Crypto markets witnessed a short-lived anomaly when the XRP price momentarily soared to a whopping $50 on the Gemini crypto exchange. Such a price elevation, if sustained, would have catapulted the token’s market capitalization to the trillions.

But as fast as it surged, the price retracted, aligning itself with the ongoing rates on other prominent exchanges.

XRP Rockets to $50 and Back

This spike, predominantly attributed to the token’s relisting on Gemini, hinted at low liquidity conditions. Speculations are rife that an investor might have unintentionally made a hefty market order, leading it to be satisfied at this exceptionally escalated rate. Consequently, XRP was traded at a premium compared to its peers for several hours.

Market watchers also hinted at a probable scenario: a seller, aiming to spoof, set the XRP rate at $50. This ambitious rate was inadvertently matched by a buyer, resulting in an unforeseen trade transaction.

A crypto trader going by the handle @lifebythedrop63 remarked on the situation. They found that the order book appeared incredibly thin to the point of no sales until someone placed a $50 selling rate. This was possibly, albeit mistakenly, accepted by an investor:

“The order book is very thin, i have been watching all day, at one point there was nothing for sale, someone put a lot to sell at $50.00 and someone must have fat fingered a market order and then they were the proud owner of $50 XRP, this was from a few hours ago.”

Yet, not all perceived this as a mere glitch or mistake. Khaled Elawad, a seasoned analyst, proposed a different theory. He opined that this brief price surge epitomized a genuine supply-demand scenario free from manipulative interferences.

Elawad stated,

“That not a glitch. That’s an example of the fair market price supply vs demand without the crypto market manipulators getting in to suppress the price. Don’t forget it only takes one exchange to manipulate the price then arbitragers everywhere pile in and the price is rebalanced.”

Risks of Low Liquidity

XRP was recently reintroduced on Gemini following a favorable July court ruling for Ripple Labs. The court decreed that XRP transactions on digital asset platforms didn’t qualify as offers and sales of investment contracts. Prior allegations also insinuated that Ripple Labs had illicitly traded XRP without the SEC’s permission.

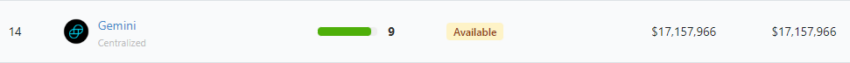

CoinGecko data claims that Gemini hosts 82 coins and 109 trading pairs. Currently, its 24-hour trading volume is hovering at just over $17,000,000.

However, this episode underscores the inherent risks of trading in low-liquidity exchanges. Price manipulation can be orchestrated by market players taking advantage of the low liquidity. This can drastically influence asset prices.

Slippage, a disparity between the intended and executed trading price, is another risk. Moreover, traders holding significant assets might find it challenging to liquidate their holdings due to a lack of counterparties.

So, how can traders navigate these murky waters? A few strategies can be employed:

- Engage with established exchanges known for high trading volumes.

- Regularly monitor market depth and be alert to liquidity conditions before making transactions.

- Favor limit orders over market orders to minimize potential slippage.

- Distribute trading activities across diverse exchanges to prevent undue reliance on one platform.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.