Entrepreneur twins Cameron and Tyler Winklevoss expect the Digital Currency Group (DCG) and its CEO Barry Silbert to respond to a litigation threat from an open letter at 4 p.m. Eastern Time today.

This deadline follows Cameron Winklevoss’s open accusation that DCG CEO Barry Silbert called himself a victim despite owing creditors $3.3 billion.

Winklevoss DCG Lawsuit Threat Cites Stall Stall Tactics

On July 4, Gemini co-founder and crypto entrepreneur Cameron Winklevoss wrote an open letter to Silbert, proposing a payment plan that, if not agreed to, would result in litigation against DCG and the CEO.

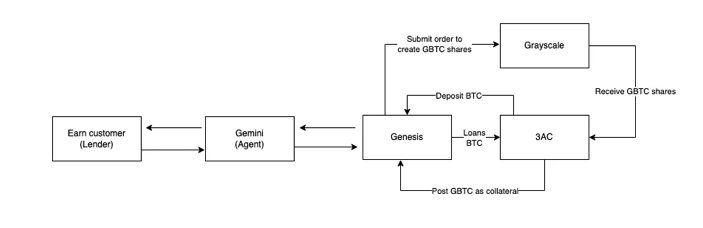

DCG owns Genesis Global Capital, which owes Gemini Earn customers about $900 million. Genesis paused withdrawals in November after the collapse of Three Arrows Capital hurt its liquidity. Three Arrows could not repay over $600 million it owed Genesis after being placed into liquidation. DCG assumed some of Genesis’ debt through a $1.2 billion promissory note.

However, Winklevoss accused Silbert of using the promissory note as a stall tactic to buy time to patch the hole Genesis had instead of tabling a concrete plan to reimburse creditors.

“To you, Earn users aren’t people, they’re numbers on a spreadsheet. Business as usual bro.”

Winklevoss also alleged that DCG entered mediation with Gemini to prevent a default on a $630 million loan to Genesis.

Tattered Alliances Leave Many Questions Unanswered

Industry players are divided on where the matter will head next.

John Deaton, a pro-crypto US attorney, said there’s no reason to wait to sue if Gemini can prove its allegations. A DCG spokesperson said that Winklevoss’ previous letter, penned 174 days ago, was a “desperate” publicity stunt that did little to advance the interests of Earn customers.

While Winklevoss invited Silbert to a private Twitter Space to discuss the new offer face-to-face, it seems unlikely that Silbert will acquiesce. The Winklevoss brothers previously tried to mediate their dispute with Meta CEO Mark Zuckerberg over the idea for Facebook with little success. Facebook ended up settling the dispute with $65 million in cash and Facebook stock.

The big elephant in the room is how the twins’ relationship with Silbert landed Earn customers in this pickle.

The twins launched their Earn product with Silbert in 2021 without the permission of the US Securities and Exchange Commission. According to Bloomberg, both Silbert and the twins used the idea of freedom from banks to win customers.

Gemini promised customers the returns of crypto wrapped in the stability of a savings account. However, Gemini was never regulated as a bank. Instead, it acted as an agent for Earn customers to lend crypto to Genesis to lend to other companies.

Find out here the primary differences between crypto and banking.

Despite marketing claims, Earn customers were unaware that Federal Deposit Insurance did not cover their funds.

Now everyone faces an uncertain future.

Got something to say about a Gemini lawsuit against DCG or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.