A new research report from Kaiko Research (Kaiko) found HTX sold large amounts of Tether (USDT) for USDC in the past three months. USDC transfers of similar size to Binance followed each sale, suggesting potentially concerning links between the two exchanges.

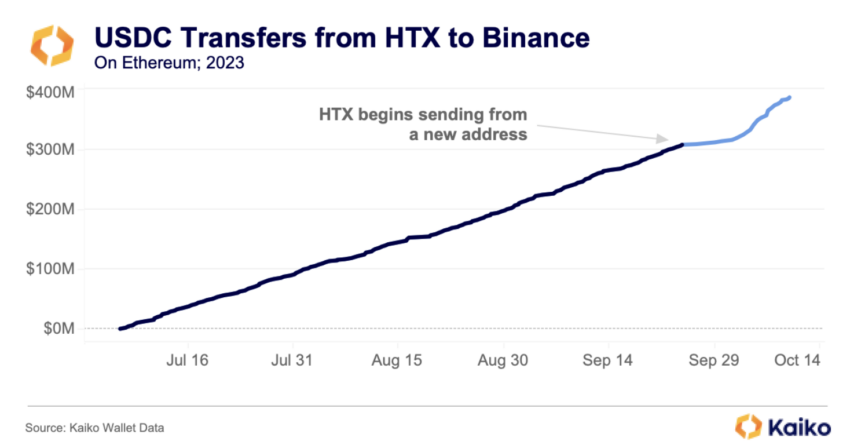

Kaiko’s wallet data revealed that HTX sold $350 million USDT for USDC since the start of July. Around the same time, two wallets Kaiko has linked to HTX started selling $400 million USDC to Binance in separate transactions.

StUSDT Holdings Similar to Binance Transfer

These transactions paint HTX’s JustLend product in a more concerning light. HTX grants JustLend customers one staked USDT (stUSDT)for each deposited USDT.

It claims to earn interest by using the deposited USDT to buy low-risk treasury instruments. Its reported stUSDT deposits total $400 million, the same amount transferred to Binance.

While there is no evidence of foul play, it calls to remembrance HTX’s history of abnormal trading activity that hasn’t always coincided with major market events.

When Worldcoin’s WLD token launched this year, Kaiko identified clusters of buy and sell orders that appeared irregular in duration and volume. Altcoins with volumes under $1 billion from March to October jumped from $1.4 billion during the week of July 16 to $3.4 billion a week later.

After Worldcoin’s token launch, HTX captured one-fifth of global exchange volumes, while Poloniex, an exchange it is linked with through crypto mogul Justin Sun, later recorded $20 billion. The latter occurred in August when most exchange volumes were at all-time lows.

Sun, who founded Poloniex and recently joined HTX’s senior management, has been accused of wash trading TRX by the US Securities and Exchange Commission. TRX is the native token of TRON, the blockchain Sun launched in September 2017.

Read more: 8 Best On-Chain Analysis Tools in 2023

HTX Reliance on stUSDT Concerns Investors

HTX’s holdings of stUSDT, also a token launched on TRON, now amount to $400 million, or about 14% of its total reserves. The concentration of reserves in a single asset has spooked institutional investors, who have reportedly withdrawn much of their holdings on HTX.

Read more: What Is TRON (TRX) and How Does It Work?

The accompanying decline in Tether is especially concerning, considering the ease exchanges enjoy when liquidating the stablecoin. Data from DefiLlama suggests that HTX only holds about 5% of its reserves in USDT, 25% less than its bigger rival, Binance.

Most of its remaining reserves comprise TRX (19%) and HT (17%), a token native to the HTX exchange. Sun denied being the party behind a $200 million injection into HTX’s reserves in August.

Do you have something to say about Kaiko’s reports on Binance links with HTX, the latter’s reliance on stUSDT reserves, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.