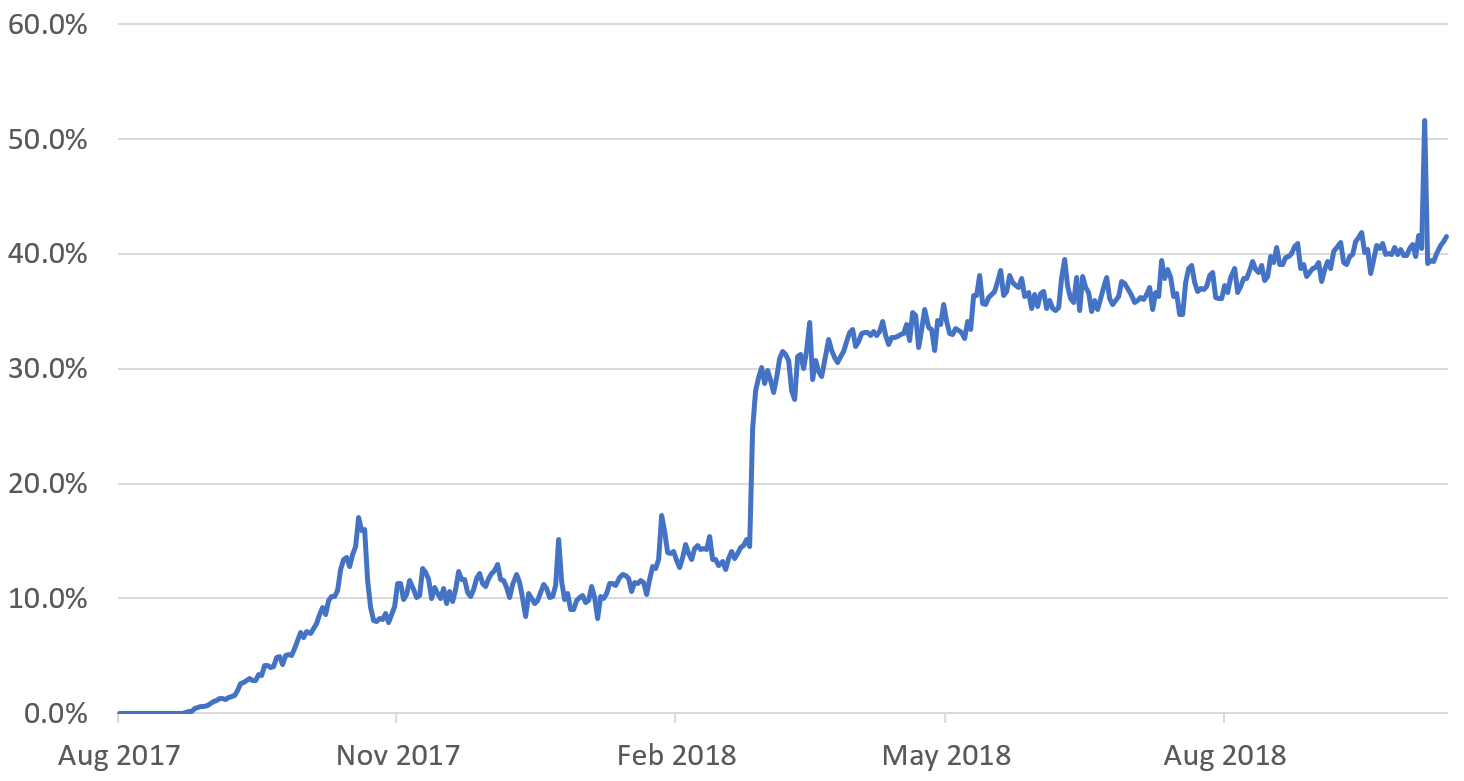

One year after launch, the Bitcoin (BTC) Segregated Witness (SegWit) upgrade has already seen impressive adoption, whereas Bitcoin Cash (BCH) appears to be gradually losing ground — according to a recent BitMEX report.

