In spite of the bearish crypto market trend, LUNA trading volume in the first quarter of 2022 was more than eight times that of the first quarter of 2021.

Terra (LUNA) reached an all-time high price of $119.18 on April 5, 2022, after seeing more than $45 billion in trading volume in the first three weeks of the fourth month of the year.

According to Be[In]Crypto Research, the trading volume recorded for Terra (LUNA) during the first quarter of the year was approximately $223.39 billion.

This was a 707% increase in the trading volume recorded during the first three months of 2021 in the region of $27.68 billion.

What caused the surge in LUNA trading volume?

Improvements in the Terra ecosystem which drew the attention of millions of investors likely played the biggest role in the spike in LUNA trading volume in the first quarter of 2022.

Improvements in the Terra ecosystem

In October 2021, in discussions following the successful network upgrade of Columbus-5, Do Kwon, co-founder of Terra pointed out that the team was preparing to add at least 160 projects to Terra’s ecosystem in 2022.

The same upgrade updated several features of Terra that changed the mechanics of how LUNA operated.

This saw a spike in the liquidity locked in the Terra blockchain.

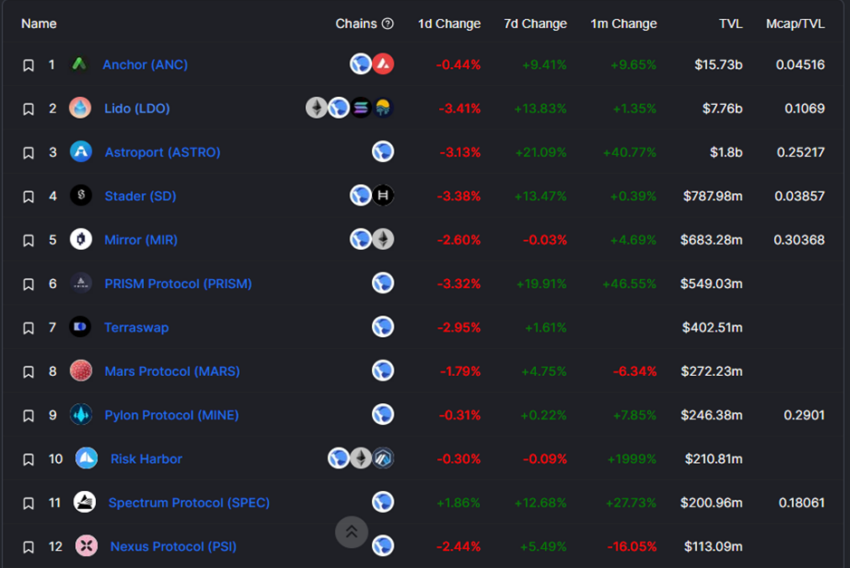

Terra opened on Jan. 1, 2022, with a total value locked (TVL) of $18.45 billion. This increased to $28.95 billion on March 31, 2022. Overall, there was a 56% increase in Terra’s opening and closing TVL in the first quarter of 2022.

Some of the individual projects on Terra that made a valuable contribution to this new milestone were Anchor (ANC), Lido (LDO), and Astroport (ASTRO) which had billions in total value locked.

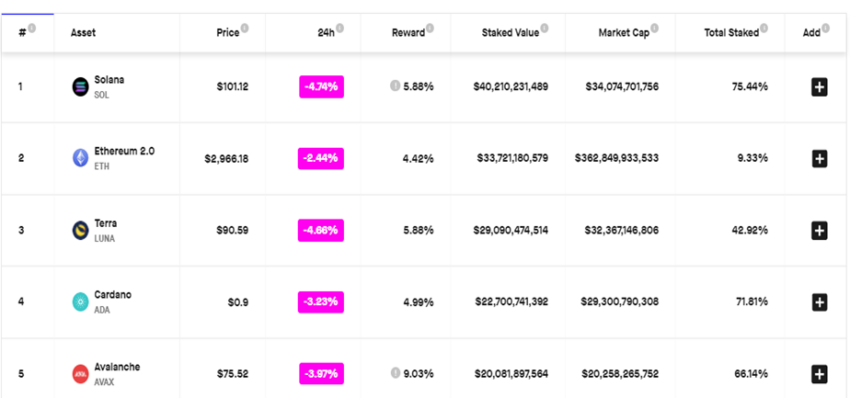

The improvement in the ecosystem helped confirm Terra’s native asset, LUNA as the third-most staked cryptocurrency. LUNA trails only Ethereum (ETH) and Solana (SOL) in total value staked.

In January 2021, the trading volume of LUNA was approximately $1.7 billion with a single-day high of $261,899,675. In January 2022, the trading volume of LUNA was around $73.07 billion and had a single-day high of $4.38 billion.

In February 2021, the trading volume of LUNA was in the region of $9.61 billion with a single-day high of around $1.15 billion. In February 2022, the trading volume was approximately $58.49 billion and had a single-day high of $6.15 billion.

In March 2021, the trading volume of LUNA was approximately $16.36 billion with a single-day high of $1.45 billion. In March 2022, the trading volume of LUNA of around $91.82 billion and a single-day high of $6.04 billion.

Price reaction

LUNA opened on Jan. 1, 2022, with a trading price of $85.51, reached a quarterly high of $111.01 on March 30, and closed the first quarter of the year at $103.01. Overall, there was a 20% increase in the opening and closing price in Q1 2022.

For the sake of comparison, LUNA opened on Jan. 1, 2021, with a trading price of $0.6529, reached a quarterly high of $22.33, and closed the first quarter of 2021 at $18.70. Overall, there was a 2,764% spike in the opening and closing price in Q1 2021.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.