew by 155%. It notes the Coinbase stock listing, Tesla’s foray into Bitcoin, and Fidelity’s Bitcoin ETF as major contributing factors.

It also compares Bitcoin’s market cap to other assets and companies. At $1.1 trillion, it has a tenth of gold’s market cap, is 60.8% away from overtaking Microsoft, and also has captured 53.8% of Apple’s value.

BNB takes the crown

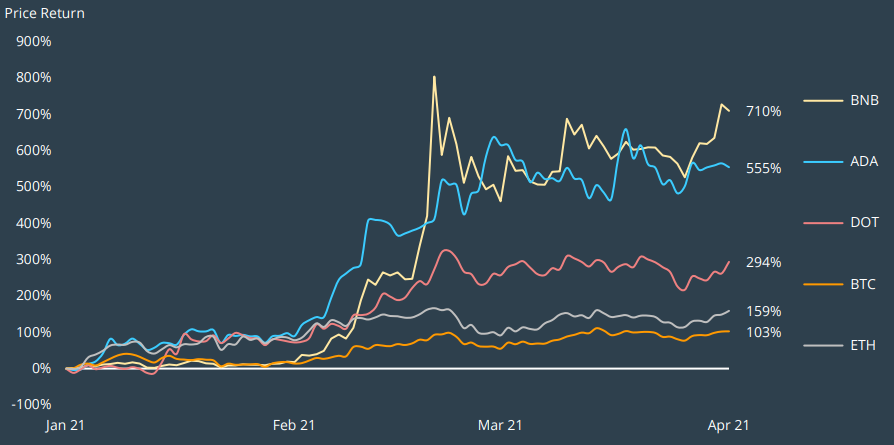

When it comes to particular assets, there are some interesting developments. Both bitcoin and Ethereum saw their performance eclipsed by Binance Coin (BNB).

BNB had the best performance with a 710% gain, followed by Cardano (ADA) and Polkadot (DOT) at 555% and 294% respectively.

Consequently, it states that an “altcoin season is here,” with Bitcoin dominance falling by 5.7%. Ethereum’s dominance, however, climbed the most to 13.1%. Altcoins have indeed been the strongest performers in the past few weeks. This includes stablecoins, which saw a gain of $32.6 billion in market cap.

But Bitcoin continues to be the defining talking point, and CoinGecko points out that Bitcoin’s role as a hedge against inflation is strong. Fiscal policies and low interest rates have analysts worried about rising inflation. Bitcoin has been made to stand out all the more with these events.

DeFi growth soars

The DeFi industry was also put under a microscope. The sector has enraptured investors, many of whom turn to it for strong yields and innovative lending solutions.

The DeFi market cap this quarter hit a record $95.7 billion, which is a 382% increase from the start of the year. But it has grown even more since the report was written, now standing $123.4 billion.

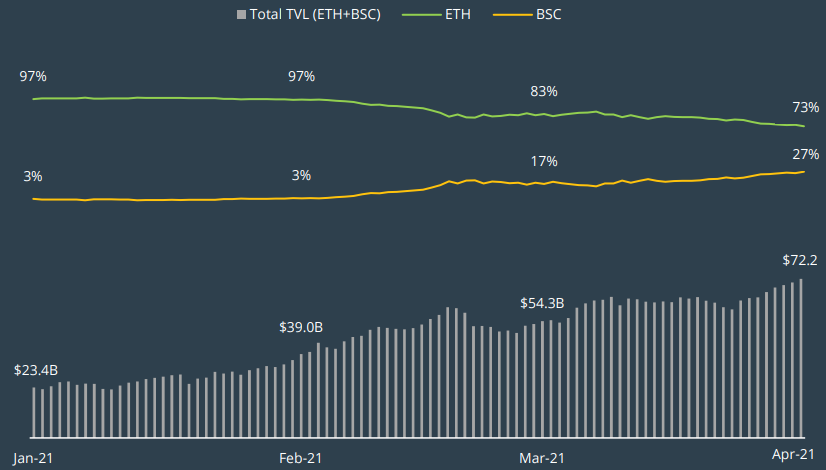

Total value locked has also soared, with both Ethereum and Binance Smart Chain (BSC) combined valued at $72 billion by that metric. However, it highlights BSC’s growth, exploding from 3% to 27%.

However, it notes that challenges remain in the DeFi space, mostly relating to gas fees and scaling. Ethereum, which has higher gas fees than BSC, is looking to several solutions, including Optimism and Zk-Rollups as well as EIP-1559 to address the problem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.