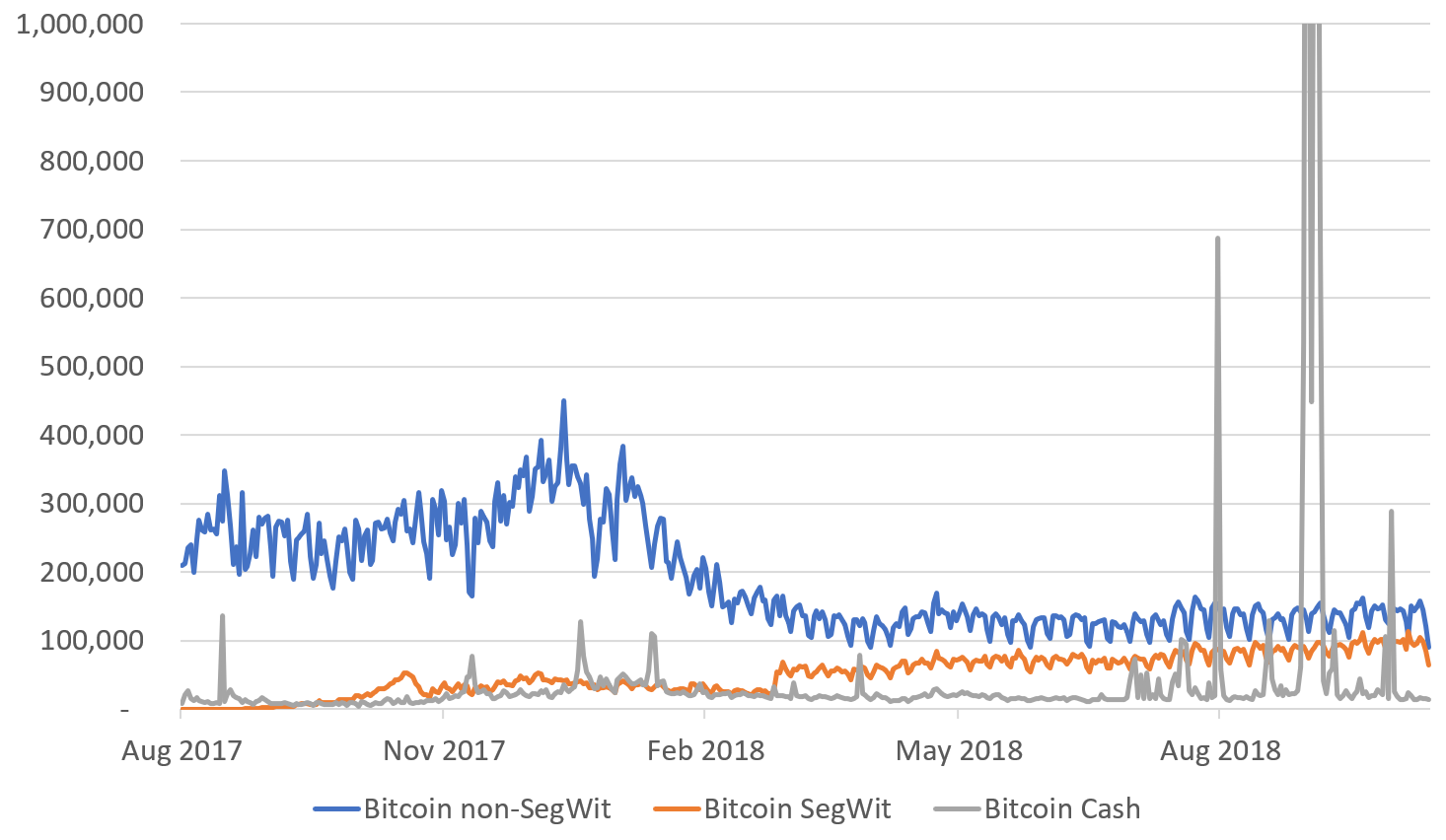

Barring the two periods of stress testing in August and September 2018, Bitcoin Cash (BCH) has gradually lost ground against SegWit in terms of numbers of transactions — decreasing from a maximum of around 10 percent of Bitcoin’s transaction volume in March 2018 to around 6 percent in October 2018.

Prior to the stress tests, SegWit transactions outnumbered BCH transactions by 20 to 1. Now, they’re currently standing at a total of just around 22 million SegWit transactions to 19 million Bitcoin Cash transactions.

What are SegWit and Bitcoin Cash?

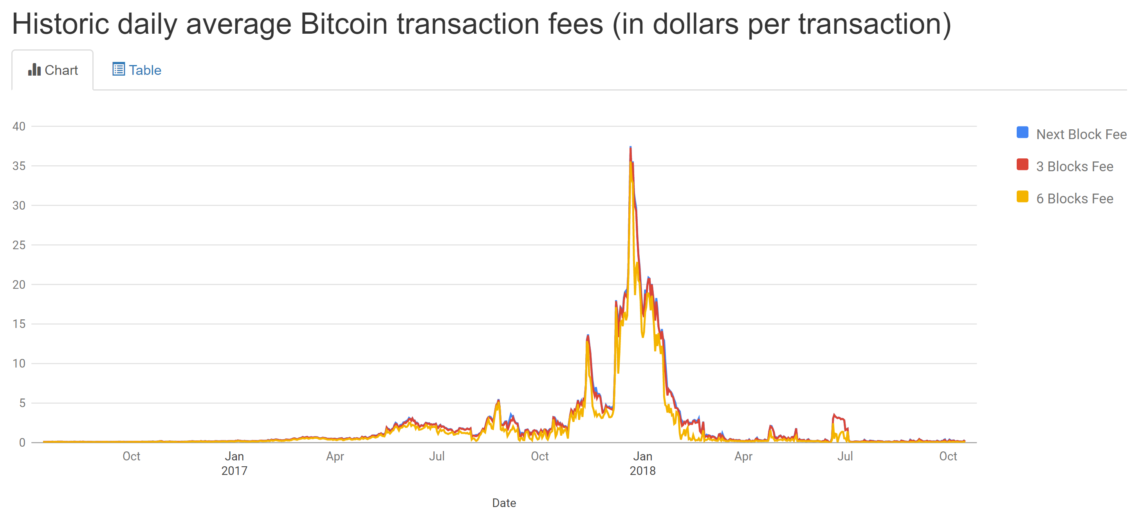

Both SegWit and Bitcoin Cash are solutions to the infamous Bitcoin scaling problem, but the way they go about this differs substantially. Because the Bitcoin network has a maximum block size of 1MB, only a limited number of transactions can fit onto the next block and hence be confirmed. At this rate, the Bitcoin network was capable of handling around 7 transactions per second. Segregated Witness (SegWit) is a soft fork introduced in August 2017 that changed the format of bitcoin transactions, allowing more transactions to fit within each 1MB block while also opening the door to further scaling solutions — such as the lightning network. The limited throughput of the Bitcoin network saw it almost crippled in December 2017 when network load significantly spiked, causing the average transaction fee to spike as high as $55 due to transaction competition. The average Bitcoin transaction fee has drastically declined in tandem with SegWit adoption, to the point where it is currently a non-issue.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

#News about Bitcoin (BTC)

#Altcoin Analysis

#Bitcoin (BTC) Analysis

#Blockchain news

#Altcoin news

#Bitcoin Cash (BCH) News

Sponsored

Sponsored