The Digital Currency Group has been sent a letter by Gemini co-founder Cameron Winklevoss. The deal consists of three payments, amounting to a total of $1.4 billion.

Gemini co-founder Cameron Winklevoss has put up a $1.4 billion deal to resolve the heated conflict that has been going on with Digital Currency Group CEO Barry Silbert. Winklevoss tweeted on July 4 about the offer, calling it the “best and final offer.”

Cameron Winklevoss’ $1.4B Deal Comes With Letter

Winklevoss posted an open letter to Silbert alongside the deal. He stated that Silbert was playing games and that they were now over after ballooning professional fees to over $100 million.

Winklevoss goes on to say that this protraction has come at the expense of creditors and Earn users.

The collapse of FTX is one of the reasons behind the fallout involving Barry Silbert and his companies. Check out our deep dive explaining the meltdown of the cryptocurrency exchange: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

The Gemini co-founder was blunt with his words regarding the nature of the incident, saying,

“It takes a special kind of person to owe $3.3 billion dollars to hundreds of thousands of people and believe…that they are some kind of victim. Not even Sam Bankman-Fried was capable of such delusion.”

The statements come with an ultimatum — that Silbert should agree to the deal by 4 PM ET on July 6 or potentially face a lawsuit. It will be interesting to see how the incident develops, as it sees a contest between some major firms in the industry coming to a boil.

Friday Deadline for DCG

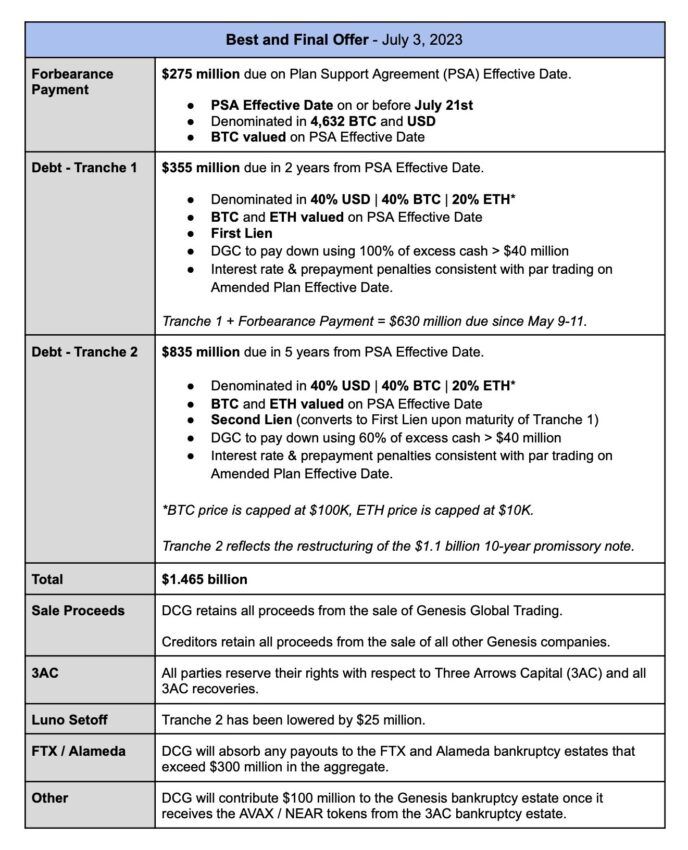

The deal includes DCG absorbing any payouts to the FTX and Alameda bankruptcy estates that exceed $300 million in aggregate. Furthermore, the Genesis bankruptcy estate will expect DCG to contribute $100 million.

DCG will retain all proceeds from the sale of Genesis Global Trading.

There will be three kinds of payments: a forbearance payment and two debt tranches. The first will be due on or before the Planned Support Agreement date of July 21, amounting to $275 million.

The first debt tranche is $355 million and is due 2 years from the PSA, while the second is due 5 years from the PSA and amounts to $835 million.

Lumida Wealth CEO also tweeted about the matter and is in conversation with both Winklevoss and Silbert. He said that he does not expect DCG to meet the deadline.

DCG has been having a tough few months. In May, Cameron Winklevoss’ Gemini handed a $630 million loan, which the company failed to repay. The collapse of Silicon Valley Bank had hit it hard. The firm is now looking for new partners following the bank’s collapse.

U.S. authorities are reportedly investigating DCG over its operations. They claim that the investigation is focused on internal transfers. Various difficulties have led to such actions as DCG closing its brokerage subsidiary TradeBlock.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.