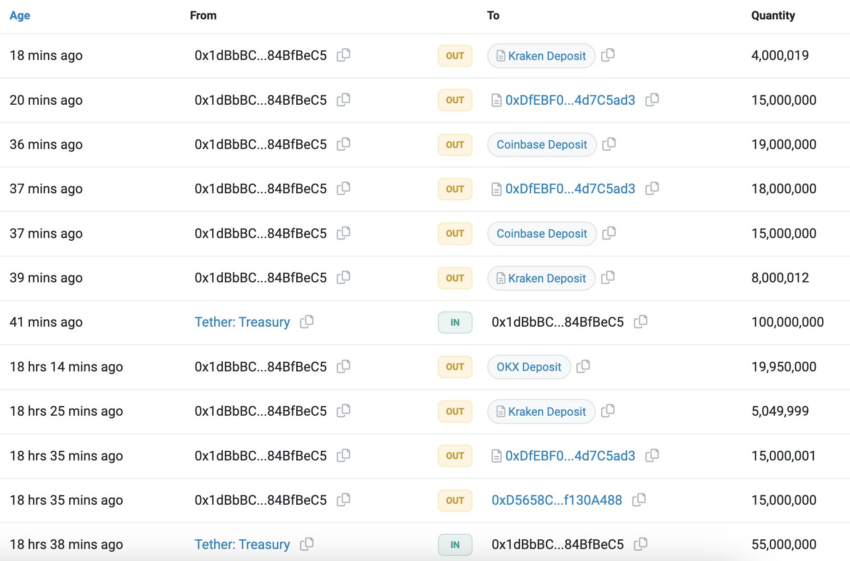

Today, a Tether (USDT) whale deposited $239 million into crypto exchanges. The latest deposit takes the total liquidity they added to stablecoin markets in the past three months to around $2.9 billion, which Tether could need ahead of onslaught by banks.

The wallet owner with an address starting with “0x1dBb” received the funds from the Tether Treasury and distributed them to OKX, Kraken, and Coinbase. The latest transfer out of the whale account at press time was 5.5 million USDT.

Stablecoin Whale Adds Funds as Banks Threaten Tether

Commentators on Twitter speculated that the whale could be BlackRock. Some industry players suspect the firm could flood the market with $2 billion if its Bitcoin exchange-traded fund gets approved.

Read more: What Is a Stablecoin? A Beginner’s Guide

BlackRock is the biggest asset manager filing to operate a spot Bitcoin ETF. The additional USDT liquidity may help ETF issuers buy and sell the BTC backing their ETF shares. Issuers need parties willing to exchange BTC for fiat or stablecoins to minimize risk.

Regardless of whether the whale is BlackRock, their transactions continue to boost USDT’s circulation. Tether recently announced that the city of Tbilisi in Georgia is allowing people to pay for Toyota vehicles in USDT and Bitcoin.

The increased visibility of the asset comes as banks close in on private stablecoin issuers. BitMEX co-founder Arthur Hayes believes banks could make companies like Tether disappear overnight if given the green light to transact with stablecoins.

“At some point, [US Treasury Secretary] Janet Yellen is going to say to Jamie [Dimon], and all the other muppets who run these TradFi banks, you are allowed to do a Tether, and they’re going be like great we’re just going to offer a JPMorgan Coin… There’s not going to be none of these trust issues. And overnight Tether has no more business,” Hayes stated.

Tether has also been trying to mend relationships with the US Treasury Department. The issuer was accused of slackness in blocking wallets linked to the terrorist group Hamas.

CBDCs Jostle With Banks For Tether Market Share

Another headwind Tether could face is the increasing number of countries testing central bank digital currencies (CBDCs). So far, Jamaica, the Bahamas, and Nigeria are operating full-blown CBDCs, while Brazil, the People’s Republic of China, the Eurozone, India, and the United Kingdom have made significant strides.

Nigeria was once considered among the most advanced African nations with respect to cryptocurrency adoption. Last week, its central bank tightened requirements for banks serving crypto businesses. Only two withdrawals are allowed per quarter, and no third-party checks may be cleared.

Read more: How to Buy and Store the Different Types of Tether

Tether could also face resistance from regulations that come into force in 2024. Europe’s Markets-in-Crypto-Assets bill and Hong Kong’s upcoming legislation are two regimes that could challenge Tether.

MiCA, in particular, has already encouraged some traditional institutions, such as Societe Generale, to launch euro-backed stablecoins. Circle, the issuer of USDT competitor USDC, recently launched a new cross-chain protocol in anticipation of regulated stablecoin use of its EURC stablecoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.