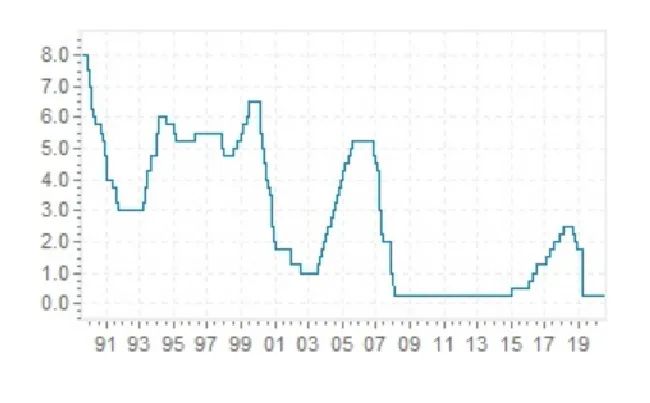

In a central banking system, as it currently exists across the world, commercial banks are subservient to the nation’s central banks, setting their interest rates according to central banks’ policies. In Europe, the European Central Bank (ECB) has long gone into a negative interest rate zone. This resulted in hundreds of commercial banks charging people for having deposits.

In the United States, although financial affairs have not come to that point, an interest rate of 0.25% is not much to be excited about either. Outside of stock market dividends, the only accessible alternative for most people is to embrace cryptocurrencies. While they may be volatile, the upside of cryptos is that they offer a path to passive income that overshadows traditional savings accounts’ gains. One popular option includes Bitcoin interests.

The earning potential of BTC

In a traditional savings account, you get with your local bank, the bank would give you a small APY (annual percentage yield) for loaning out your money to third parties.

However, in order to prevent the economy from “overheating” and stimulate economic growth, central banks have been keeping the interest rates as low as possible. After all, because interest rates are low, borrowing encourages investing.

In the crypto space, the same principle applies, but without any central body setting the policies. Therefore, your cryptocurrency deposits generate a much higher interest rate as they are loaned out to third-party borrowers. In contrast, a traditional savings account can generate between 0.1%–0.6% annual interest yield (APY). This is several orders of magnitude less than cryptocurrency savings accounts that can go up to 10% APY or even higher.

Methods for generating Bitcoin returns

Overall, you can generate income from Bitcoin and other cryptos using the following methods:

- Trading: The simplest method consists of buying the dip. You buy Bitcoin and then sell it at a higher price than when you bought it. Such trades can be completed on a micro level — hourly or daily — or on a macro level years after you have purchased BTC.

- Arbitrage: Similar to BTC trading, but between different marketplaces. For example, South Korea is notorious for having a much higher BTC price than the rest of the world. This phenomenon is called the kimchi premium. Accordingly, if one manages to go through the regulatory hurdles and enter the South Korean crypto market, one can buy BTC cheaply in the Western market and sell it in South Korea for a hefty profit.

- Lending: A much more elegant option for crypto gains. Instead of actively trading, you simply lock in your Bitcoin deposits so others can borrow from this crypto pool. Many crypto exchanges offer this passive income, with APY depending on the time period for locking your funds.

- Savings account: Much like traditional savings accounts, it is the passive income method that requires the least engagement. Instead of a bank that yields an interest rate on your deposit, a crypto savings account relies on either a DeFi protocol or a centralized crypto exchange. The only difference between a regular crypto wallet and a crypto savings account is that the latter allows you to accrue interest over time.

Risks of earning Bitcoin interest

This guide will focus on the last two methods to earn interest from cryptocurrencies. However, keep in mind that almost all crypto savings accounts are not FDIC-insured. In the banking system, your cash deposits are automatically ensured by registered banks for up to $250,000.

You have to take responsibility by either properly selecting the right platform or acquiring insurance via Nexus Mutual or a similar smart contract-based service in the crypto space. In order for your funds to be accessible to others, which gives you your interest rate, the platform holds your savings account’s private keys. Therefore, it is paramount that they offer some security for your funds. After all, if they go under — either from cyber theft or bankruptcy — your funds will follow suit.

For this reason, make sure the platform you are entrusting your crypto assets with has a good reputation.

More importantly, if they had previously been hacked, they would have out proper compensation. Under these criteria, here are the top services that provide crypto savings accounts with Bitcoin interest or high yields.

Top 9 platforms for your crypto savings accounts

1. Uphold

Uphold, a global digital asset trading platform, distinguishes itself by offering various tradable assets. It grants access to over 250 digital currencies, four precious metals, 27 national currencies, and stocks tailored to the user’s location.

The platform achieves competitive pricing by pooling liquidity from 26 exchanges, ensuring users can secure the best available rates. Uphold guarantees that all assets on the platform are fully reserved, emphasizing a policy against lending out customer funds.

In addition to its trading services, Uphold introduces a premier wallet that supports multiple blockchain technologies, making storing popular assets like BTC easy for users. This wallet, compatible with Android and iOS devices, enhances user experience by offering flexibility in managing digital assets.

