Terra total value locked (TVL) fell sharply in the second week of May due to an overall bearish market, which has seen several chains see decreased investor interest in DeFi.

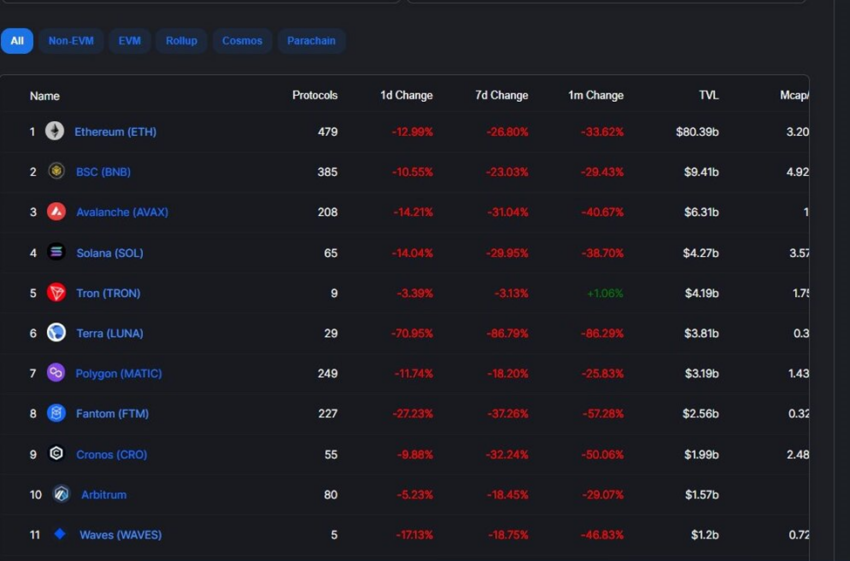

After Ethereum, Terra came in as the second blockchain with the most TVL in March and April.

According to Be[In]Crypto research, Terra has lost 78% in total value locked since the first day of 2022. On January 1, Terra had a TVL of approximately $18.4 billion, and this decreased to around $4.02 billion on May 11, 2022.

Terra is a protocol that deploys a suite of algorithmic decentralized stablecoins which support a thriving ecosystem that brings DeFi to millions of people. As one of the leading cross-chain protocols in the crypto finance space, it maintains a growing ecosystem that comprises more than 100 projects across the Web3 and DeFi spaces.

Why a decline in TVL?

Many believe that Terra TVL crashed this week due to dApps in its ecosystem sinking to new lows.

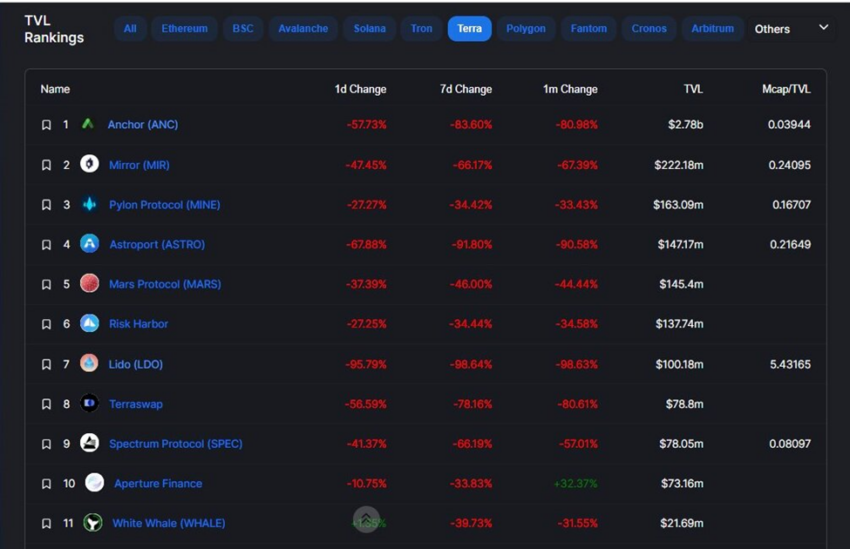

Decentralized lending and borrowing platform Anchor, for example, has fallen by more than 80% in the last month, while staking platform Lido, has also shed more than 98% of its TVL within the same period.

Automated DEX protocol Astroport and TerraSwap have lost more than 90% and 80%, respectively, of their total values locked.

Others that have contributed to the plunge in total value locked include, but are not limited to Mirror, Pylon Protocol, Mars Protocol, Risk Harbor, Spectrum Protocol, Aperture Finance, Stader, Loop Finance, and PRISM Protocol.

After tumbling by more than $14 billion thanks to the aforementioned dApps, Terra has also lost its place in line to Binance Smart Chain, Avalanche, Solana, and TRON.

With that said, despite the waning TVL, Terra still holds the lion’s share in value locked over Polygon Fantom, Waves, Near, and Cronos among others.

LUNA price reaction

LUNA opened in 2022 with a trading price of $85.51. The coin reached a yearly high of $119.18 on April 5 and was exchanging hands for $1.06, as of writing.

Overall, this equates to a 98% loss in the price of LUNA since the start of 2022. On Thursday, Terra Chain announced that it had resumed operations after a two-hour pause on its block production.

What do you think about this subject? Write to us and tell us!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.