TRON’s native token, TRX, which is targeted by SEC charges, constitutes a significant portion of Huobi’s reserves, raising concerns over the crypto exchange’s financial stability and Justin Sun.

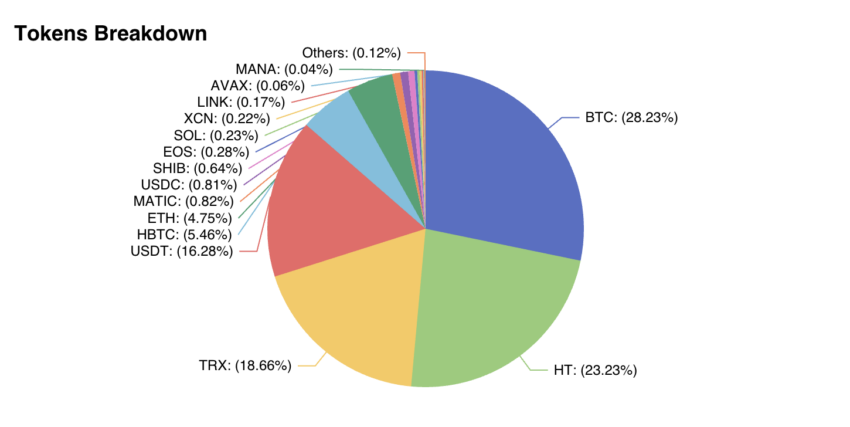

The recent fraud charges against digital asset mogul Justin Sun and his TRX token have cast a shadow over the Huobi Global crypto exchange. TRX, also known as TRON, constitutes 18.66% of Huobi’s reserves, according to data from DeFiLlama.

With the US Securities & Exchange Commission (SEC) accusing Sun of market manipulation and securities rule violations, doubts about TRX’s legitimacy may threaten the stability of Huobi’s financial position.

The SEC Goes After Justin Sun

The SEC alleges that Justin Sun manipulated the market to make TRX appear actively traded. Consequently, this led to a 17.60% drop in the TRON token’s value. Sun has dismissed the charges, claiming the SEC’s complaint lacks merit.

This has has helped the price of TRX partially recover from the significant dip it suffered after the SEC’s announcement.

However, the uncertainty surrounding TRX’s future has reignited concerns about the strength of Huobi in the digital asset sector following the collapse of the FTX exchange.

Huobi’s reserves also include a significant portion of its native token, HT. Combined, TRX and HT make up 41.89% of the crypto exchange’s reserves.

The recent implosion of FTT, FTX’s native token, has made crypto markets increasingly wary of native tokens, as their collapse can severely impact exchanges. Despite assurances from crypto exchanges that they maintain adequate assets to back investor deposits, calls for full audits persist.

Adam Cochran, partner at Cinneamhain Ventures, argues that the recent developments may explain why Justin Sun was selling some of his “tokens and is probably going to push assets heavily into cash again.”

Huobi May Be Compromised

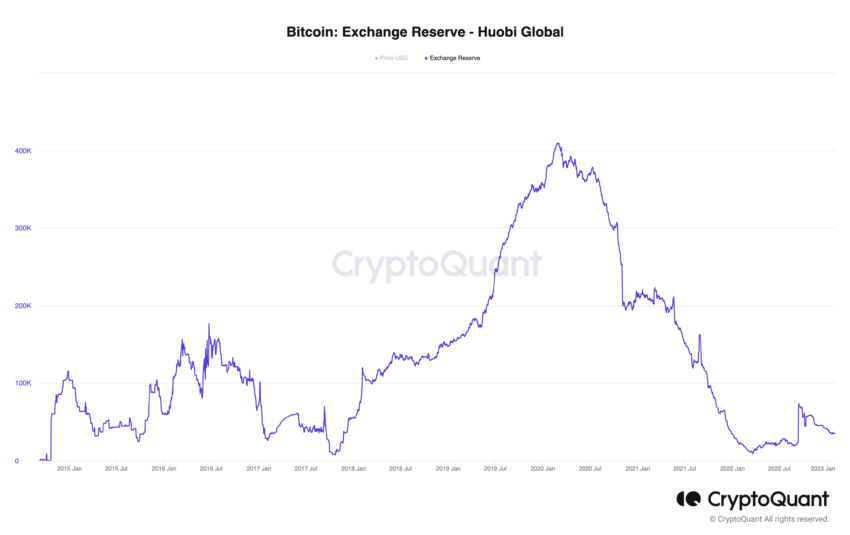

Huobi’s total reserves amount to $3.1 billion, per CryptoQuant data. Excluding native tokens, this figure drops to approximately $1.8 billion. This is the lowest clean-reserve ratio among the eight exchanges the digital asset data provider listed.

CryptoQuant warns of potential liquidity risks if a self-issued token represents a significant percentage of an exchange’s total reserves.

Huobi has responded to concerns about the concentration of HT and TRX in its reserves. The crypto exchange stated it maintains a strong and healthy reserve pool to address potential risks.

Earlier this year, Sun injected $100 million of stablecoins twice into Huobi to strengthen its financial cushion. The most recent transfer occurred in March, countering concerns sparked by a flash crash in HT. Meanwhile, the previous one took place in January after Huobi experienced a wave of withdrawals.

The exchange claims the combined $200 million came from Justin Sun’s personal funds.

In 2022, Sun reportedly spent about $1 billion to acquire a 60% stake in Huobi. However, he has denied owning a majority stake, insisting he only serves as an adviser.

Despite retreating from its position as a global leader in crypto exchanges, Huobi recorded $11 billion in monthly trading volume in February 2023, according to CryptoCompare data.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.