2. Hodl Hodl

Hodl Hodl is a decentralized peer-to-peer Bitcoin trading platform emphasizing direct transactions between users without involving intermediaries, thus mitigating third-party risks. The platform’s unique feature is that it does not hold users’ funds. Instead, funds are secured in escrow with multi-signature addresses, facilitating trades directly between buyers’ and sellers’ wallets. Hodl Hodl offers an anonymous trading environment, allowing participants from around the globe to trade and settle in various fiat currencies based on mutual agreement.

Additionally, the platform enables users to originate loans, setting their terms for Bitcoin interest rates, typically ranging from 1% to 12%. This model provides a flexible and secure option for trading, lending, and borrowing Bitcoin, leveraging the benefits of decentralization while offering users control over their transactions and terms.

3. Nexo

Nexo stands out as a highly regulated financial platform that operates in over 200 jurisdictions, offering a wide range of services tailored to cryptocurrency users. It provides a seamless way for users to earn interest on their Bitcoin holdings and borrow and lend fiat currencies. One of Nexo’s notable features is its Nexo debit card, which allows users to spend their cryptocurrencies directly without the need to convert them into fiat currency beforehand. This feature enhances the liquidity and usability of digital assets in everyday transactions.

Moreover, Nexo prides itself on its strong partnerships with some of the most prominent names in the cryptocurrency and blockchain industry, including Paxos, Brave, BitGo, Ledger, Securitize, Blockchain.com, Circle, and others. Hodl Hodl is a decentralized peer-to-peer Bitcoin trading platform emphasizing direct transactions between users without involving intermediaries, thus mitigating third-party risks. The platform’s unique feature is that it does not hold users’ funds. Instead, funds are secured in escrow with multi-signature addresses, facilitating trades directly between buyers’ and sellers’ wallets. Hodl Hodl offers an anonymous trading environment, allowing participants from around the globe to trade and settle in various fiat currencies based on mutual agreement.

Additionally, the platform enables users to originate loans, setting their terms for Bitcoin interest rates, typically ranging from 1% to 12%. This model provides a flexible and secure option for trading, lending, and borrowing Bitcoin, leveraging the benefits of decentralization while offering users control over their transactions and terms.

4. Atomic.Finance

Atomic Finance, based in Toronto, offers a platform for earning interest in Bitcoin, focusing on self-custody, transparency, and verifiability. Tailored specifically for the Bitcoin community, the platform ensures users can verify their assets on-chain, preventing rehypothecation.

5. ZenGo

ZenGo offers a user-friendly mobile app that simplifies investing for users across 188 countries, with diverse payment options and leveraging biometric security to eliminate the need to manage private keys or seed phrases, offering a seamless experience for new investors. Established in 2018 in Tel Aviv, Israel, by a team of industry and academic experts, ZenGo supports earning daily interest and rewards through its lending and staking services without imposing fixed loan terms.

6. Binance

Binance, the largest global crypto exchange with daily trading volumes exceeding $6 billion, has expanded its offerings since its inception in July 2017. It now includes the Binance Smart Chain, crypto loans, tokenized stocks, savings, and locked staking. Its Savings account provides steady yields on major cryptocurrencies, including stablecoins.

7. Yield App

Yield App is a fintech platform focused on cryptocurrency, designed to simplify access to digital assets. Its web platform and mobile app enable users to earn daily compounding passive income. The platform stands out for its strong security measures, intuitive design, and effective investment strategies, catering to beginners and institutional investors while avoiding high-risk lending practices.

8. Sovryn

9. Smart.Fi

SmartFi is a cryptocurrency-based open-lending platform that integrates the advantages of digital currency with traditional monetary policies. It offers a unified earning, trading, lending, and borrowing space.

SmartFi Token holders can govern the platform and benefit from its wealth creation, positioning it as an alternative to conventional banking. The platform is designed for users of all levels, from novices to experts and large institutions, and enables funding of small business loans with the opportunity to earn rewards.

Financial independence: The rise of self-sovereignty

If you have any amount of crypto assets, you don’t have to resort to begging Elon Musk on social media in the hopes of your assets gaining value. Instead, approach your investment’s long-term, just like your parents and grandparents.

It is clear that banking saving accounts have become not only useless but may even drain your funds. Deflationary cryptocurrencies like bitcoin provide a perfect remedy for such central bank experiments. Fortunately, there are not that many platforms to choose from for high-yield interest rates. The longer the platform has been publicly exposed, and the higher user count it has, the likelier it is that your funds will be safe, even if not FDIC-insured.

Crypto.com, Binance, and BlockFi provide the widest regional coverage, consistently high APYs, and negligible transfer fees. Others have their own strengths, with Gemini being the only one with FDIC coverage. Whichever platform you end up choosing, this passive income method represents the safest method to earn crypto gains.

Frequently asked questions

How can I earn interest on my Bitcoin?

Is earning interest on Bitcoin safe?

How much interest can I earn on my Bitcoin?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.